- Square is benefiting from a long-term secure trend: the shift from cash to digital payments. The company has barely scratched the service of the market opportunity available to it, which implies a massive growth potential ahead. For example, it currently operates in five countries when its rival PayPal is already available in more than 200 countries. Square has made strategic acquisitions to enable it to make the most of the revenue opportunity.

- Square has perfected the art of upselling its customers. It means the company can grow its revenue with its existing customers by adopting more of its products. Square’s penetration with large merchants also bodes well for the company’s long-term growth. Moreover, Square’s exposure to bitcoin is a strategic advantage that investors shouldn’t ignore. The company’s $50 million bitcoin investment in 2020 has grown significantly, with the cryptocurrency price recently crossing $50,000.

- Square executives have been prudent in the way they run the company. When they realized that Caviar food delivery service wasn’t an excellent strategic fit, they offloaded it, and Square made good money in the process. The management team has proven dependable to make the right decisions to ensure the business’s long-term prosperity.

Square: The company and the business

Square is a financial technology company. Its first business was selling card readers that enabled small merchants to accept credit card payments. They ensured the merchants didn’t miss a sale simply because a customer wanted to pay with a card instead of cash. The company has since expanded and diversified to a one-stop-shop for financial solutions. Square’s offerings are grouped as Seller solutions and CashApp.

With PayPal, Square is waging war on cash, which the fintech industry considers its greatest competitor.

Square was founded in 2009 by Jack Dorsey and Jim McKelvey. The company has made the number of acquisitions expand and diversify its business to serve its customers better and capitalize on the growth opportunity. Its notable acquisitions include Weebly and Credit Karma Tax. It acquired Weebly in 2018 for $365 million to strengthen its online business. Weebly offers website building services. Merchants use it to set up digital shops. Square acquired Credit Karma Tax to bring free tax filing to its platform.

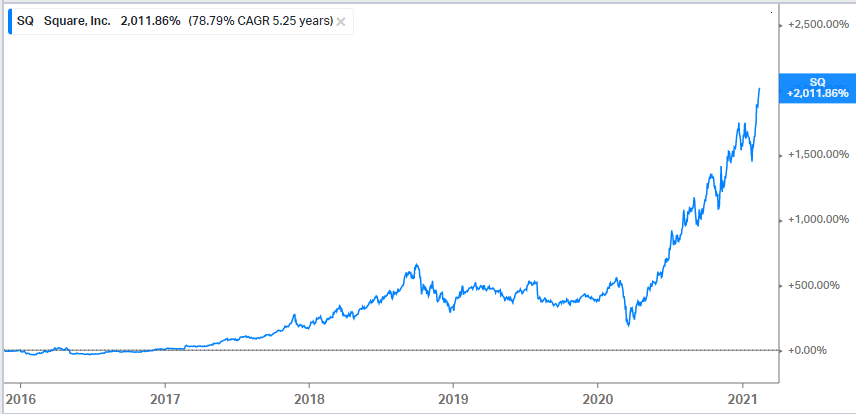

Square went public in November 2015. It priced its stock at $9 apiece for the IPO and raised $243 million. Those who purchased Square stock immediately became public, looking at returns of more than 2,000% on their investment in about five years.

Why invest in Square stock?

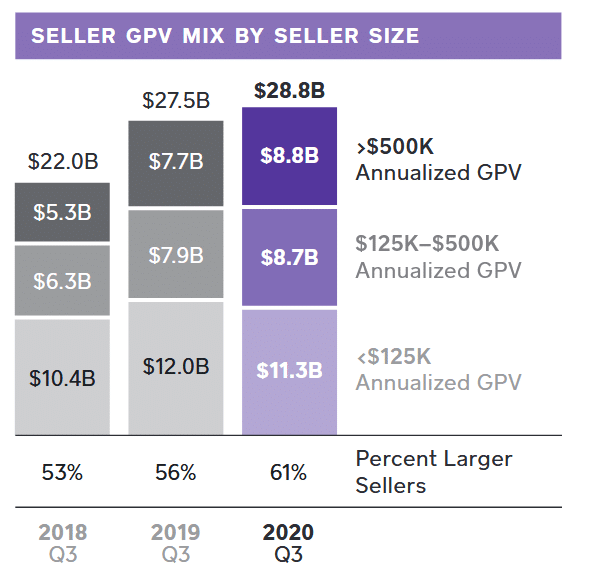

A growing number of merchants are using Square products and services. Notably, Square is making inroads with large merchants. Merchants selling more than $125,000 a year now account for 61% of Square’s transaction volume, up from around 35% in 2015. The expanding large merchant base enables Square to make more money with its fee-based services.

