Limassol-headquartered financial giant Just2Trade Limited is an international brokerage company with an umbrella of offices around the globe serving thousands of customers with brokerage, investment, and portfolio management services. Since its debut in 2006, Just2Trade transformed the financial trading space offering clients direct market access, low spreads starting from 0.0 pips, and ultra-fast executions in a wide range of markets.

Pros

- Serves both international traders and investors

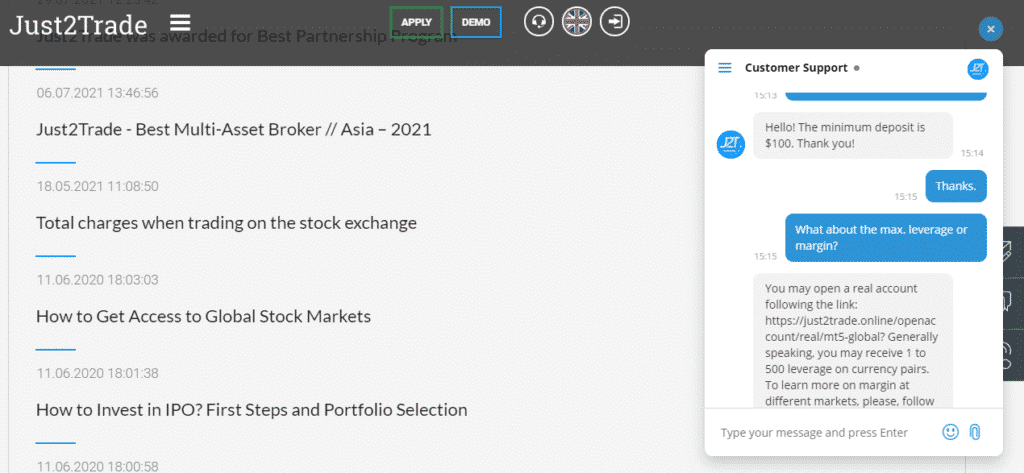

- $100 minimum deposit

- Leverage of up to 1:500

- 10+ years of experience in the financial industry

- An actual STP/ECN execution broker

- Negative balance protection

- Authorized in the EU and regulated by the CySEC

- Low spreads starting from 0.0 pips

- Extensive markets holding dozens of instruments

Cons

- Trading fees and commissions

- Charges an inactivity fee of $15 quarterly

- Bank deposits charge a transaction fee

- Few educational sources

International brokerage firm Just2Trade Ltd dates back to 2006 when it launched its financial services. The company offers financial services to market traders and investors within the retail and institutional space and claims to have won the hearts of more than 155,000 clients since its debut. The clientele revolves around 130 countries worldwide as the broker extends roots across America, Europe, Asia, Russia, among other regions.

It operates as an actual No Dealing Desk (NDD) broker offering STP/ECN executions and direct market access of multiple asset classes trading with low spreads and margins and leverages of up to 1:500. The minimum spread starts from 0.0 pips, while some assets trade with up to 2% margins.

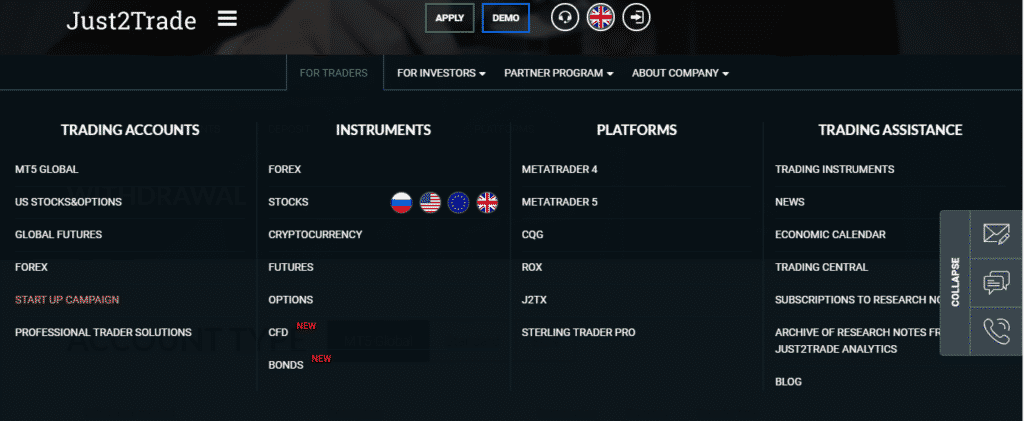

Its asset classes include:

