- US dollar firms near one-year highs ahead of CPI.

- GBPUSD shrugs as dollar strength retakes 1.3600.

- GBPJPY remains under pressure at 4-month highs.

- Gold is trading in a narrow range after rejection near $1770.

- Bitcoin and Ethereum upward momentum wanes.

A strengthened US dollar is the central theme in the forex market ahead of pivotal consumer data that could provide clues on when the Federal Reserve will start monetary policy tapering. While the greenback did ease slightly on Wednesday morning, it remains elevated at one-year highs.

The dollar index, which measures the greenback strength against a basket of six other major currencies, has found support above the 94.30 level. With inflation edging higher amid energy crunch, the dollar looks set to strengthen further amid talk the FED will be forced to taper sooner rather than later.

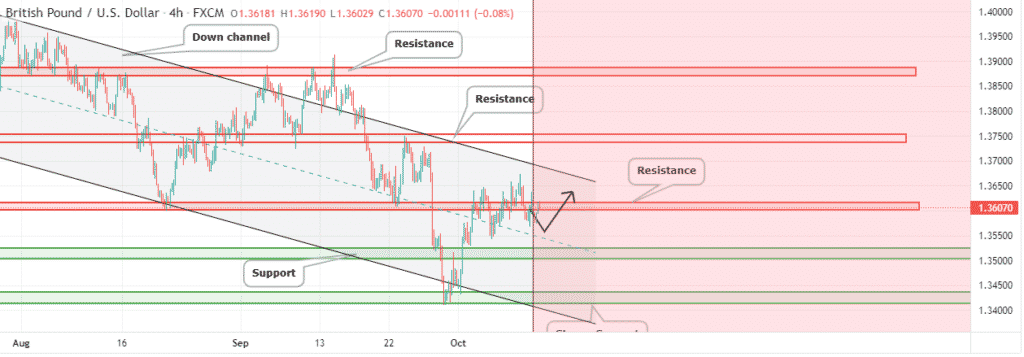

GBPUSD shrugs off dollar strength

The British pound appears to have found its footing shrugging off dollar strength across the board. GBPUSD has since bounced back and retaken the 1.3600 level after coming under pressure in recent days. However, bulls face an uphill task to hold on to gains above the crucial level given the dollar bullish biases.

A sell-off below the 1.3600 level could reignite a push to the 1.3567 level, which has recently emerged as a crucial support level. On the flip side, bulls defending the 1.3600 level would reignite a push to highs of 1.3640, the next substantial resistance level.

The British pound remains well supported at the back of mixed economic releases. The Claimant Count Exchange for September improved to -51.1k, better than the August reading of -58.6k. Additionally, the ILO Unemployment rate dropped to 4.5% from 4.6%. However, GDP monthly releases showed the economy expanded less than expected in August by 0.4% against an expected 0.5%.

GBPJPY pullback

Meanwhile, the British pound is struggling to hold on to gains at four-month highs against the Japanese yen. The GBPJPY appears to have hit strong resistance at 154.84, where bears are increasingly coming into the fold.

Any pullback from current highs would have to contend with support at 154.06 level below which GBPJPY could turn bearish and edge lower. The Japanese yen has come under immense pressure in recent days amid the energy crunch and rising US treasury yields that have seen many traders opt for dollars as opposed to the yen.

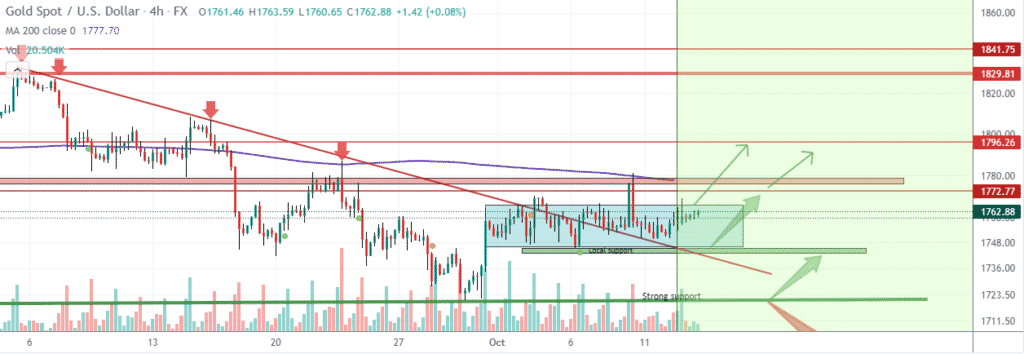

Gold narrow range

In the commodity markets, gold maintains a neutral stance after failing to power through the $1770 level. However, some bullish momentum appears to be building on US treasury yields retreating slightly ahead of FOMC minutes and consumer price data.

