- Moderna stock up 214% ahead of Q3 results.

- Q3 revenue and earnings are expected to top estimates.

- Coronavirus vaccine uptake impact on Q3 revenue.

Moderna Inc. (NASDAQ: MRNA) is scheduled to report its third-quarter results on November 4, 2021, before the market opens. The biotechnology company has topped estimates over the last two quarters driven by strong uptake of its COVID-19 vaccine.

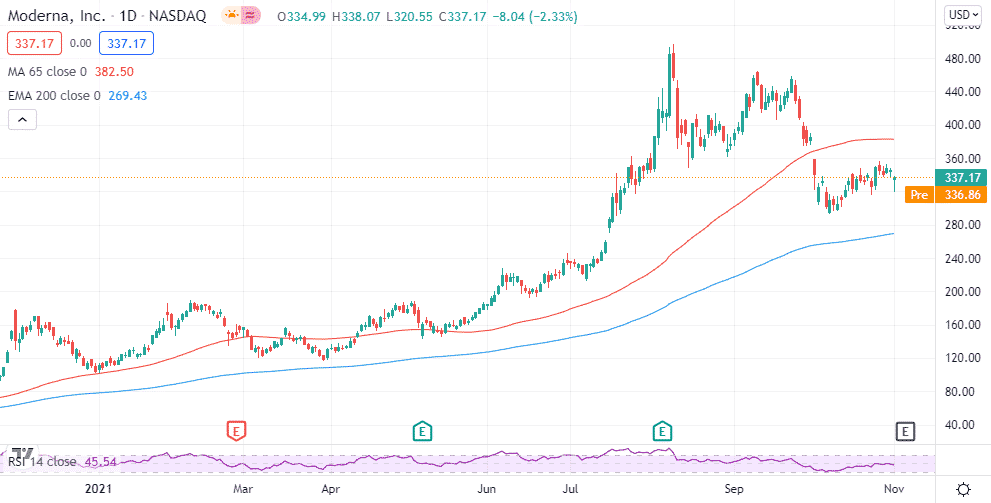

Additionally, the stock is up by 214% year to date, outperforming the S&P 500, which is up by about 21%. However, it is down by about 31% from all-time highs registered in August. Consequently, the outcome of the third-quarter report will be pivotal if the stock is to bounce back and continue edging higher after the recent consolidation.

Moderna headed into the third-quarter earnings session at the back of an impressive record, having delivered an earnings surprise of 7.49% in the second quarter. Likewise, the expectation is high that it will top estimates on revenue and earnings given the strong demand for its COVID-19 vaccine, among other products.

The biotechnology company has deployed an industrialized approach to developing mRNA therapies that continue to elicit strong interest in the market. The program has already generated a broad pipeline of 21 programs.

Q3 earnings expectations

Wall Street expects Moderna to deliver an EPS of $9.01, representing year-over-year growth of over 1,600% compared to a net loss of $0.53 a share delivered the same quarter last year. In the second quarter, net income landed at $2.8 billion, up from a net loss of $117 million delivered the same quarter last year.

Revenue, on the other hand, is expected to increase by 3,500% to $6.09 billion, mostly driven by strong demand for the company’s COVID-19 vaccine. In the second quarter, revenue was up to $4.4 billion compared to $67 million delivered the same quarter last year.

For the full year, Moderna is projecting product sales of upwards of $20 billion as part of the Advance Purchase Agreements already signed. Dose capacity, on the other hand, is expected to range between 800 million and 1 billion doses.

What to look out for when Moderna Reports

During the quarter, Moderna received regulatory approval for its mRNA-1273 in India and Australia, a development that expands the target market for the COVID-19 vaccine. Additionally, the FDA has authorized the third dose of the vaccine to be administered to adults in the U.S., all but fuelling further demand for the vaccine.

The biotechnology company also secured regulatory approval from the European Medicines Agency for the use of booster doses in people aged 18 years and above in Europe. In the second quarter, the company sold 199 million doses.

Consequently, it will be interesting to see the impact of regulatory approval on vaccine orders in Q3 crucial to Moderna generating significant revenues.

In addition to the COVID19 vaccine, the focus will also be on other vaccine candidates that Moderna is working on. The biotechnology company is working on other mRNA candidates targeting different indications, including cancer. It has already inked strategic collaborations with the likes of AstraZeneca and Merck as part of the push.

Additionally, the focus will be on the Biomedical Advanced Research and Development Authority (“BARDA”); from here, Moderna earns grant revenue. It will be interesting to see the revenue the company accrues on this front.

Bottom line

While Moderna stock is up by more than 200% year to date, the outcome of the Q3 report could make or break the stock. After a period of consolidation, a better than expected earnings report could strengthen the stock’s sentiments triggering a bounce back to all-time highs. Similarly, a disappointing report could accelerate a drop from current lows after the recent pullback from all-time highs.