- US dollar strengthens to three-week highs ahead of FED meeting.

- GBPUSD tanks to three-week lows on dollar strength.

- EURGBP bottoms out amid pound weakness.

- Oil prices are under pressure on dollar strength.

- US equity retreated from record highs post weekly losses.

The US dollar remained elevated at three-week highs at the start of the week, helped by a string of positive economic releases the past week. Better-than-expected retail sales and manufacturing data have backed the expectation of the Federal Reserve reducing asset purchases before the end of the week.

Additionally, the greenback remains well supported by a spike in nerves to a cautious mood amid a looming catastrophe in China owing to the Evergrande debacle. Concerns over the spread of the delta variant also continue to fuel demand for safe-havens.

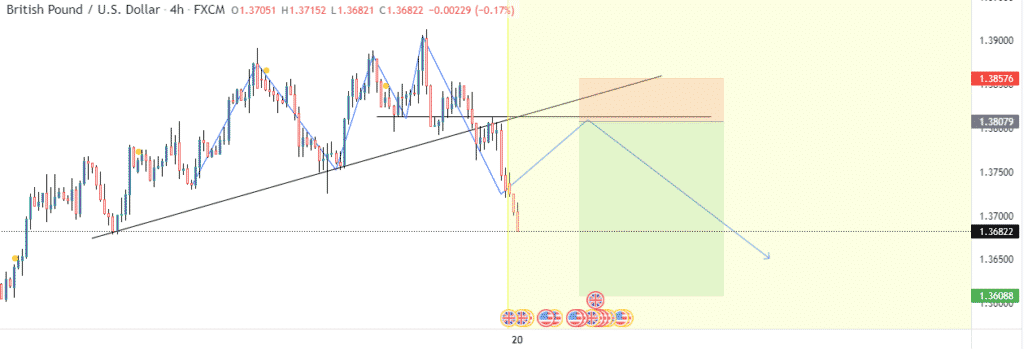

GBPUSD at 3-week lows

Amid the dollar strength, the British pound remains on the back foot at the start of the week, with the GBPUSD pair sliding to three-week lows below the 1.3700 level. The pair remains susceptible to further losses on tanking to 1.3682, a critical support level. The sell-off on the GBPUSD pair comes at the back of the gains on the greenback against the majors.

Better than expected economic data in the US continues to fuel dollar strength against the pound, sending the pair lower. The British pound also remains on the back foot amid growing concerns about the UK inflation situation. A spike in inflation levels could force the bank of England to hike interest rates that could have serious ramifications on an already struggling economy.

US House representative speaker Nancy Pelosi warned that there will be no US-UK deal until the British government resolves the Brexit stalemate and continues to pile pressure on the pound.

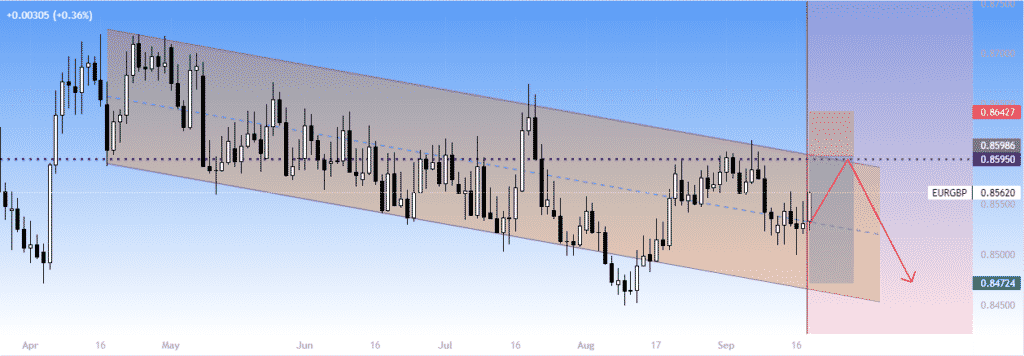

EURGBP bounce back

The pound weakness across the board is the catalyst fuelling a bounce back in EURGBP from one-month lows. The pair has since bounced off the 0.8504 level, taking out the 0.8540 level.

Given the upbeat momentum favoring further upside action, the EURGBP could be on its way to the 0.8565 level, which happens to be the next substantial resistance level. The upside action could be limited given that the Euro also remains under pressure across the board.

The Euro remains under pressure on the European Central Bank, remaining divided on the future tapering of bond purchases and rate hikes.

