- Coinbase stock up 40% over the past month.

- Estimates projecting higher revenues and earnings.

- Focus to be on monthly transacting users and trading volume.

Coinbase Global, Inc. (NASDAQ: COIN) is scheduled to report its third-quarter results on November 9 after the market close. The stock has been in fine form in the past month, rallying by more than 40% in the wake of heightened volatility in the cryptocurrency space.

The stock’s sentiments have improved significantly in recent months amid increased interest and trading activities. The overall cryptocurrency space has turned bullish in the wake of Bitcoin Ethereum and others bottoming out from four months low.

However, much of the trading activities improved in October, after Q3 came to a close. Likewise, Coinbase might have not benefited from increased trading activity in the third quarter compared to the fourth quarter, which is underway. However, the company could register meaningful growth driven by transactional and custody revenue owing to increased institutional onboarding in the third quarter.

Increased capital allocation by institutional investors is emerging as an important aspect of Coinbase business. Additionally, the company continues to benefit from increased trading volumes from existing clients.

Q3 earnings expectations

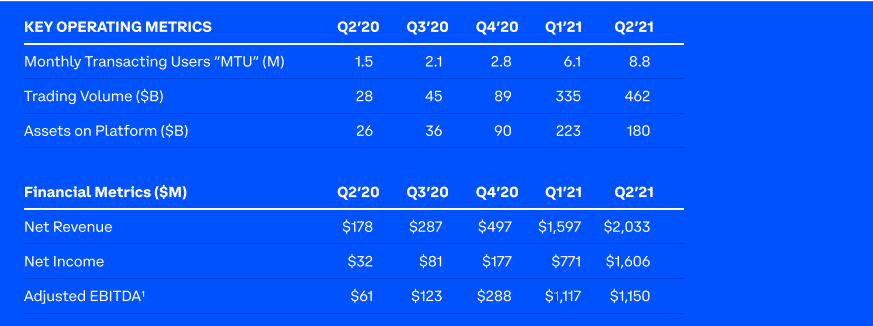

Coinbase has already warned that it expects its retail Monthly Transacting Users (MTU) and total trading volume in Q3 to be much lower compared to the third quarter of last year. The projection does not come as a surprise as trading activities early in the quarter in July were low as cryptocurrencies edged lower.

While delivering Q2 results, Coinbase reiterated that its monthly transacting users and trading volume, which are a key driver of revenue, had slightly improved in August compared to July levels but were much lower than a year earlier.

Crypto trading volumes are believed to have slowed in Q3, declining by about 40% compared to Q2 levels. The decrease was mostly fuelled by weak trading activity in July. Crypto trading volume data for Coinbase suggest a decline of 25% compared to a decline of 38% for the overall industry.

The warning could explain why Coinbase could struggle to top analysts’ estimates on revenue in Q3. Revenue has been increasing steadily in recent quarters amid the growing adoption of crypto assets. In the second quarter, the company hit the $2 billion milestones waiting to see if the momentum continued in Q3.

Analysts, on the other hand, expect the company to deliver EPS of $1.73.

For the full year, Coinbase is projecting Monthly Transacting Users to range between 5.5 million and 8 million, assuming that crypto market capitalization will continue to increase on the back of high crypto-asset price volatility. MTU is expected to continue growing for the remainder of the year.

What to look out for when Coinbase reports

When Coinbase reports, the focus will be on monthly transacting users’ and trading volumes, key revenue drivers. Given that the company operates in one of the most volatile sectors, transaction revenue tends to fluctuate significantly with significant changes on these two metrics.

The situation is further compounded as people respond to changes in the crypto-asset prices and crypto asset volatility. Consequently, it becomes extremely difficult to forecast the amount of revenue that Coinbase will generate. In July, MTU’s and trading volume totaled 6.3 million and $57 billion, respectively, way below Q2 levels. The decline came as crypto asset prices and crypto volatility levels declined significantly.

Average annual revenue per user is another important aspect to pay close watch to, as Coinbase reports. The metric varies due to fluctuations in crypto asset prices and trading volume. Over the past two years, the average annual transaction revenue per retail MTU’s has ranged between $34 and $45 a month, with the lowest range occurring in 2019, a period of low Bitcoin price.

The impact of Bitcoin powering to record highs of $64,000 will mainly be reflected in Coinbase’s fourth-quarter report and not the third. Consequently, the average net transaction revenue per user is expected to exceed the historical range.

Bottom line

Coinbase has been on an impressive run in recent months, recouping some of the losses accrued in the first half of the year as cryptocurrencies imploded in April and May. The stock has been up by more than 40% over the past month, in line with the bullish momentum in the overall cryptocurrency sector.

The rally has come on the backdrop of cryptocurrencies sentiments improving and most coins powering to record highs. A solid Q3 report could be the catalyst to accelerate the stock bounce back. Similarly, a disappointing report could put a pause to the recent upside action.