Cryptocurrency enthusiasts have created some peculiar lexicon over the years with terms such as ‘fork,’ ‘HODLing,’ ‘mooning,’ and ‘whales’ floating on the internet. Of course, in the context of digital coins, whales have nothing to do with the actual large marine mammal swimming in the seas!

However, this word is a metaphorical symbol for the animal’s size. In recent history, whales in cryptocurrencies have been creating ‘ripple waves’ among the ‘small fish’ of your everyday crypto holders.

Case in point, in June 2017, Ethereum fell from $300 to 10 cents in minutes on the GDAX exchange on suspicion of a multimillion-dollar selling order. Thus, it’s pretty evident that cryptocurrencies are no strangers to price manipulation incidents caused by individuals with deep pockets.

Such is the presence of whales that we now have numerous data analytics platforms dedicated to showing information about their existence on particular blockchain networks. Let’s explore this concept in more detail and its significance in the crypto markets.

What is a whale?

A whale is simply an individual or group holding substantial amounts of a specific cryptocurrency.

In the case of organizations, these tend to be known investment or finance-related groups such as Pantera, Falcon Global Capital, Grayscale, and Fortress, who have recently taken an interest in buying crypto along with massive corporations like Tesla, MicroStrategy, and Square.

Other whales include actual crypto exchanges like Binance, Coinbase, and OKX, who understandably need large amounts of crypto to increase liquidity for their clients.

When this term first gained prominence, it exclusively referred to Bitcoin holders. However, it now applies to virtually all digital currencies. There isn’t a general threshold for someone to be deemed a whale.

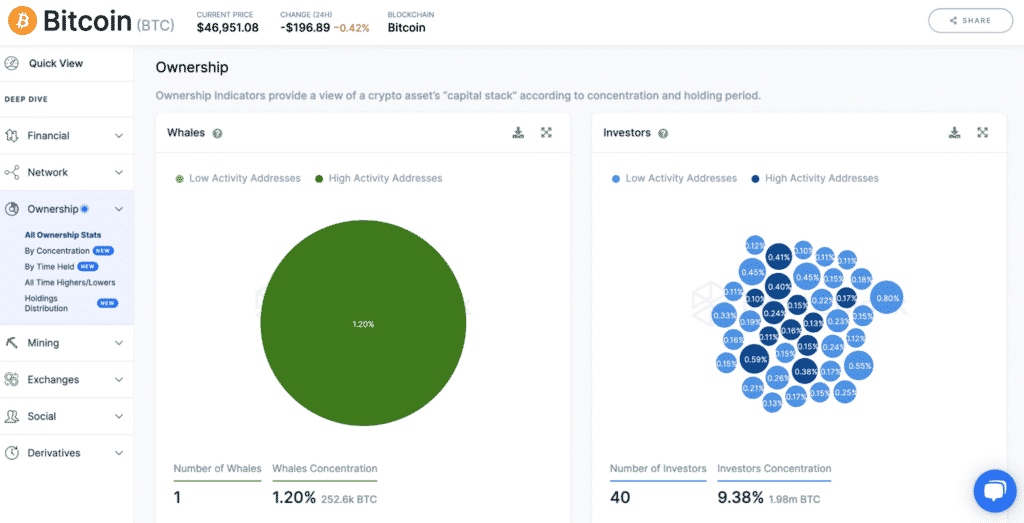

Yet, in the case of Bitcoin, the consensus has somewhat been at least 1000 BTC (worth about $44.66 million presently). Another metric is employed by the site IntoTheBlock, which considers a whale as individuals or groups holding at least 1% of a crypto asset’s circulating supply.

The site above has an insightful tool, the Whales Indicator, showing users the whale ownership for different coins. It further segments data into retail and investors, low-activity and high-activity addresses.

Some characteristics of whales

So, what happens when whales ‘splash?’ Whales are characterized as having a massive influence on price movements due to the volume they hold.

A simple buy or sell order from these individuals can quickly move the value of a coin by a few or several percent either way. The methods in which whales transact are also interesting and go beyond the simple exchange trading retail traders perform.

The most common avenue for whales is OTC (over-the-counter), which simply describes deals conducted privately between two parties (one of which is a crypto exchange). Brands like Binance, Huobi, OKX, and many others have dedicated OTC divisions catering exclusively to high-net-worth individuals or groups who conduct large-scale transactions.

Other means for which whales trade digital currencies include private wallet-to-wallet, exchange-to-exchange, or wallet-to-exchange deals.

