- US dollar weakness persists.

- GBPUSD powers through 1.3300.

- USDJPY remains range-bound at around 113.50.

- Gold powers through $1800 on dollar weakness.

- Bitcoin and Ethereum sell-off persists.

The US dollar is under immense pressure heading into the weekend. Hawkish stances by the Bank of England and the European Central bank have hurt its sentiments. The dollar index, which measures the greenback strength against the majors, is struggling to hold on to gains near the 16-month highs.

The index has since pulled from above the 96.00 handle and flirted with one-week lows of 95.90. The dollar index looks set to remain under pressure as risk sentiment in the market improves on the BOE and ECB adopting more hawkish stances than what the market expected. ECB moving to taper and a surprise interest rate hike by the BOE remains the talk of the market.

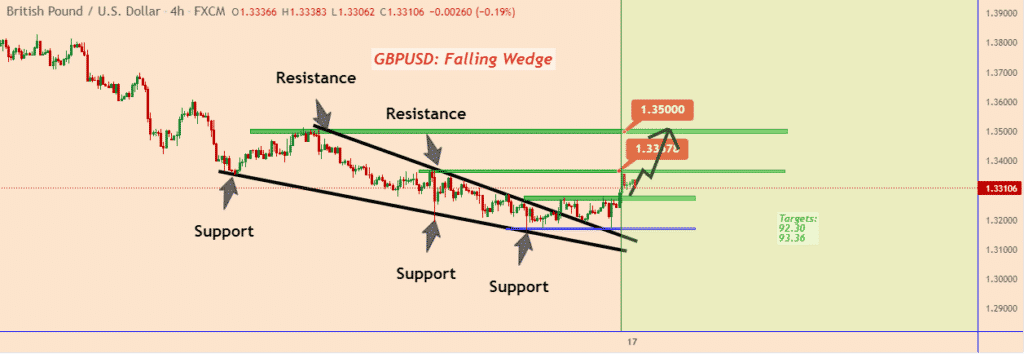

GBPUSD bounce back

The British pound has strengthened across the board, resulting in the GBPUSD pair powering to three-week highs above the 1.3300 level. In the medium term, the 1.3303 is the immediate support level above which it remains bullish.

Similarly, the pair looks set to make a run for the 1.3376 level, the next substantial support level. A breakthrough in the resistance level could open the door for bulls to fuel a rally to one month highs near the 1.3490 level.

The bullish bias on the GBPUSD pair stems from the BOE voting 8 to 1 to increase the benchmark interest rates to 0.25% from 0.1%. The decision came as a surprise as the market expected the policy maker’s to push back on rate hikes amid the spread of the Omicron variant.

Solid economic releases also continue to affirm pound strength across the board. UK retail sales for November came in at 1.4% versus 0.8% expected and 1.1% registered in October.

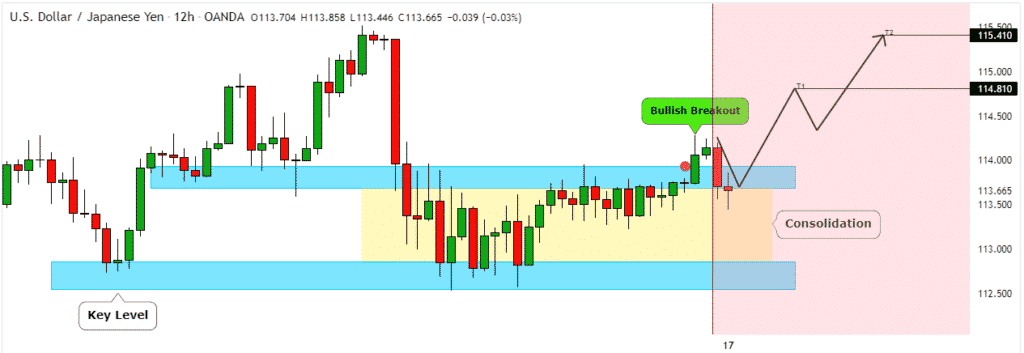

USDJPY struggling for direction

Meanwhile, the USDJPY remains on the defensive amid the dollar softness across the board. The pair is struggling for direction near the 113.50 level in the aftermath of the dollar coming under pressure. In recent days, the pair has witnessed selling pressure on failing to find support above the 114.00 level.

Japanese yen has continued to hold firm against the dollar in recent days amid concerns over the potential impact of the Omicron variant. With investors taking refuge in safe havens, USDJPY could remain under pressure.

Turkish lira sell-off

Meanwhile, the Turkish lira hit a new all-time low after plunging 5.6% against the dollar. The sell-off came on the backdrop of the country’s central bank slashing interest rates amid mounting pressure from President Tayyip Erdogan. The central bank cut the basis point by 100 basis points resulting in the lira plunging to lows of 15.68 against the greenback.

XAUUSD above $1800

In the commodity markets, gold has turned bullish, with XAUUSD powering through the $1800 level to two-week highs of $1806. Gold upward momentum stems from central banks moving to stem accommodative monetary policy as a way of curtailing runaway inflation.

The precious metal is on course for its best week since mid-November. With the dollar under pressure, the metal looks set to make a run for the $1818 level, a key resistance level.

US Indices under pressure

In the equity markets, major US indices remain under pressure as investors react to central banks moving to cut back on accommodative monetary policy. NASDAQ suffered its worst day since September plunging 2.47% on Thursday as the S&P 500 fell 0.87% and Dow Jones fell modestly by 0.08%.

The sell-off in the equity markets comes amid concerns that accelerated tapering could lead to interest rate hikes. An increase in interest rates amid the uncertainty being fuelled by COVID-1 is not boarding well with investors.

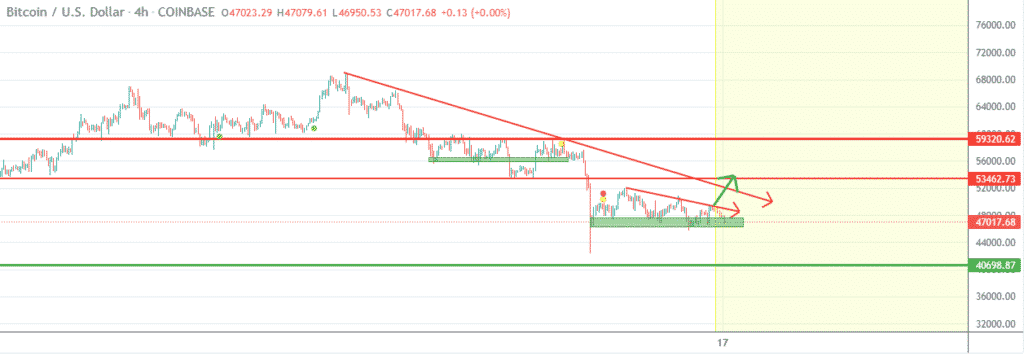

Crypto sell-off

Meanwhile, Bitcoin and Ethereum are poised to finish the week in the red as they remain under pressure despite dollar weakness. BTCUSD is struggling to hold on to gains above the $47,000 handle after rejection above the $50,000 level.

ETHUSD remains under bearish pressure after sliding below the $4,000 level to lows of $3,884. The sell-off in the crypto market stems from investors turning their attention to other heavily battered currency pairs.