Overview

- Palantir stock just entered the second month of trading, and it is already displaying excellent prospects. Covid-19 has generated strong tailwinds on which the stock could ride to higher levels. Efforts by authorities in the US and Europe to control the pandemic have created great revenue opportunities.

- The US government, especially the Pentagon, is a significant Palantir client. Despite the ethical issues that this relationship raises, the company’s connection with this massive spender is a boon. Commercial companies are also beginning to embrace Palantir’s software products.

- Investors seemed to be staying away from PLTR, perhaps due to the mystery surrounding the business, but this view will go away as attention shifts to growth potential. Technicals show that PLTR is entering an upward trend, and the fundamentals are in place to strengthen this momentum.

Why should PLTR be in your portfolio?

Early this month, reports emerged indicating that the UK government intends to solicit Palantir’s help to enforce its COVID-19 strategy. Palantir’s software solutions have become popular within government circles especially due to their spying and surveillance capabilities. The UK will deploy the Foundry software hoping its capabilities will transcend the inefficiencies of the contacting tracing apps in use at the moment.

Palantir Technologies Inc. (NYSE: PLTR) just completed its first month on the New York Stock exchange, and the performance is satisfying. In the last 24 hours of trading, market activity pushed PLTR up by 6.07% to $14.67, mainly on the back of orders from government agencies as the war on Covid-19 rages.

Palantir is a controversial business. Even its CEO, Dr. Alex Karp, conceded in a conversation with The New York Times that “Palantir is the convergence of software and difficult positions.”

Despite the ‘complicated and mysterious’ business, PLTR is an unmissable opportunity. The Big Data and Analytics industry, in which Palantir belongs, is just getting started. Commercial entities and government agencies realize the power of data and their insights to help shape decision-making.

As the Covid-19 pandemic threatened to run down the US healthcare system, the National Institutes of Health handed Palantir a $36 million contract to streamline storing and sharing scientific and patient data relevant to the war against the virus. The deal follows two others awarded back in April valued at a total of $24.9 million, both related to the efforts to combat the pandemic.

The US Department of Veterans Affairs via the Veterans Health Administration also solicited Palantir’s solutions in May in a contract worth $5 million. However, Palantir’s most significant boon in the government sector category is its close working relationship with the US Pentagon. It offers data analysis solutions through the Gotham software.

When looked at analytically, Palantir’s software solutions are not focused on short-term reprieve. Instead, the solutions are geared at preparing clients for any uncertainty in the future, and this where PLTR’s growth prospects lie.

Palantir Technologies and its products

Palantir Technologies is a Denver, Colorado-based Big Data analytics company whose customer base is mostly government agencies. The company describes its products as tailored explicitly to enabling “human-driven analysis of real-world data.”

It categorizes its operations into the government sector, which the Gotham software services, a software platform deployed across a broad range of government functions. The other category is Commercial, which takes major private sector players as clients, and the Foundry software is the solution offered. Palantir describes the software as an operating system for its clients’ data.

The company was established in 2003 with PayPal’s former executive, Peter Thiel, as one of the co-founders and a current Board member. In the prospectus to support its bid for listing on the NYSE filed with the SEC, Palantir disclosed that it serves 125 customers. Dr. Alex Karp is the CEO and a co-founder.

What do key indicators say about Palantir’s future performance?

Palantir will release financials for the quarter ended September 30 (Q3) on November 12, 2020. The results will become the first release since the company’s stock started trading on the NYSE. Even then, investors will be holding their breath because the numbers will have a massive influence on the stock’s direction.

So far, Palantir’s financial position is strengthening. The company is just coming from a long period of non-profitability and huge loss-making. According to the prospectus filed with the SEC, Palantir’s revenue has been growing over time, but operational costs have remained dangerously high. In 2019, for instance, the company incurred a net loss of $579.6 million despite a 25% jump in total revenues generated.

The company managed to lower the net loss incurred in the first six months of 2020 to $164.7 million. Simultaneously, the period’s revenue grew at an unprecedented rate to $481.2 million, a 49% increase compared to H1 2019. This period also saw the company increase clients primarily on the government side.

Furthermore, Palantir reported improved operating results in H1 2020, majorly brought about by increased efficiencies and increased revenue. Palantir is sure that there is a market opportunity to the tune of $119 billion, and the company is laying the strategy to exploit. If successful, the company is likely to begin turning up a profit in a couple of months.

From a technical perspective, PLTR is on the path to growth

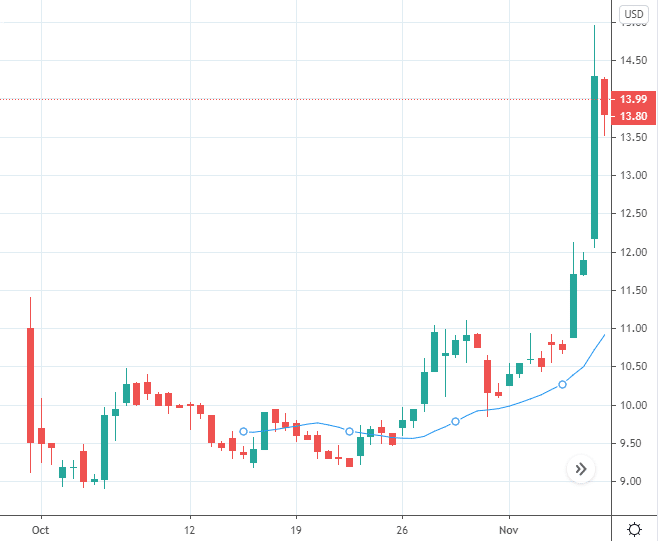

PLTR’s prospects are encouraging, specifically, since price action has been advancing upwards over the past two weeks. In Figure 1 below, the price breaks above the 21-period moving average at around October 23. In effect, this breakthrough marks the beginning of the stock’s break above the IPO price range.

Since the IPO, PLTR seems to have a favorite for short-sellers, especially in the first week. We can see the price putting up a fight twice, but the market remains adamant at the $10.50 resistance level. When the breakthrough happens, PLTR consistently establishes higher highs and higher lows, which signals the onset of an upward trend.

Conclusion

No doubt, Palantir is in a difficult position but one that comes with huge revenue potential. Once the Palantir narrative’s ethical aspect takes a back seat, no one will want to miss out on the opportunity that PLTR presents. The US military dominates Palantir’s revenue share, but its remarkable efforts will surely net more commercial clients. Moreover, the company is implementing operational efficiencies that should significantly cut losses. Already, PLTR’s technicals are pointing to an upward trend, and fundamentals support this outlook. Therefore, investors should BUY PLTR.