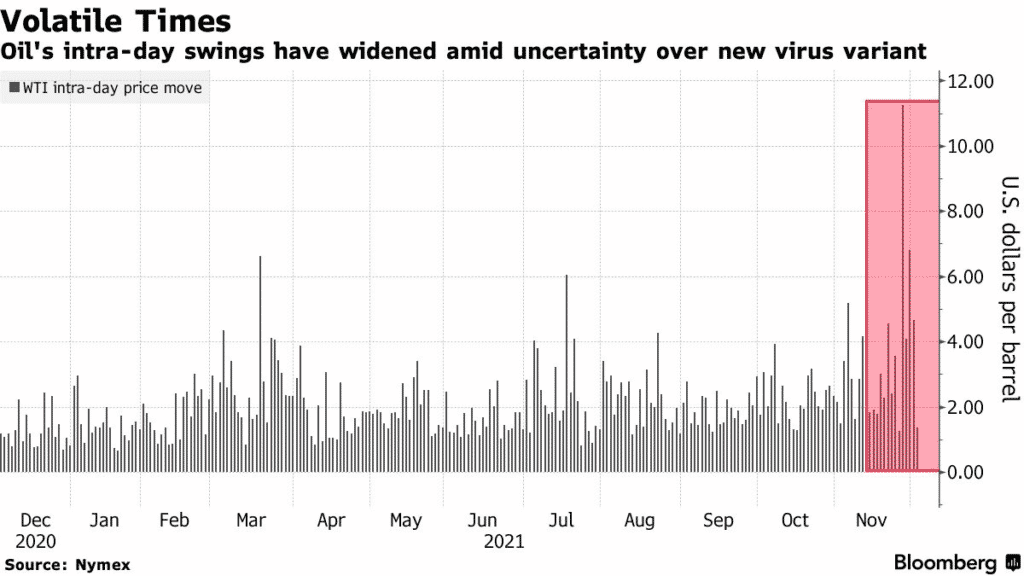

(Bloomberg) The West Texas Intermediate crude fell up to 4.8% on Thursday as investors expect OPEC+ to increase oil production in January.

Bets against oil rose as Russia proposed a production boost by 400,000 barrels a day, contrary to market expectations that the cartel will stick with the current output plan.

Concerns of the omicron variant dented expectations of OPEC+ boosting oil production, with demand seen to be threatened by new restrictions.

Strategists led by Goldman Sachs still believe oil prices have “overshot” the omicron variant. Bank of America is bullish on oil and expects the price to rise to $85 a barrel in 2022, with a potential to go past the $100 mark.

Oil has now shed at least 20% since the US released strategic reserves in late October.

CL1! is down -1.13%.