- London hard fork upgrade has given Ethereum an extra push to add on to the current crypto market rally.

- The DeFi revolution is providing a strong case for sustainable institutional interest.

Ethereum was up by 11% in 24 hours, as it continued to ride on the success of its London upgrade to break the $3,000 barrier. During that period, its 24-hour trading volume stood at 38 billion, with nearly $9 billion in the value of transactions. At the time of writing, ETH was up by 25% over its position seven days ago.

With that move, Ethereum’s market capitalization has risen to $357 billion, and it currently accounts for about 20% of the total market capitalization. Many investors have moved to buy the cryptocurrency in anticipation of a potential price rally brought in by the deflationary attributes of the upgrade.

ETH’s current position is its highest in 3 months, but it is still some way off the $4,383 price it hit in May. Despite its struggles in the May-July period, ETH is still up by 317% year-to-date.

The EIP-1559 upgrade, commonly known as the London upgrade, was a success and had burnt about $12 million worth of ETH. Ultimately, Ethereum is expected to be increasingly rare as more Ether gets burnt up, thereby reducing the circulating supply.

DeFi key to strong institutional interest

Until recently, Ethereum’s stability had been mostly hinged on the popularity of the DeFi segment. Even though ETH has the London upgrade to thank for its significantly improved rate of growth in its recent days, DeFi’s role is still significant, according to Genesis Digital’s second-quarter report,

DeFi is expanding its role in global financial services

Ethereum’s hold on the DeFi ecosystem puts it at an advantage over its peers in the crypto market. One week ago, investment bank Goldman Sachs filed to initiate an ETF specialized in DeFi. This shows that the DeFi segment is likely to grow further and for the long haul. The Genesis Digital Q2 report also noted a rise in institutional interest in cryptocurrencies, with the recent decline in the prices of cryptocurrencies doing little to deter investors.

The latest instance of growing institutional affinity towards cryptocurrencies is by leading luxury fashion company Phillip Plein. The Swiss company has started accepting fifteen cryptocurrencies, including ETH.

NFTs playing a strong supportive role

Ethereum’s other strong growth front, NFTs, is also likely to provide further support for Ethereum, both in the short term and long term. In an exciting case, CryptoPunk just sold an NFT for $43 million. The profitability of NFT was once again on display, with the NFT having been bought three years ago at only $443.

Ethereum NFTs have also recently attracted attention, with the rising popularity of Axie Infinity giving Ethereum another significant boost.

Technical analysis

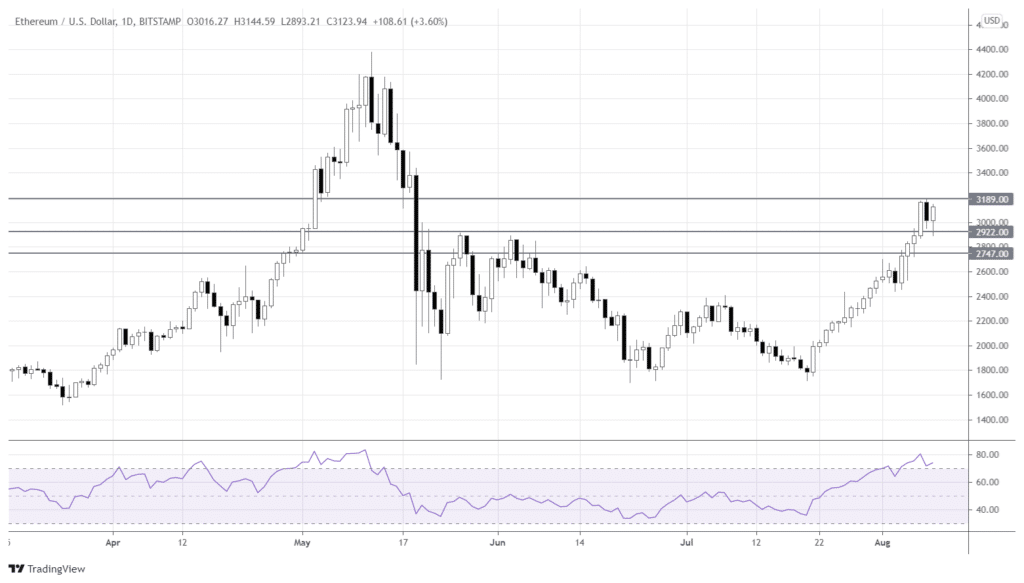

ETHUSD is riding on strong momentum, and its RSI was at 74 at the time of writing. Ethereum is likely to rise to find the first resistance at $3,189.

If the market becomes bearish, the pair could head down to find the first support at $2,922. A further slide is likely to find the second support at $2,747.