Why should you care about whales?

As we know, the value of a digital currency can be impacted by a myriad of factors, one of which is the presence of whales. Ultimately, these individuals can influence the markets in two ways: through the ‘sell wall’ or (‘buy wall’) phenomena and FOMO (fear of missing out).

Sell wall

This interesting effect describes how a whale places a substantial sell limit order to drive the price of a coin down massively. A sell wall can also transpire with multiple orders clustered around the same price.

The purpose is to scare traders, who are then influenced to place sell orders of their own. This culmination brings about a tremendous decline in value, creating a ‘fire sale’ as more people follow suit and panic-sell.

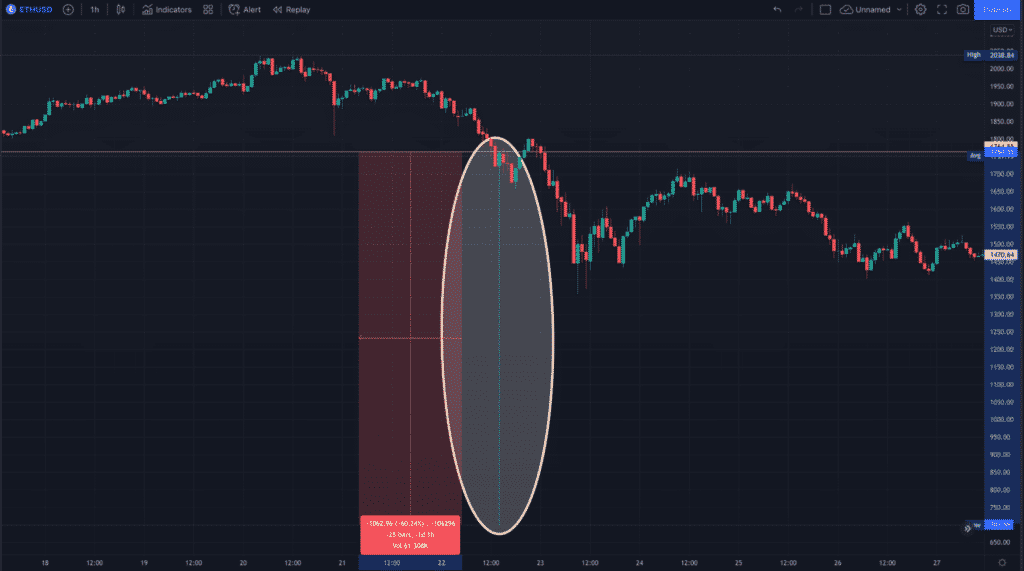

Traders can view this data on most advanced trading platforms using depth charts and order books. While the cause was not precisely confirmed (the CEO said someone ‘decided to dump his life savings’), Kraken experienced something very much like a sell wall on 22 February 2021 at 14h00 UTC.

The price fell by roughly 60% from about $1700 to $700 before quickly recovering within an hour back to its previous value. Here is an image below showing us this incident.

FOMO

FOMO is the opposite of the sell wall, and it might be described instead as the ‘buy wall.’ Fear of missing out is a real emotional bias held among crypto investors. In this regard, whales can artificially inflate the value of a coin with huge buy orders.

Similar to the herd mentality described earlier, retail investors can take note of this activity and be urged to place their own bids, creating increasing demand and a surge in prices.

After this point, those who bought in near the bottom of the rally stand to gain the most profit. One classic example of FOMO is during the crypto bull run of 2017, particularly in December.

While it is speculative to believe numerous factors may have been at play, some research emerged years later of a few large transactions carried out by what appeared to be whales.

Curtain thoughts

The effects we described in the previous sections are a lot more common than most people think, reinforcing the power of whales.

For many blockchains, their existence is often viewed negatively because of the manipulation potential at the expense of smaller holders. Moreover, there is also a perceived lack of decentralization, especially with coins worth pennies where it is less expensive to purchase millions or billions worth of a token.

In some cases, such as with proof-of-stake ledgers, whales are actually good for the system because their immense voting power (due to their enormous staked funds) brings stability and an incentive to act honestly in the network.

It’s worth noting that the constant study of whales is no easy feat since one needs to analyze blockchains, stay abreast of whale alerts on social media networks, and perhaps even subscribe to dedicated analytics platforms like IntoTheBlock.

However, this doesn’t diminish the necessity to keep track of their movements which can drastically impact your trading decisions.