- Forex

- Stocks

- Cryptocurrencies

- Futures

- Options

- CFDs

- Bonds

Customers speculate on these classes’ instruments through the broker’s array of trading platforms that integrate powerful tools providing clients with execution speeds of up to 0.5 seconds. Just2Trade offers clients access to the renowned MT4 and MT5 platforms and other states of the art trading platforms such as:

- CQG

- ROX

- J2TX

- Sterling trader pro

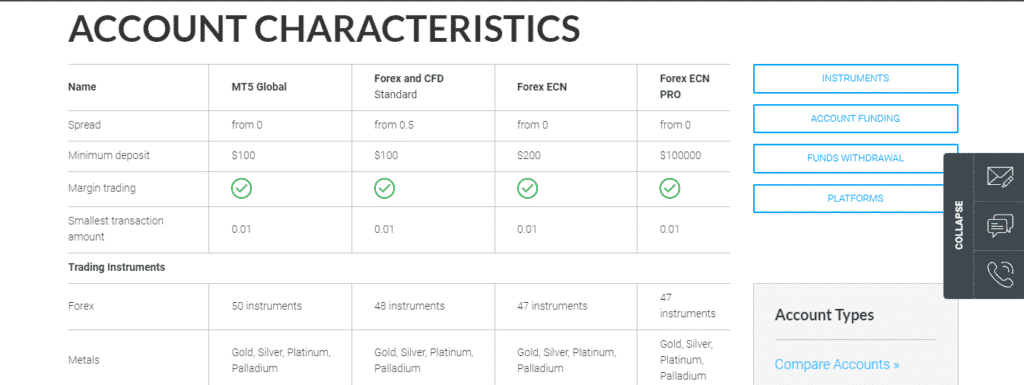

Trading conditions depend on the asset class and the account type the client selects. Some asset classes trade with higher fees and commissions compared to others. The account type also affects the conditions applicable to a client. For example, the minimum deposit is capped at $100 for the MT5 Global clients while the amount stretches to $100,000 for the Forex ECN Pro customers.

The broker offers the following accounts:

- The MT5 Global account

- Standard Forex and CFD account

- Forex ECN account

- Forex ECN Pro

However, besides the slight differences in the accounts as shown in the account type section of this review, the broker curbs all clients from going negative regardless of the number of losses incurred. It also waives fee transactions on an array of deposit methods except for banks and a few other channels.

Some of the payment options include:

- Bank transfers

- Credit cards

- Union Pay

- E-wallets like skrill and Netteler

- PayPal

- Cryptocurrency wallets

Amid funding the trading accounts, clients trade the broker’s extensive instruments aided by 24/7 customer support and smart trading tools giving traction to effective and profitable trading. The broker offers tools such as economic calendars, fix API, market watch tools, among others, and guarantees to maintain loyalty and transparency as it holds reputable trading licenses from bodies such as the CySEC.

Regulation

Just2Trade claims to operate under the surveillance of legitimate regulatory bodies. It also notes having EU authorization making it relatively safe for financial operations. Just2Trade holds the following regulatory licenses:

- Abides by the laws imposed by the European Securities and Markets Authority (ESMA)

- Regulated by the Cyprus Securities and Exchange Commission (CySEC), under license number 281/15

Pros

- Regulated by the CySEC

- Follows the ESMA laws

Cons

- It’s unavailable in some nations

Account Types

As mentioned in this review, Just2Trade attends to its spectrum of clients by providing multiple account types tailored to meet the clients’ needs.

