Naragot portfolio is available for both MT4 and MT5 platforms and trades using price action techniques. The robot applies a take profit and stop loss to each trade to mitigate the risk. The developer claims to manage over $700000 in equity. Considering all the promotions made on the MQL 5 experts page, we decided to review the product and see if it could be profitable.

Naragot Portfolio trading strategy

The expert advisor uses a fixed stop loss and take profit for each position. It trades only on EURUSD, GBPUSD, XAUUSD, and USDJPY using price action techniques and follows the trend on the market. According to the developer, the algorithm does not trade each day. It will rarely pen positions when the conditions are suitable. The robot does not employ grid and martingale strategies. The trading history on Myfxbook is private, so we can not analyze any results there. The developer is trying to hide something which is fishy.

Naragot Portfolio features

The robot has the following features:

- Uses a fixed stop loss and take profit for each trade.

- The developer has $700000 in management.

- The EA uses price action for trading.

- There are no grid and martingale methods in use.

- Traders can customize the risk settings within.

Price

The software comes with a one-time payment of $449. There is no money-back guarantee as per the rules of the MQL 5 marketplace.

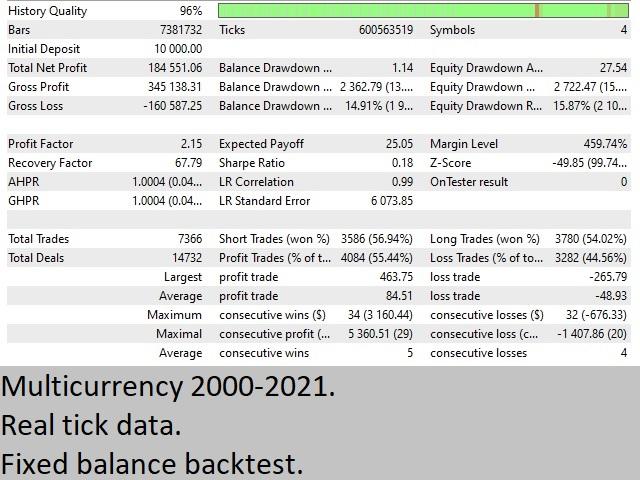

Naragot Portfolio backtesting results

Backtesting results are available for multiple currencies where the relative drawdown was around 15.87%. The winning rate was 55.44 with a profit factor of about 2.15. The starting balance was $10000.

The robot tanked an average profit of $184551.06 during this period. There were 7366 trades in total, with 14732 deals. The best trade was $463.75, while the worst one was -$3780.

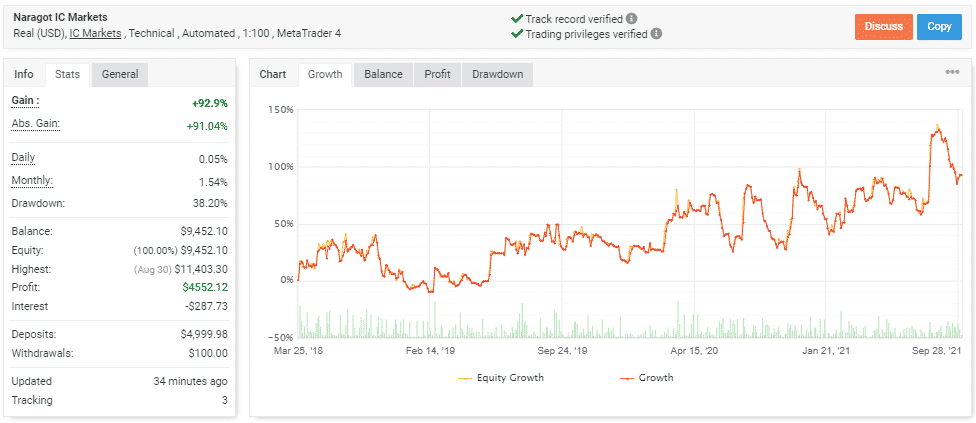

Naragot Portfolio live trading results

Verified trading records on Myfxbook show performance from May 25, 2018, till the current date. The system made an average monthly gain of 1.54%, with a drawdown of 38.20%. The stated drawdown is way higher than the monthly profits. This gives a poor risk-reward ratio and makes the algorithm unfit for use. The winning rate stood at 39%, with a profit factor of 1.11.

The best trade was $267.62, while the worst was -$178.60 in a total of 6008 trades. The developer made $4999.98 in deposits and $100 in withdrawals.

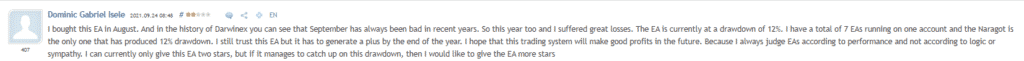

Naragot Portfolio reputation

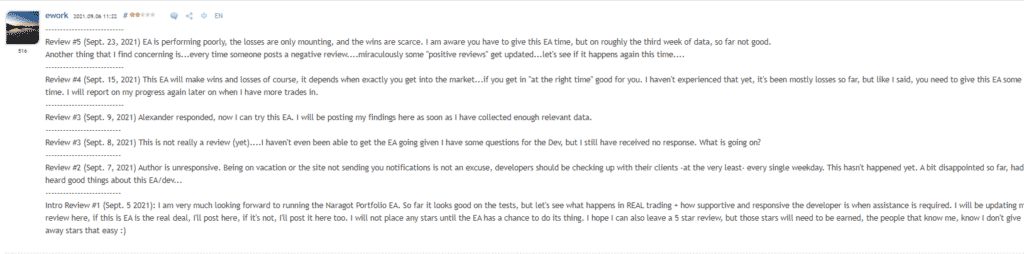

Customer reviews are available on the MQL 5 marketplace, where traders are not happy with the robot. One of the customers states that he is facing high drawdowns. He claims he suffered a great amount of losses.

Another trader mentions that the robot is mounting a big amount of losses and the winners are scarce. He states that the EA only did good in backtesting but failed when put on a live account.

Is Naragot Portfolio a good EA to invest in?

Naragot Portfolio is not a good robot to invest in as it only shows good results on backtesting which is useless for us. The algorithm is facing a high drawdown on a live account which makes it useless for our use. Traders can face margin calls with the use of the EA.

Naragot Portfolio review summary

| Strategy | 3/10 |

| Functionality and features | 6/10 |

| Trading results | 4/10 |

| Reliability | 5/10 |

| Pricing | 3/10 |

Traders have to take the risk-reward ratio into account before investing in any algorithm. Naragot Portfolio EA does not give good profits and is a bit pricey. The EA can be devastating for an account. It is better to stay away from the expert advisor.