- US dollar strengthens across the board, sending majors lower

- NZDUSD tanks amid slow economic growth concerns

- Gold under pressure on rising yields, but further downside not favored

- US equities retreat from record highs sending indices lower

- Bitcoin correction continues as sell-off gathers pace

The US dollar began the week on a strong footing strengthening against the majors as the market remained wary of the Federal Reserve tapering the super supportive policy. The greenback rallied by about 0.6% last week, registering its biggest gain in three weeks. In addition to tapering talks, it remains well-supported by rising yields as well as strong demand for safe-havens to hedge against the escalating COVID-19 situation.

NZDUSD corrects lower

The NZDUSD remains under pressure amid the renewed dollar strength across the board. The pair began the week on a back foot, plunging to 0.7097 levels. The pair remains well supported for further gains above 0.7080, a critical support level.

A sell-off followed by a close below the critical support level could result in the pair plunging to the 0.7011 level, the next substantial support level.

The New Zealand dollar remains under pressure despite Prime Minister Jacinda Ardern announcing the easing of a virus-led emergency in Auckland. The NZD failed to cheer against the greenback on the widely expected positive news.

Additionally, NZD sentiments have been weighed heavily by downward economic revision by the NZ Institute of Economic Research. There are growing fears among economists that the recent lockdown is likely to reduce economic activity. While inflation is expected to remain inside the Reserve Bank of New Zealand target of 1-3% annual average GDP growth is expected to remain at 4.5% to March 2023.

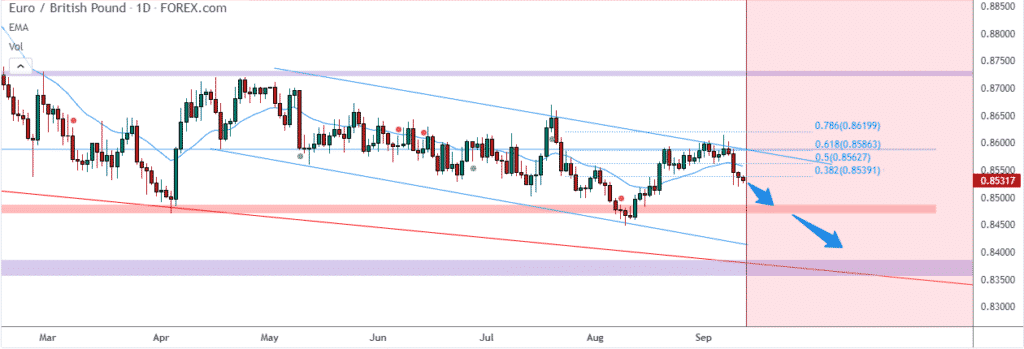

EURGBP slides on euro weakness

Meanwhile, EURGBP remains under pressure despite the British pound starting the week subdued amid a resurgent US dollar. The pair has since plunged to three–week lows as the euro remains under pressure against the pound.

The recent slide means the pair is trading near the 0.8510 psychological levels below wish bears could push the pair even lower.

A breach of the 0.8500 level could result in EURGBP sliding to one-month lows of 0.8440. The pair remains bearish as the pound remains resilient against the euro on the Bank of England, hinting it could hike interest rates in the first half of next year. However, Brexit concerns and dismal economic data continue to curtail the pound strength against the euro.

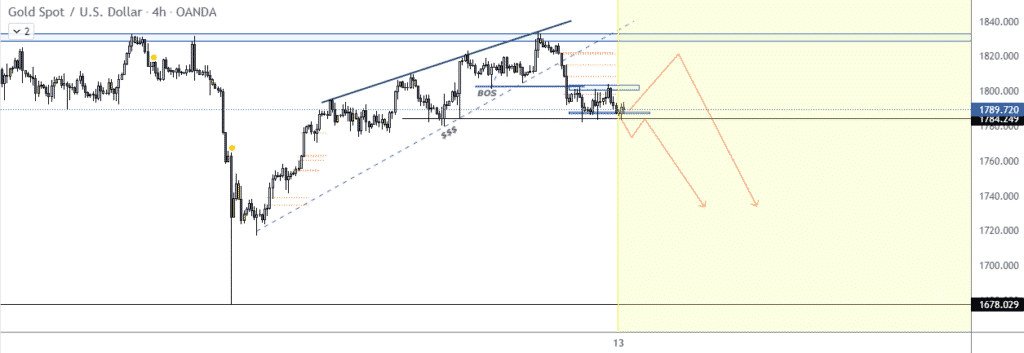

Gold bears under control

In the commodity market, gold remains under pressure after the recent slide below the $1800 an ounce level. Following the formation of a bearish engulfing candlestick last week, it seems bears remain under control below the critical level.