MT5 Global account

- Spread from — 0.0 pips

- Minimum deposit — $100

- Margin trading — yes

- Smallest transaction amount — 0.01

- Forex instruments — 50

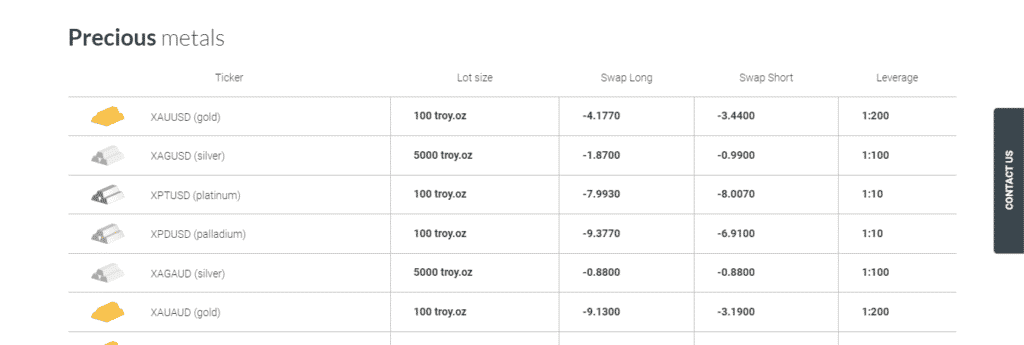

- Metals — gold, silver, platinum, palladium

- Cryptocurrencies — five

- Stocks — from five global stock exchanges

- Futures — yes from two exchanges

- Bonds — yes

- CFDs and shares — access to global share markets

- CFDs on indices — yes

- Oil — yes

- Order execution — market

- Re-quotes — no

- Forex — $2 per lot

- Commission on CFDs — less than $3 per lot

- Swap — yes

- Platform — MetaTrader 5

- Mobile trading — yes on android

- Contract size — 1 lot = 100000

- Pricing — five decimal places

- Margin call — 100%

- Stop out — 50%

- Position hedging — no

- Phone trading — yes

- Automated trading — yes

- Trading on the news — yes

- Scalping — yes

- Trading central news — yes

- Trading central signals — yes

Standard forex and CFD account

- Spread from — 0.5 pips

- Minimum deposit — $100

- Margin trading — yes

- Smallest transaction amount — 0.01

- Forex instruments — 48

- Metals — gold, silver, platinum, palladium

- Cryptocurrencies — 2

- Stocks — no

- Futures — no

- Bonds — no

- CFDs and Shares — access to the US shares market

- CFDs on indices — yes

- Oil — yes

- Order execution — market

- Re-quotes — no

- Forex commission — no

- Commission on CFDs — yes

- Swap — yes

- Platform — MetaTrader 4

- Mobile trading — yes on android

- Contract size — 1 lot = 100000

- Pricing — five decimal places

- Margin call — 100%

- Stop out — 50%

- Position hedging — yes

- Phone trading — yes

- Automated trading — yes

- Trading on the news — yes

- Scalping — yes

- Trading central news — yes

- Trading central signals — yes

Forex ECN account

- Spread from — 0.0 pips

- Minimum deposit — $200

- Margin trading — yes

- Smallest transaction amount — 0.01

- Forex instruments — 47

- Metals — gold, silver, platinum, palladium

- Cryptocurrencies — two

- Stocks — no

- Futures — no

- Bonds — no

- CFDs and shares — no

- CFDs on indices — yes

- Oil — yes

- Order execution — market

- Re-quotes — no

- Forex commission — less than $3 per lot

- Commission on CFDs — yes

- Swap — yes

- Platform — MetaTrader 4

- Mobile trading — yes on android

- Contract size — 1 lot = 100000

- Pricing — five decimal places

- Margin call — 100%

- Stop out — 50%

- Position hedging — yes

- Phone trading — yes

- Automated trading — yes

