The PayPal (NASDAQ: PYPL) stock price jumped sharply on Monday as investors positioned themselves for the company’s upcoming quarterly results. The stock jumped by 5% and is trading at $171, which is about 13% above the lowest level this year.

PayPal stock performance

PayPal is one of the biggest fintech companies in the world. The company offers a number of services, such as peer-to-peer funds transfer and business payments.

For a long time, PayPal was one of the most popular stocks among investors in Wall Street. As a result, its stock price jumped, pushing its total market capitalization to over $250 billion.

Recently, however, the company has fallen out of favor and its stock has slipped. The PayPal stock price has dropped by 44% from its highest point in 2021.

In all fairness, other fintech stocks have also declined. The Affirm stock price has slipped by over 60%, while Block is hovering near its 52-week low. Other fintech firms like Remitly and Shift 4 Payments have also slipped.

There are several reasons for this performance. First, analysts are focused on the company’s growth, considering that the pandemic has peaked. The sentiment worsened when PayPal attempted to buy Pinterest for over $40 billion.

Second, there is the lingering fear of the Federal Reserve and its impact on growth stocks. The Fed has announced that it will implement a few hikes this year in its battle against inflation. Some analysts expect that the bank will implement between 4 and 7 rate hikes this year. Historically, growth stocks like PayPal tend to disappoint in a period of higher interest rates.

Third, the performance of Bitcoin and other cryptocurrencies has affected the company’s growth. The company embraced cryptocurrencies in 2021 and introduced features that allow people to buy, sell, and send Bitcoin and a few other cryptocurrencies. Recent reports by Robinhood and Coinbase show that the volume has declined.

PayPal earnings preview

The next key catalyst for the PayPal stock price will be the company’s quarterly results scheduled for Tuesday after the market closes.

Analysts are generally optimistic about the company’s revenue and profitability but are concerned about growth.

According to SeekingAlpha, analysts expect that the company’s revenue will come in at $6.8 billion, which will be higher than the previous quarter’s $6.18 billion. The increase will be because of the holiday shopping.

If analysts are correct, the company’s revenue will be bigger than the $6.0 billion that it generated in the same quarter in 2020.

PayPal’s profitability is also expected to rise. Analysts believe that the earnings per share rose from $1.08 to $1.12.

In addition to the headline figures, the PayPal stock price will react to the membership additions. Analysts expect that the number of quarterly additions will continue easing, considering that most people created an account during the peak of the pandemic. Still, the average revenue per user (ARPU) is expected to have increased.

Analysts are torn about the future direction of the PayPal stock. Some, like Jim Cramer, believe that the stock is now fairly valued and that it will bounce back this year. Others expect it to continue retreating for a while.

PayPal stock price forecast

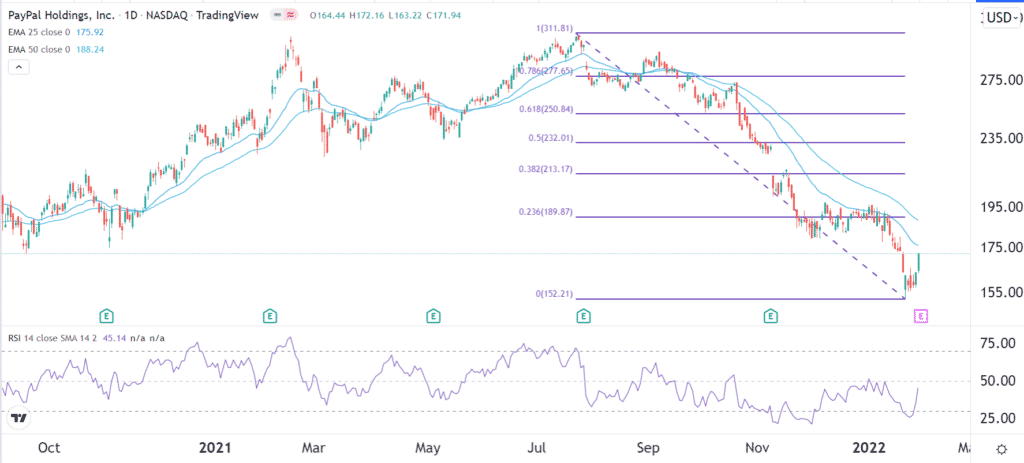

The daily chart shows that the PayPal stock price has been under intense pressure in the past few months. As a result, the stock has remained below the 25-day and 50-day exponential moving averages (EMA). The Relative Strength Index (RSI) has tilted higher recently and is still below the 23.6% Fibonacci retracement level. Therefore, I suspect that the stock will decline sharply after the Q4 earnings considering that it is still below the moving averages.