(Markets Insider) Strategists at JPMorgan believe investors can benefit from another 40% bull run in commodities, pointing out that the asset class is still under-allocated.

The strategists say that commodity prices are yet to fully price in the Ukrainian war, with more room to move higher.

The comments come amid a jump of 33% in oil prices year-to-date. Other commodities such as natural gas, wheat, and copper have added 65%, 33%, and 7%, respectively.

The bank highlights that increased demand for commodities in the post-pandemic era, combined with the lack of Russian suppliers, will support prices.

The strategists point out that oil, metals, and agricultural products are among those that will see around a 30% to 40% rise.

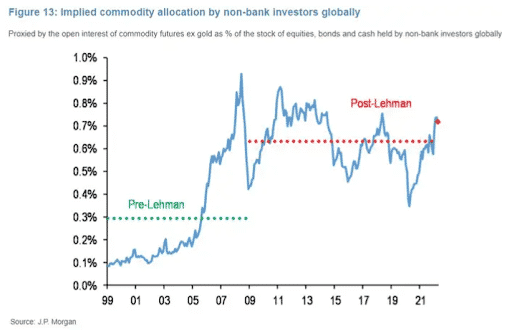

JPMorgan says that the open interest of commodity futures in gold is currently $1.4 trillion. It says although the level is high by historical standards, it is much lower compared to those of bonds, equities, and cash.

Investors’ implied commodity allocation is estimated at 0.72% by JPMorgan, above the average during the Lehman Brothers crash, but below the highs of 2008 and 2011.

The bank sees longer-term commodity allocations rising above 1% of total financial assets globally, which will surpass the 2008 and 2011 highs. The level coincides with a 30% to 40% rise in commodities.

CL1! is up +0.22%, XAUUSD is up +0.57%