- Trading on the news — yes

- Scalping — yes

- Trading central news — yes

- Trading central signals — yes

Forex ECN Pro account

- Spread from — 0.0 pips

- Minimum deposit — $100000

- Margin trading — yes

- Smallest transaction amount — 0.01

- Forex instruments — 47

- Metals — gold, silver, platinum, palladium

- Cryptocurrencies — two

- Stocks — no

- Futures — no

- Bonds — no

- CFDs and shares — no

- CFDs on indices — yes

- Oil — yes

- Order execution — market

- Re-quotes — no

- Forex commission — less than $2 per lot

- Commission on CFDs — yes

- Swap — yes

- Platform — MetaTrader 4

- Mobile trading — yes on android

- Contract size — 1 lot = 100000

- Pricing — five decimal places

- Margin call — 100%

- Stop out — 50%

- Position hedging — yes

- Phone trading — yes

- Automated trading — yes

- Trading on the news — yes

- Scalping — yes

- Trading central news — yes

- Trading central signals — yes

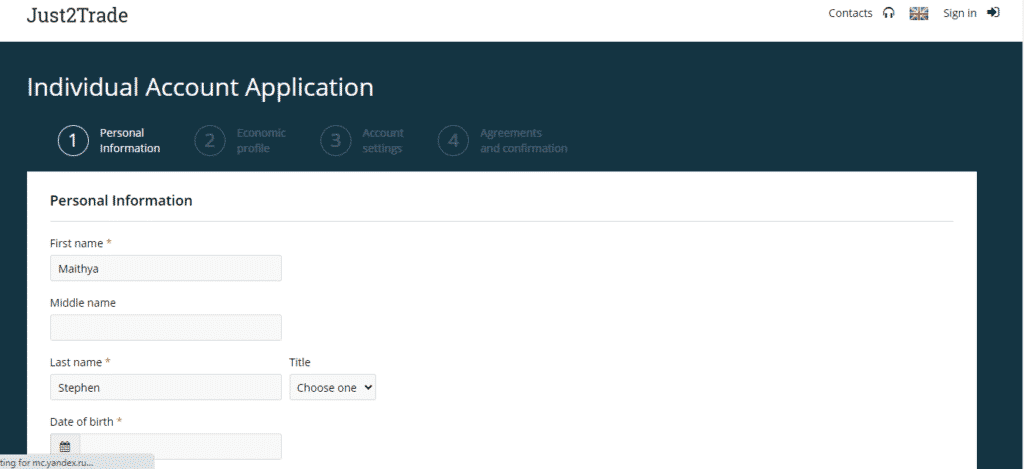

How to open a Just2Trade account?

Just2Trade allows both individual and corporate clients to open a live trading account. Besides, the broker also offers a demo account that helps traders to familiarise themselves with the Just2Trade environment. The live account opening process involves the following simple steps.

Step 1. Log into their official website and press the apply button.

Step 2. Fill in your details on the simple form that pops up.

Step 3. The broker redirects you to another page that asks for your personal information, economic profile, account settings, and agreements and confirmations.

Step 4. After filling in those details, verify and fund your account.

Step 5. Start trading.

Fees and Commissions

Just2Trade, a trustworthy STP/ECN broker, does not offer fees on the spread but charges fees and commissions on its products. The broker charges one-time fees, such as the brokerage fee and an account commission the clients incur every month.

The other fees and commissions include forex and CFDs trading commissions, as highlighted in the account section of this review. The broker also charges an inactivity fee of $15 quarterly. In addition, deposits made through some banks attract a transaction fee, as do most withdrawal charge fees.

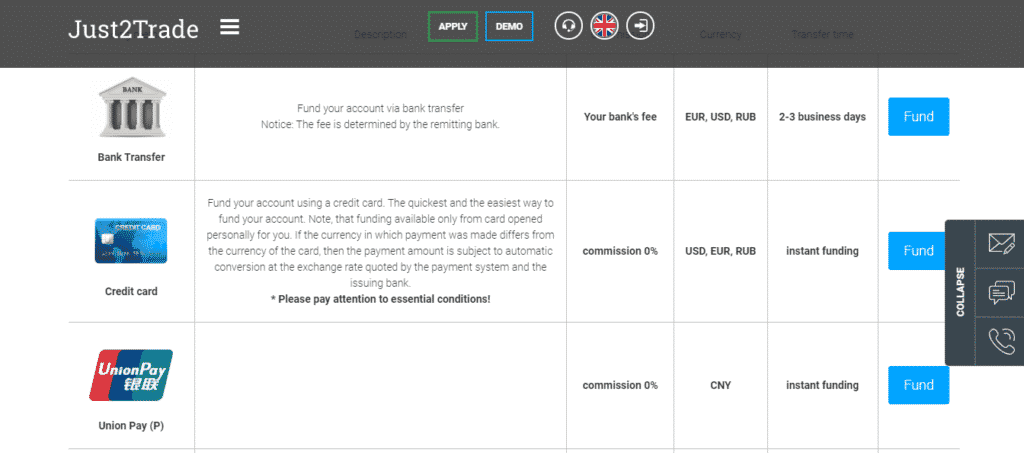

Payment options

As an international company serving clients from all corners of the globe, Just2Trade provides multiple payment options encompassing bank transfers, e-wallets, cryptocurrencies, among a spectrum of other channels.

