Credit Suisse Group AG and Nomura Holdings Inc. plunged more than 14% after being exposed to ‘significant’ losses, according to Bloomberg. The loss projections follow exposure to wrong-way bets by Archegos Capital Management.

Lenders to Bill Hwang’s New York-based family office raced to contain the fallout after Archegos failed to meet margin calls last week.

The unwinding of Archegos-related bets is projected to go further as Credit Suisse and other lenders are still in the process of existing positions.

Details about Hwang’s trades are unclear, but analysts estimate that his assets had grown to between $5 billion and $10 billion, as total positions may have topped $50 billion.

Nomura disclosed that the estimated amount of its claims to an unnamed US client, believed to be Archegos, totals about $2 billion.

Credit Suisse said while it cannot quantify the loss size, it may be “highly significant and material” to its first-quarter results.

The projected loss is a blow to Credit Suisse as the bank faces possible financial hit related to the Greensill and reputational damage following the spying scandal.

Other lenders, including Deutsche Bank, Goldman Sachs, and Morgan Stanley, are also embroiled in the Archegos.

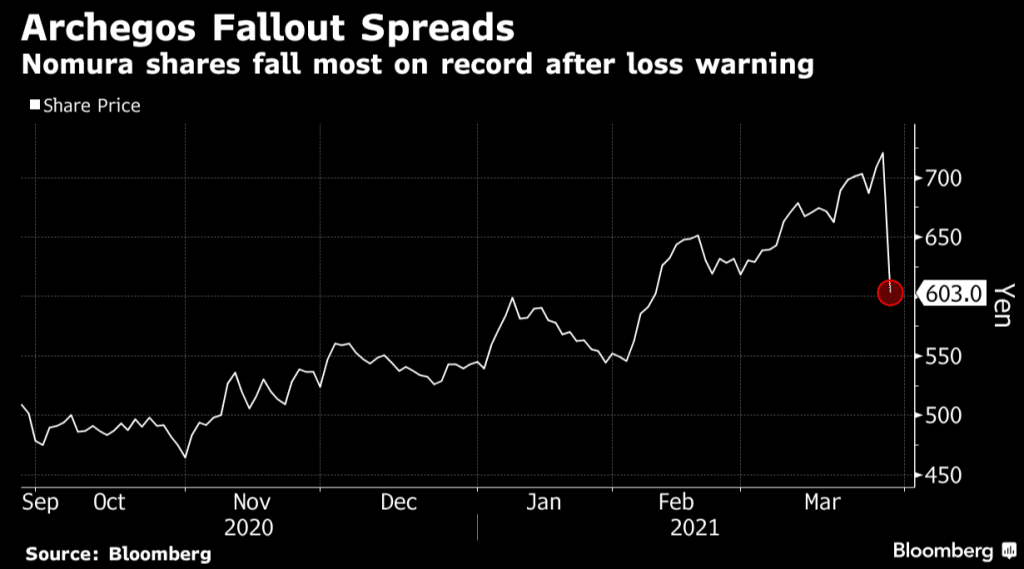

Credit Suisse and Nomura stocks are currently declining. CSGN: SWX is down 14.55%, 8604: TYO is down 16.33%.