XAUUSD has since found support above the $1760 level, be it in the short term. A sell-off followed by a close below the $1760 level could reignite a push to lows of $1750, a crucial support level below which gold could resume its leg lower. On the flip side, a rally followed by a close above $1770 would reignite a push to the $1787 level.

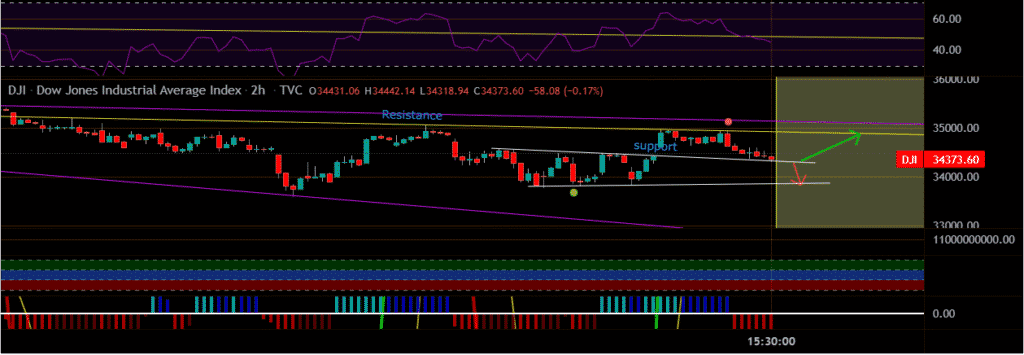

US indices waiver

In the equity market, US stocks continue to waiver, sending major indices lower. The Dow Jones Industrial Average fell 0.2% as the S&P 500 fell 0.1% and the tech-heavy NASDAQ fell by less than 0.1%. The indices continue to be dragged lower by choppy trading.

Investors remain wary ahead of a pivotal earnings session that could provide insights on the impact of runaway inflation. Bond yields spiking to four months highs have all but increased the case for the FED to taper, all but providing another headwind.

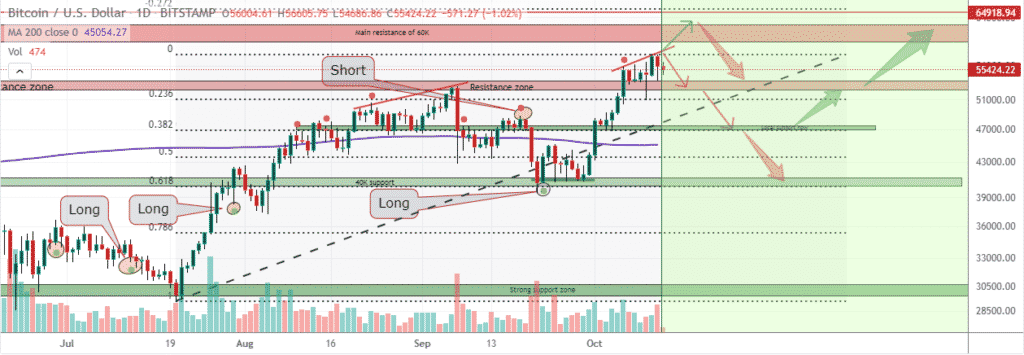

Crypto rally stalls

In the cryptocurrency market, Bitcoin and Ethereum appear to have hit a strong resistance level as part of the recent leg higher. BTCUSD has once again started edging lower after failing to hold on to gains above the $57,000 level. The pair faces strong support at the $53,300 level, below which it could plunge to the $50,000 level.

Ethereum, on the other hand, found the going tough above the $3,600 level retreating to lows of $3,460 level. The pullback faces strong support at the $3,373 level, below which it could plunge to the $3,068 level.