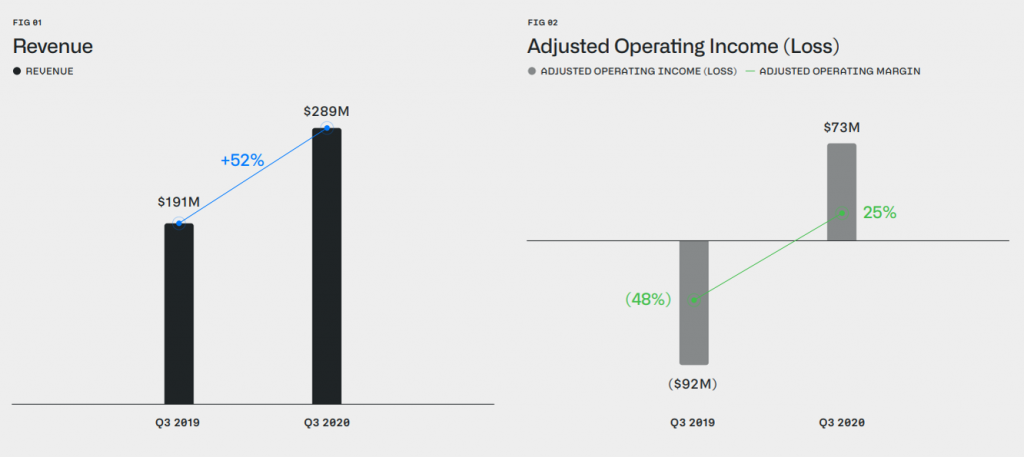

Palantir recorded revenues of $289.4 million in Q3 2020, up 52% year over year, according to the company’s press release. Revenue rises reflect increasing demand for software in the past year despite economic and geopolitical risks in the U.S. and beyond.

- Q4 and FY20 Guidance

- Palantir expects a full-year revenue range of $1.070 billion to $1.072 billion, up 44% year-over-year.

- The company expects year over year revenue growth in 2021 to be greater than 30%

- Q4 revenues to range between $299 million and $301 million, up 30% to 31% year over year

- Annual adjusted operating income is projected to range between $130 million and $136 million, excluding stock-based compensation, payroll taxes, and direct listing expenses.

- Q4 adjusted operating income is expected to range between $44 million and $50 million, excluding stock-based compensation and employer payroll taxes.

- Q3 Highlights

- Loss from operations was $847.8 million, including $847.0 million in stock-based compensation on its recent direct listing.

- Income from operations was $73.1 million, adjusted for $847 million stock-based compensation, $20.2 million in employer payroll taxes, and $53.7 million for listing.

- The company closed fifteen deals with new and existing customers, each worth $5 million or more, and renewed contract with one of the world’s leading aerospace companies worth $300 million.

- The average revenue generated per customer rose 38% in the first nine months of 2020 to $5.8 million from $4.2 million the prior year.

- Palantir had declining customer concentration in the past nine months as revenue from the top twenty clients was 61% of total revenue, down from 68% the same period last year.

- As of September 2020, the total cash and cash equivalents were $1.8 billion.

Fig: Q3 Highlights

Palantir stock is currently gaining. PLTR is up 1.78% on premarket.