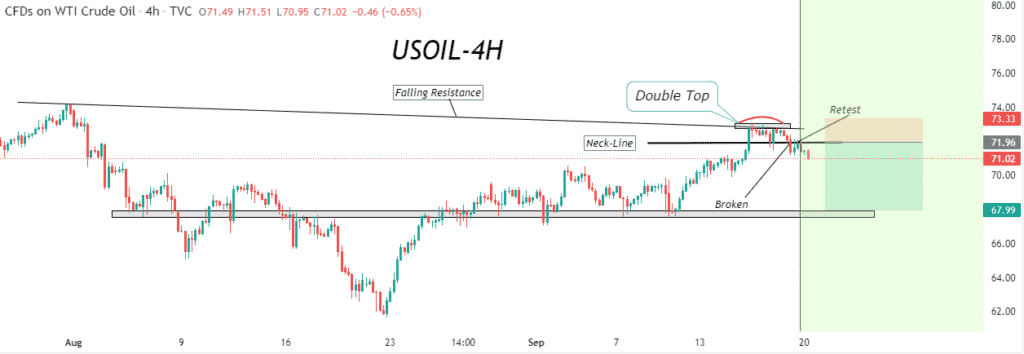

Oil hurt by dollar strength

Oil was down early Monday morning in the commodity markets, pressured by greenback strength across the board. Oil prices have come under immense selling pressure after a recent spike to six-week highs. Brent crude was down by 0.7% to $74.50 as US West Texas oil fell 0.9% to $71.34 a barrel.

A strengthened USD in the last few days continues to provide some headwinds to the oil markets. Oil prices look set to consolidate over the next few days until the trajectory of the greenback is clear, with the Federal Reserve policy minutes scheduled for Wednesday’s tapering announcement that would likely put pressure on oil prices on sending the dollar higher.

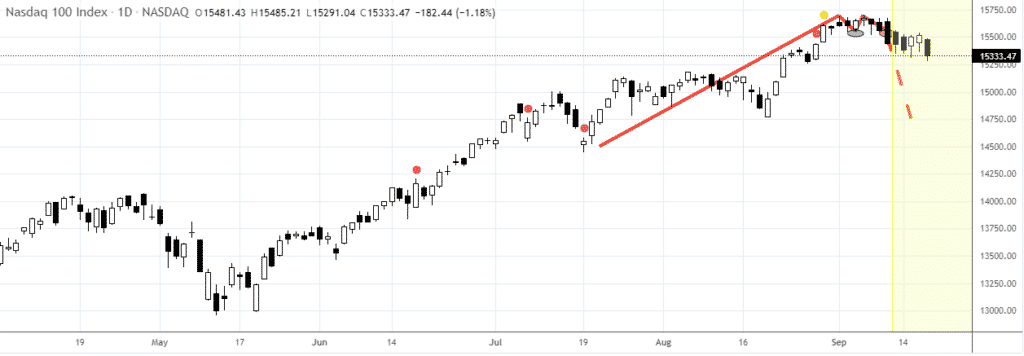

US equity sell-off

In the equity markets, Futures were lower on Monday, building on a weekly sell-off last week. Last week the S&P 500 fell the most in a month to test the buy-the-dip mentality. The Dow Jones Industrial Average was down by about 0.1% last week, registering its third straight weekly loss. The S&P 500 was down 0.6%, posting a second straight weekly loss as the NASDAQ fell 0.5% to post a second straight weekly loss as well.

Bears have been cycling in recent days, wiping out any gains that come into play. A rise in Treasury yields in recent days ahead of the Fed meeting this week is already sending jitters in the equity markets. There are growing concerns that the FED could taper monetary policy that has helped fuel a rally in the equity markets.

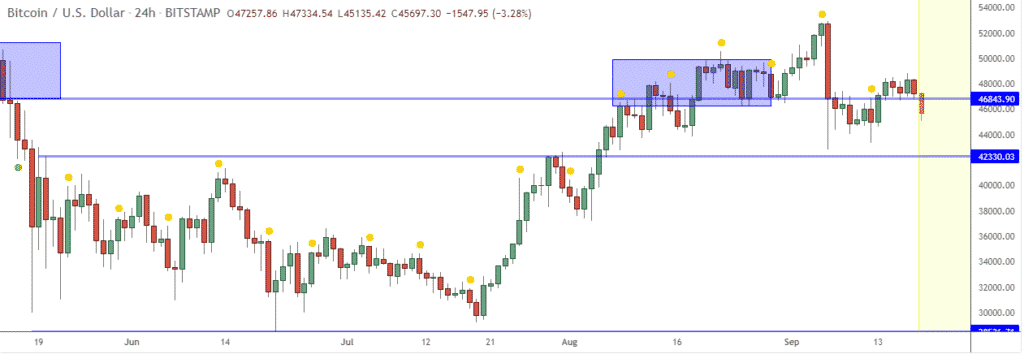

Bitcoin & Ethereum sell-off

A sell-off wave is building up in the cryptocurrency market, with Bitcoin and Ethereum struggling to hold on to gains after a recent bounce back. BTCUSD has since been rejected above the $48,000 level tanking to lows of $45,660.

BTCUSD remains under pressure and could tank to the $43,100 mark, the next substantial support level. ETHUSD also remains under pressure after coming under pressure above the $36,600 the pair has since retracted to lows of $3,190 near the $3,000 support level.