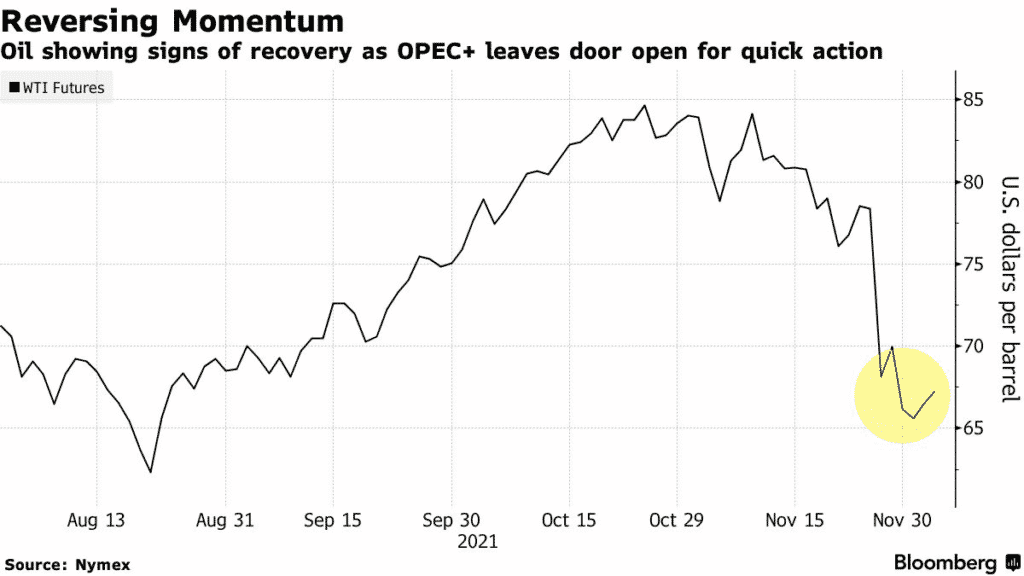

(Bloomberg) The West Texas Intermediate crude topped $68 on Friday after OPEC+ said it could alter the $400,000 barrels a day production boost set for January.

OPEC+, which put a floor under prices in the latest agreement, says it could change the planned production increases within a short notice.

The stance by OPEC+ reflects ongoing impacts of the Omicron variant, with the cartel’s ability to forecast the demand dimmed. The demand and supply assessment are also challenged by the US decision to release its strategic oil reserves.

The jump in oil prices happens after a more than a month period of declines on a low demand outlook. The open interest on main oil futures contracts have also fallen to the lowest in several years.

UBS Group AG commodity analyst Giovanni Staunovo say oil may have touched the floor on Thursday, with upsides only limited by potential new Covid-19 variants. Vandana Hari, Vanda Insights founder, says OPEC+’s “clever” decision helped avoid market panic that could have triggered oil sell-offs.

CL1! is up +3.05%.