Pros

- Multiple payment options

- Deposit is free for several payment options

- Accepts deposits in cryptocurrency

Cons

- Some banks charge transaction fees on deposits, and most channels charge for withdrawals

Deposit

Just2Trade accepts deposits from these methods:

- Bank transfers

- Credit cards

- Union Pay

- Skrill and its affiliates

- POLI

- WebMoney

- Neteller

- Crypto-wallets like BTC, ETH, and Tether

- Trustly

- Klarna by skrill

- Banks of Vietnam

- Alfa-bank

- PayPal

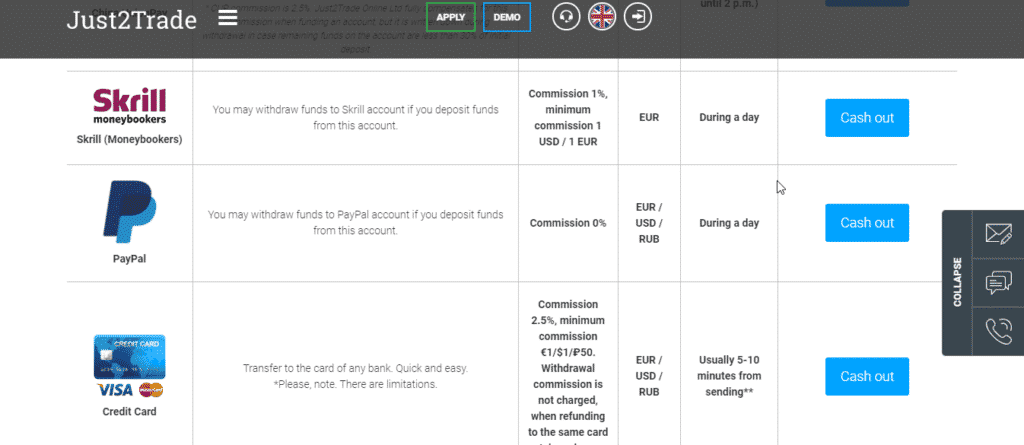

Withdrawals

Accepted withdrawal methods include:

- Finam Bank

- Currency transfers

- Crypto-wallets

- Neteller

- AstroPay

- China UnionPay

- Skrill

- PayPal

- Credit cards such as Visa and MasterCard

Available Markets

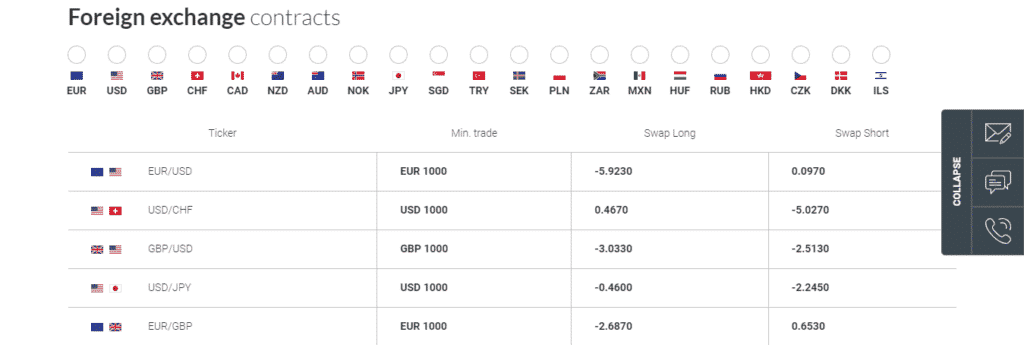

Forex

FX trades from Sunday 21:05 UTC to Friday 21:00 UTC with direct market access and ultra-fast executions. The broker notes to provide 50 currency pairs of significant pairs, majors, and exotics, but the number of pairs a client trades depends on the account chosen. As some clients trade 50 pairs, others only have access to 47 currency pairs.

