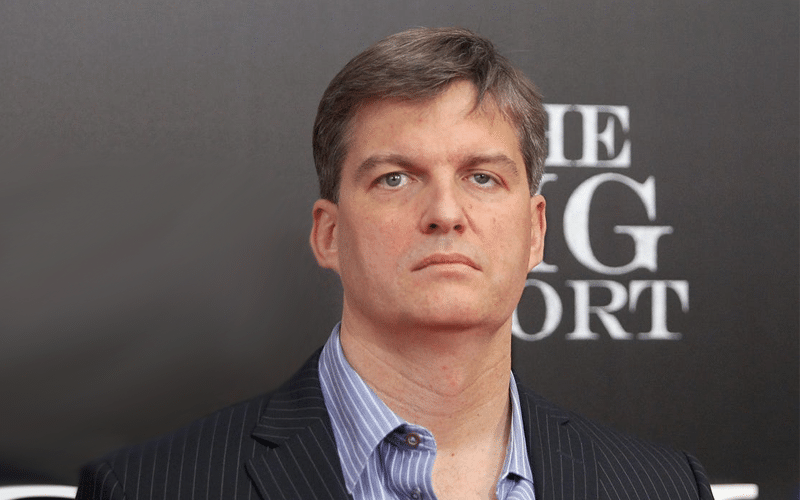

(WSJ) “Big Short” investors led by Michael Burry and hedge funds are betting for further plunges of the ARK Innovation ETF, which is already down 6.9% this year.

At the end of June, Burry’s Scion Asset Management held bearish put options of as much as $31 million on 235,500 shares of ARK.

Other funds, including Laurion Capital Management, had about $171 million bearish put options against ARK’s 1.3 million shares.

GoldenTree Asset Management, Cormorant Asset Management, and Moore Capital are other major funds that have bearish positions against ARK.

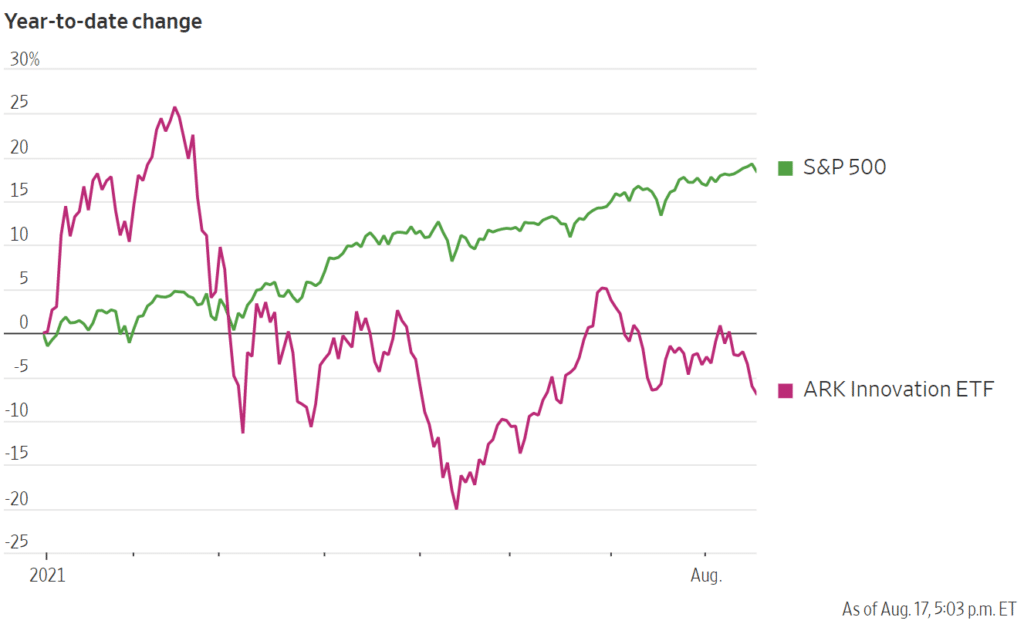

Investors are pessimistic about ARK’s massive holdings of shares of technology firms and those in fast-growing industries, which have fallen in recent months.

Despite Wood supporting her investing thesis, Mr. Burry has faulted it saying she does not understand the fundamentals driving the exponential growth in the innovation space.

With a 6.9% plunge year to date, Cathie Wood’s ARK lags S&P 500, which has risen 18% so far this year.