- U.S. dollar is on the back foot on less hawkish Fed.

- GBPUSD and EURUSD are poised for a weekly gain.

- U.S. indices struggle for direction on FED policy uncertainty.

- Bitcoin and Ethereum bounce of three-month lows.

The U.S. dollar is headed for its biggest weekly loss in eight months as it remains under pressure against the majors. The dollar index, which tracks the greenback strength, has dropped to a two-month low of 94.89 after shedding about 0.9% this week.

The sell-off in the dollar has been fuelled by traders trimming net long positions. The cuts come on rate hike prospects appearing to be already priced in. A spike in inflation to 40-year highs has done little to fuel dollar strength even on affirming the prospect of the Federal Reserve hiking interest rates.

GBPUSD rally persists

Dollar weakness might explain why GBPUSD is flirting with two and half month highs after turning bullish in recent weeks. The pair has since powered to highs of 1.3729 level, with bulls setting sights on the 1.3800 handles.

The bullish momentum on the GBPUSD pair stems from the Bank of England turning hawkish in recent weeks. It has also found support on the BOE carrying out a 15 bps rate rise last month. Expectations of further rate hikes in the year should continue to fuel the upward momentum on the pair.

The dollar remains under pressure in the aftermath of less hawkish comments by Federal Reserve Chairman Jerome Powell. Looking ahead focus is on the release of U.S. retail sales for December, which could influence dollar strength conversely GBPUSD.

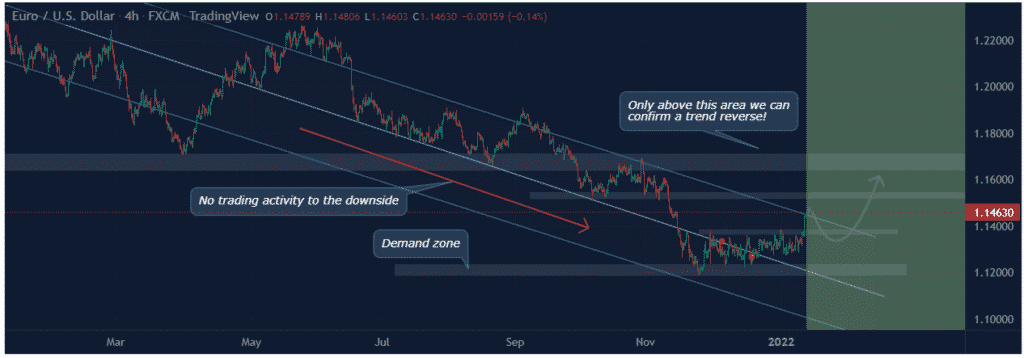

EURUSD weekly gain

The EURUSD is also on course for its biggest weekly gain in months after powering through the 1.1400 handle. The pair is up by more than 0.8% for the week, having found support above the 1.1400 handle. The bullish biasness stems from the dollar weakening across the board and weakening against the majors.

After the recent rally, the 1.1480 has emerged as a critical resistance level standing in the way of the pair making a run for the 1.1500 handle. A rally followed by a close above the 1.1500 should pave the way for bulls to steer a rally to the 1.1570 handle.

Oil price under pressure

In the commodity markets, oil prices remain under pressure for the second day, running amid growing concerns that Washington may act to cool prices which remain above the $80 a barrel level. Prices also remain under pressure amid new movement curbs in China as authorities look to reign on the spread of the Omicron COVID-19 variant.

Brent crude was down 6 cents to $84.41 as U.S. WTI oil continues to hold above the $80 a barrel level at $81.91 a barrel. Oil prices could remain under pressure heading into the weekend in China, suspending some international flights expected to reign in demand.

The U.S. Energy Department has also sought to ramp up supply by selling eighteen million barrels of strategic crude oil reserves to 6 companies. The sale is part of an effort to curtail a further spike in prices.

Indices struggle for direction

Major benchmark indices remain under pressure dragged by losses in technology stocks in the equity markets. NASDAQ was down 1.5% as S&P 500 gained 0.4% and the Dow Jones Industrial Average was flat.

The choppiness in the equity market stems from investors being extremely cautious and watching for any developments that could affect the Federal Reserve calculation on monetary policy tightening.

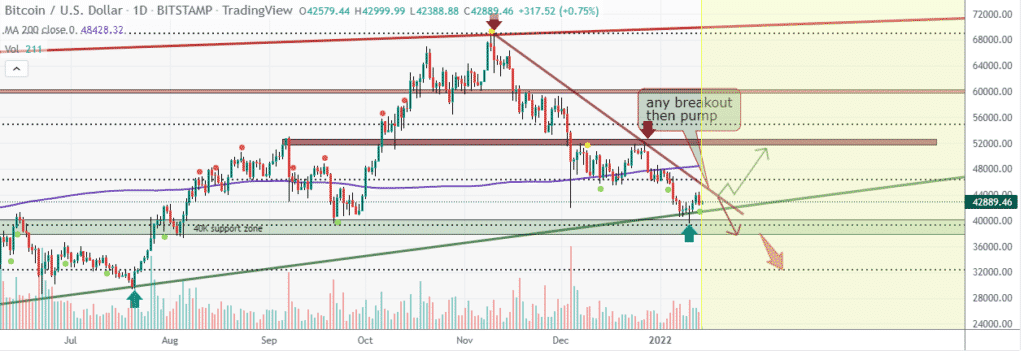

Crypto bounces back

Bitcoin and Ethereum are in a recovery mode in the cryptocurrency market after a recent slide to three-month lows. BTCUSD has powered to highs of $42,800 after a slide to below the $40,000 handle at the start of the week.

ETHUSD has also found its footing above the $3,000 handle after selling to lows of $2,963 at the start of the week. The bounce back in the crypto market coincides with the dollar coming under pressure and weakening across the board.