Source: Bloomberg

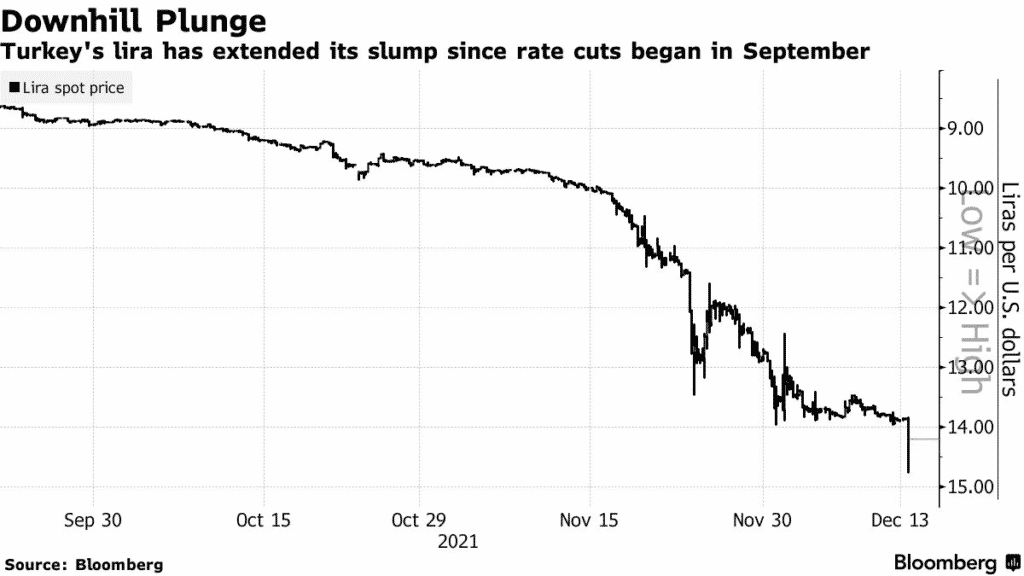

Turkish lira fell to a fresh record low on Monday, extending declines against the dollar to above 14 after S&P Global Ratings gave it a negative outlook. USDTRY is up +3.49%

- S&P gave the outlook, citing growing risks of lira due to high volatility.

- The downgraded outlook dampened the lira which was already facing pressure from recent rate cuts by the central bank. Turkey’s Treasury and Finance chief Nureddin Nebati said, on Sunday, that the country will not raise rates.

- The fall in the lira saw Turkey’s 10-year government bond rise up to 31 basis points to trade at a three-year high before shedding some gains. The benchmark Borsa Instanbul 100 index rose 2.7%.

- Lira has now shed about 48% this year against the dollar, making it the worst performer in the emerging markets. The decline is now reigniting inflation concerns, with prices expected to peak at 25% to 30% in early next year.