The Meta Platforms stock price crashed hard in extended hours as investors reacted to the soft quarterly results. The stock declined by over 20% to $148. It has fallen by about 35% from its highest level in 2021.

Meta Platforms earnings review

The earnings season has been a bit mixed this week. On Tuesday, Alphabet published strong quarterly results, which pushed its stock up by about 5%. The company’s market cap is slowly approaching the $2 trillion mark.

On the same day, PayPal published weak results, which pushed its stock down by over 20%. On Wednesday, Meta Platforms and Spotify stock prices nosedived after the two firms warned about growth.

The Meta stock price crashed after Mark Zuckerberg warned about the rising competition in its business. He pointed to the rising popularity of Tik Tok among young people and Discord among gamers. Also, he pointed to the strong performance of apps like Slack and Microsoft Teams.

In total, Meta’s ad revenue jumped by 20% in the fourth quarter to over $32.6 billion. As a result, the company’s annual revenue jumped by 37% to over $118 billion. Its total expenses in Q4 came in at $21.1 billion as its cost of revenue rose by 22%.

By segment, Family of Apps generated revenue of $32.4 billion while the Reality Labs segments revenue rose by 22% to $877 million.

Apple privacy and currency headwinds

In addition to the rising competition, Meta attributed its weak performance to other key factors. For example, it complained about the recent Apple upgrade that made it easier for people to change their privacy settings. As a result, ad targeting within the Apple ecosystem became a bit challenging.

Another reason is that the company experienced some currency headwinds in the quarter. As a global company, Facebook often sees major currency implications based on the performance of the greenback. Most importantly, many of its customers experienced a tough period due to supply chain issues.

Looking forward, the management announced that the company will focus on 7 key areas to reinvigorate growth. These areas are in messaging, commerce, ads, privacy, artificial intelligence, and the metaverse.

Is FB stock a buy?

The Meta stock price retreated hard during the extended session. So, some investors may be tempted to buy the dip.

However, there are several reasons why it makes sense to wait before you buy the stock. First, the company has demonstrated that its business is indeed slowing down partly because of the Apple upgrade. Therefore, there is a likelihood that the company will continue seeing these challenges going forward.

Second, at a time when the Fed is increasingly hawkish, it makes sense to invest in value companies that have a solid growth. Alphabet, Apple, and Microsoft are good examples of such companies.

Finally, there is a likelihood that investors will start exiting the stock after the sharp decline. As such, as the supply and demand divergence widens, the stock will likely keep falling.

Meta stock price forecast

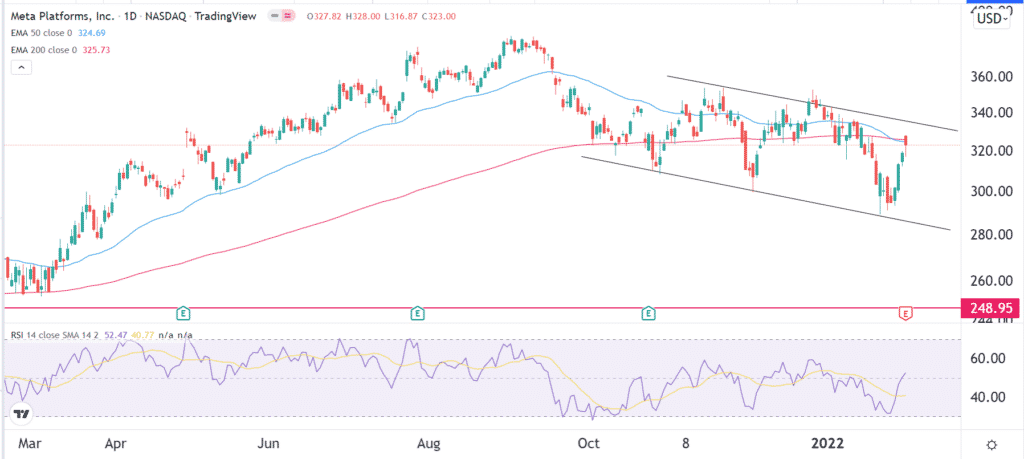

The daily chart shows that the FB stock price closed at $323 on Wednesday. It then declined to a low of $248 after the earnings. Even before the results, the company’s stock was at the 200-day moving average level. A death cross was also about to form.

As it dropped, the stock moved below the lower side of the descending channel shown in black. Therefore, for now, I expect that the Meta stock will remain below $250 for a while.