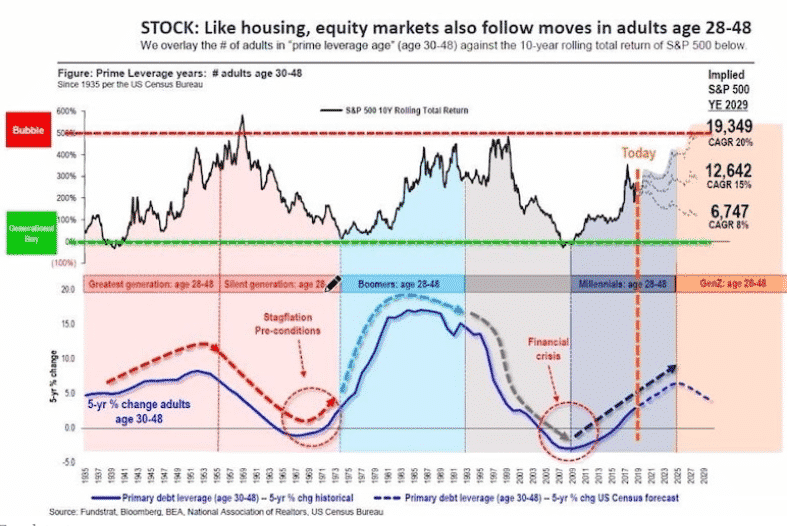

(Markets Insider) Fundstrat’s Tom Lee is optimistic that as millennials enter the peak earning years and start families in this decade, they would propel the S&P 500 to a 313% rally by 2029.

Lee says the millennials are the reason to stay bullish on S&P 500, forecasting a return of 11% on the index in 2022.

The investor says his projections align with a similar outcome when stocks boomed as the Baby Boomers and Generation X entered the 30-50 years of age.

Lee’s thesis underlines the fact that most mega-cap firms were founded by entrepreneurs in their third decade of age at the time. The US records a rise in patent issuances when its population in the 30- to 50-year-olds grows.

The investor says the US demographics are turning into a tailwind now, with a 14-year window ahead which is likely to lead to a strong bull market.

At a 313% surge, S&P 500 would hit 19,349 by 2029. The rise represents a compounded annual growth rate of 20%, which is above the historic average of 7% to 10%.

S&P 500 is currently up +0.62%.