However, bears will have to break the $1780 support level to push XAUUSD even lower as it has emerged as a critical support level in recent days.

Above the $1780 level, bulls could come into the fold and help fuel a rally back to the $1800 level. Last week open interest in gold shrunk by 532 contracts reversing the previous uptick. Therefore, the slide in XAUUSD coincided with shrinking open interest and volume but suggesting extra decline is not favored.

However, the rising US treasury yields pose the biggest pressure to XAUUSD rallying after the recent sell-off. Higher yields should result in a strengthened dollar that could push the precious metal lower.

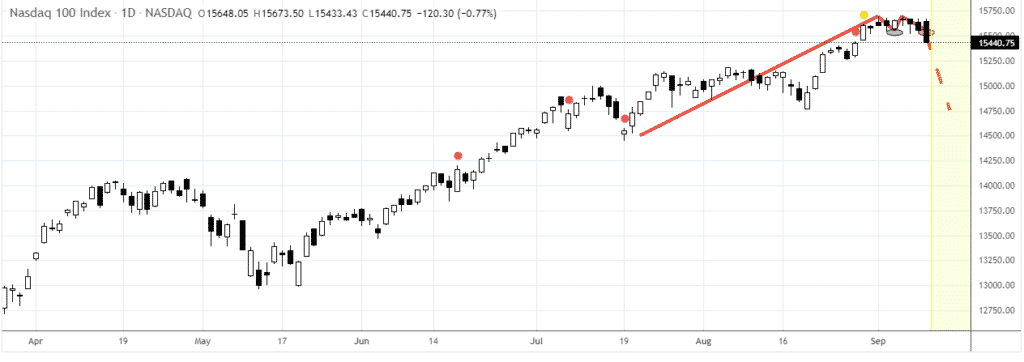

US benchmarks sell-off

Major US benchmarks ended lower on Friday in the stock market, posting a rare weekly loss pointing to growing jitters in the equity markets. The Dow Industrial Average fell 0.8% as the S&P 500 fell 0.8% and the NASDAQ composite lost 0.9%.

The slide in the equity markets came as investors remained wary that a high number of coronavirus delta variant cases could trigger slow economic growth. Additionally, growing concerns of the FED pulling the plug on supportive monetary policy continue to weigh heavily on sentiments in the equity markets. Apple selloffBitcoin sell-off persists

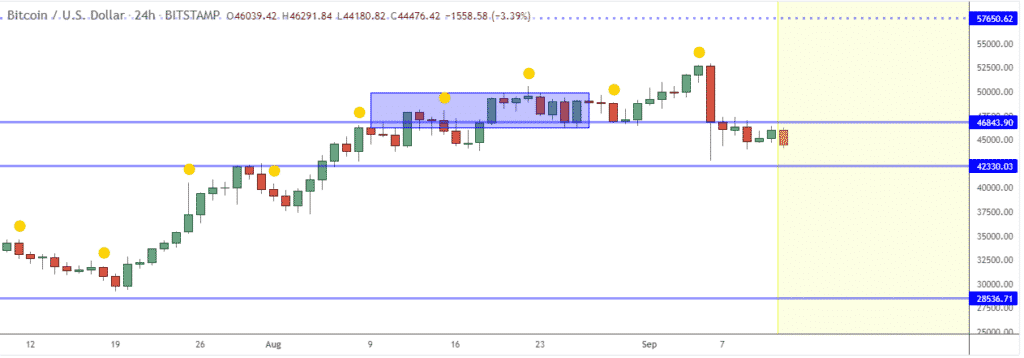

In the cryptocurrency market, BTCUSD remains under pressure as the sell-off in the market continues to gather pace. The flagship crypto could plunge to the $43,969 level, the next substantial support level with bears in control.

Below $43,969, Bitcoin could plunge to two months lows of $42,330, the next substantial support level, Bitcoin is under pressure as traders continue to take profit following the recent rally to four-month highs.