Nonetheless, traders also incur a brokerage commission of $2 per lot but benefit from real-time expert customer support. Other fees such as swaps are added every trading night. However, the instruments trade with leverages of up to 1:500 and margins from 2% or lower against eight base currencies.

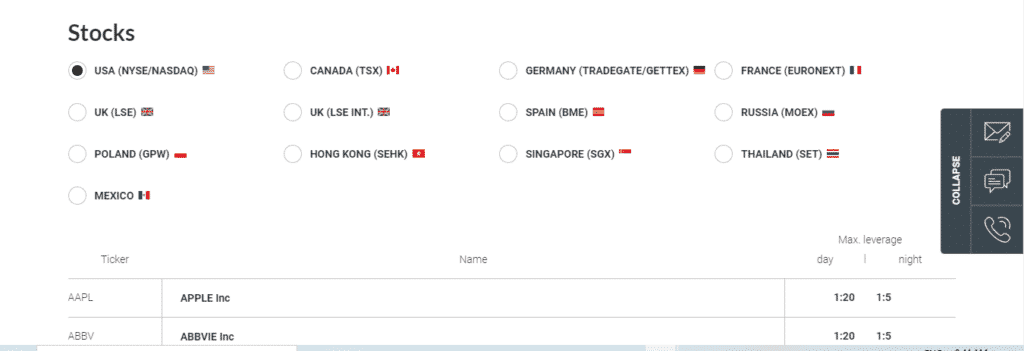

Stocks

Just2Trade provides a rich stock market summing from major global stock exchanges from the USA, Canada, Germany, UK, and France. Depending on the account type chosen, the trading conditions, such as fees and the instruments available to the trader. Some accounts, such as MT5 Global, have direct access to the Just2Trade stock market instruments. The US stock market trades with a leverage of up to 1:20 during the day and 1:5 during the night.

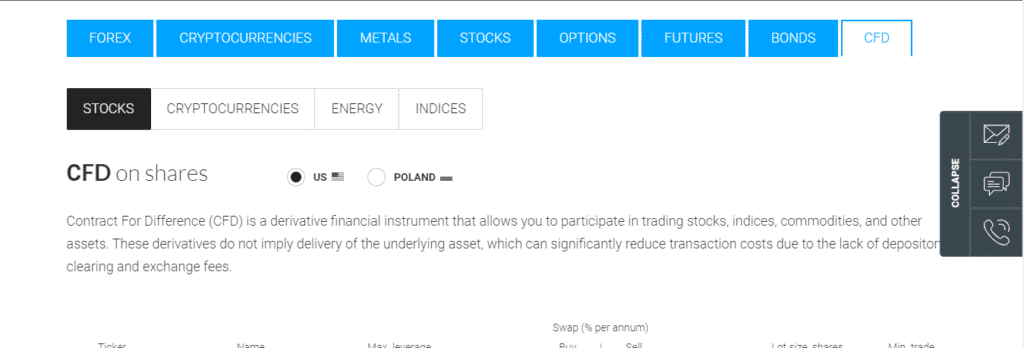

CFDs

Just2Trade allows clients to access the CFDs market on asset classes such as stocks, cryptocurrencies, energy, and indices. They gamble on the value movement of these assets’ instruments from Monday through Friday with leverages of up to 1:5.

Metals

The broker also allows clients to access the metals market, holding the world’s valuable products such as gold, palladium, silver, among others. These instruments trade from Monday through Friday with a brokerage commission of $2 per lot.

