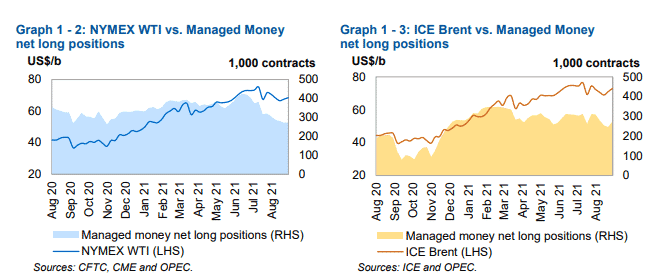

(OPEC) The new long positions on combined futures and options in Brent crude stood at 273,894 lots in the week ending August 31, after a fall of 12.1% or 37,765 contracts. Similar positions on WTI were down 15.0% or 48,318 contracts to 272,917 lots.

Fig: Long Positions on Brent and WTI

In Brent markets, gross short positions went down by 16.6% or 13,245 lots to reach 66,371 contracts. Gross long positions closed down 13.0% or 51,010 lots to reach 340,265 contracts in the week of August 31.

In WTI crude markets, short positions were up by 16.1% or 7,542 lots to reach 54,260 contracts. Long positions went down by 11.1% or 40,776 contracts to reach 327,177 contracts in the week to August 31.

OPEC hints that despite the sluggish demand outlook, prospects of demand and supply deficit in the second half of this year keeps the oil market structure in backwardation amid price falls in August.

The oil cartel opines that Brent backwardation reduced in August due to more supply in the Atlantic Basin and the release of unsold volumes, especially from the Asia-Pacific refiners.

CL1! is up +1.70%