What Square has proved successful at is making the most of its customers. A customer may be drawn to the Square platform by a single product. But once in, Square sells them more products, which they gladly accept because of their benefits. For example, a merchant that came looking for a card reader to accept credit card payments soon discovered a Square service that helps with payroll management and loans to expand their operations.

Square continues to innovate around finding new revenue sources. A perfect example of how this is happening is its CashApp platform. It started as a free peer-to-peer money transfer service. But it has evolved into a digital banking and trading tool, providing Square with many ways to make money with it. Rising from almost nothing at the start, CashApp contributes 70% of Square’s revenue and more than 48% of gross profit in the latest quarter.

Square is in the process of opening a bank unit, which would go a long way toward expanding its merchant loans business and potentially lead to better earnings. Moreover, operating a bank would allow Square to deepen its ties with customers better, reducing customer churn while opening up more monetization opportunities for the company.

Square has a huge growth opportunity ahead. Its CashApp has only captured 2% of an existing $60 billion market opportunity. Meanwhile, the seller solutions division has only captured 3% of a $100 billion market opportunity.

Square fundamentals: Strong revenue growth and solid balance sheet

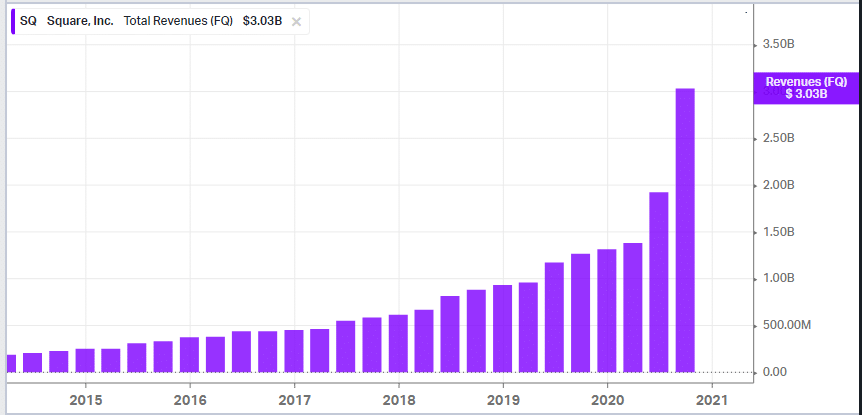

Square will report its fourth-quarter earnings on February 23. The company has a track record of delivering strong revenue growth. Its sales rose 140% year-over-year in the third quarter to more than $3 billion. The growth accelerated from 64% in the second quarter and 44% in the first quarter. Revenue growth was strong across all the countries in which Square operates.

As Square is currently focused on growth, investors should consider a profit as a bonus. The company delivered a $37 million profit in the third quarter, reversing a loss of $11 million in the second quarter. The profit also increased from $29 million in the third quarter of 2019. Square loaned $155 million to 35,000 merchants. The company demonstrated prudent lending to minimize risk in the credit business. Its loan volume dropped more than 70% in the quarter.

Square wrapped up the third quarter with $3.3 billion in cash against long-term debt of $1.8 billion.

A look at Square stock’s technicals

Square stock gained more than 250% in 2020 and has risen more than 25% in 2021. Trading at more than 230 times 2021 earnings estimates, Square valuation looks stretched. However, PE valuation is irrelevant for a growth company like Square. At this point, Square is directing its resources and energies into building the foundation for long-term growth. Therefore, while the stock may look expensive, the company has massive growth potential that should justify the lofty valuation in the long run.

Conclusion

Square stock has numerous tailwinds to continue rising. We recommend BUY.