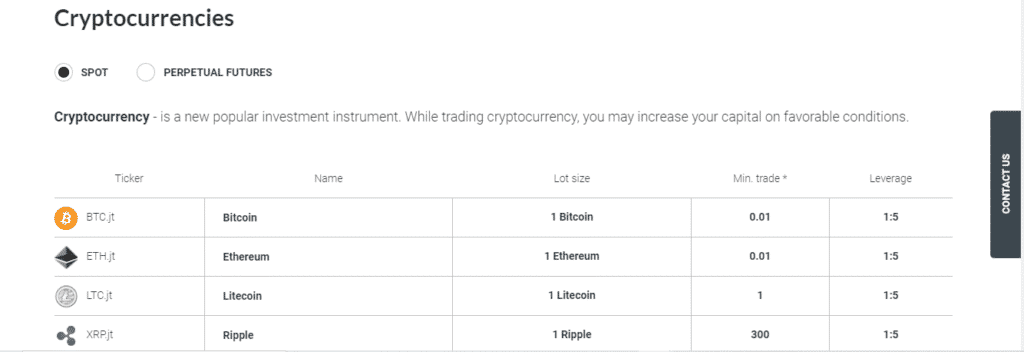

Cryptocurrencies

The cryptocurrency market trades 24/7 and contains instruments such as Bitcoin, Ethereum, Litecoin, among others. Customers speculate on these products with a leverage of up to 1:5. Other commissions depend on the monthly turnover of client’s trades.

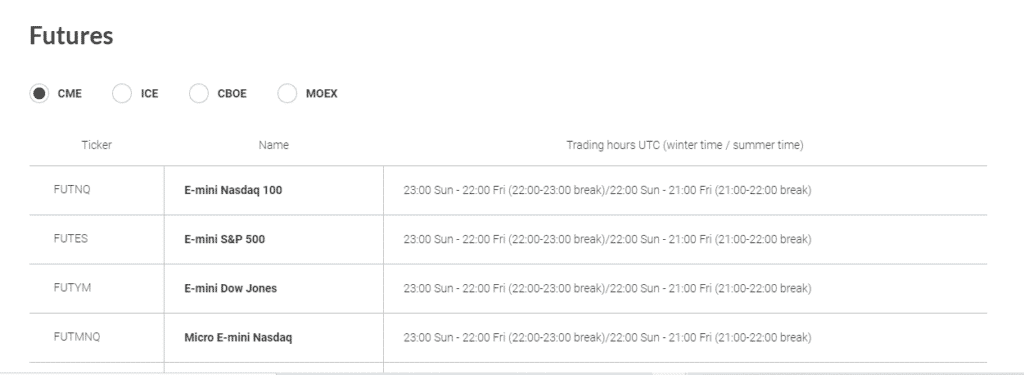

Options & futures

Clients access the US equity options from Monday through Friday with a 100% margin requirement for long positions and $5 commissions per contract on the MT5. Futures trade with a margin requirement close to an exchange and a $1.5 per contract brokerage commission.

Trading Platforms

Just2Trade offers two leading platforms with a stream of other platforms. It provides traders with the popular trading platforms, MT4 and MT5, and an array of other platforms. However, the broker advocates clients for the MetaTrader platform. They integrate with tools and plugins, prompting a good trading environment, and operate on multiple web, desktop, and mobile interfaces.

MetaTrader 5

- Time frames — 21

- Indicators and graphic objects — yes

- User-friendly-yes

- Additional types of pending orders

- Programming language — MQL5

- Market depth — yes

MetaTrader 4

- Spot metals and futures trading on forex

- Programming language — MQL4

- Trade on multiple interfaces — yes

- Financial news from leading providers — yes

- Technical analysis from trading central — yes

- Trading advisors — yes

Clients also access other trading platforms such as CQG with subscriptions. The type of subscription depends on the objectives the client intends to achieve with the platform. Besides, the broker also provides other platforms such as:

- ROX

- J2TX

- Sterling trader Pro

Features

Just2Trade features generally include:

Trading tools

- Expert advisors such as Robo-advisor

- Fix API

Analytical tools

- Market watch information tools

- Technical analysis tools

- Economic calendar

Education

Just2Trade provides few educational resources compared to other brokers. It only allows clients access to its blog furnished with tutorial articles about how to open an account and trade some of the instruments, among others.

Customer Support

Just2Trade claims to offer 24/7 customer support accessed by clients via its official website. Clients contact the support team through a live chat, email, and calls. The live chat response takes only a few seconds.

Review Summary

Just2Trade rolled out its financial services in 2006, aiming to serve retail and institutional clients in the trading space. Over time, the broker grew to achieve this milestone and started offering STP/ECN order executions, tight spreads on a wide range of markets to more than 150,000 clients.

Generally, the broker is suitable for intermediate and expert traders. Besides, it also serves an umbrella of clients looking for quality investment services such as portfolio management and investment advice. It is deemed as an average safe broker as it holds a two-tier regulation license.