What is volatility?

Volatility refers to the degree to which returns of a security or market index are dispersed. Technically, it is defined as the average difference between the highs and lows of a given security or market index over a specified period, divided by its prevailing price.

How do you trade in a volatile market?

1. Keep your eyes on consolidations and watch for breakouts

This is a strategy that is commonly used by traders, based on a security’s known support and resistance levels. When using this approach, no action is to be taken during the oscillations between the support and resistance levels. In a volatile market, a breakout of the price to the upside usually signals that it’s time to buy because chances of further rises in price are high. This is the most attractive thing about trading in volatile markets. However, this is unlikely to happen in quoted markets, where price momentum often loses steam and assumes a sideways trading pattern.

False breakouts are also commonplace in volatile markets and can lead to great losses in case of reversals. It gets worse because false breakouts in volatile markets can be followed by reversals going all the way below key support levels.

2. Go for shorter-term trading strategies

The strategy uses a “hit-and-run” approach to trading, where traders go for the kill and take their profits within short time intervals. Using this strategy typically requires one to identify “safe” margins within which to make profits. However, this may also result in reduced profit margins in cases where the profit is taken or locked before the price ascent is completed.

Whenever you’re in a volatile market, ensure that your trailing stop is activated sooner than usual. To get the most out of the volatility, you should set your profit target and sell part of your position at the first instance of a good profit-making opportunity. You should then keep holding on to the remaining position and wait for another opportunity to generate additional profit.

3. Create wider stop losses

Emotions often play a greater role in volatile markets than in calmer markets. However, you should never play in the gallery. It’s normal for traders to follow their adrenaline at the slightest hint of an onset of a reversal in a volatile market. As other traders throw caution to the wind, you should keep your eyes on the price and make well-informed adjustments. Reset your stop-loss by making it wider than usual but based on strong support and resistance levels.

4. Set up additional time frames

Using more timeframes is an effective way of minimizing risk and maximizing profit. Have a mix of long and short time frames and use them to assess the effectiveness of your setup. The different time frames work as confirmations to one another. If there’s a divergence in their trends, you should adjust your setup. However, if their trends are congruent, it is a confirmation that your setup is likely to work in your favor.

5. Working with Volatility Index (VIX) options and futures

Volatility Index Futures (VIX) options are traded in the Chicago Board Options Exchange (Cboe) based on the implied volatility of the S&P 500 option prices. VIX allows traders to trade on the market index and make a profit whether prices are going upwards or downwards. Traders who expect increased volatility buy VIX call options, while those expecting reduced volatility buy put options. To trade in futures, traders have to buy long positions if they expect increased volatility and short futures if they expect the market volatility to reduce.

Out the money call and out the money put options

This strategy involves two approaches; long strangle and long straddle options.

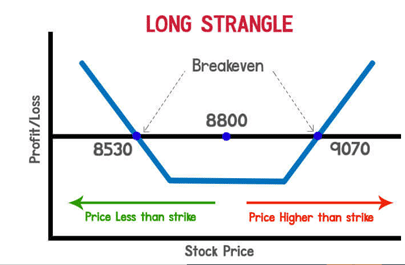

Long strangle

This strategy involves going for both out the money (OTM) call and out the money put options, which must have the same expiry. OTM call option involves buying a security at a strike price set higher than the prevailing price of the security. Conversely, an OTM put option refers to a situation whereby the strike price is set lower than the prevailing/current price. However, in this instance, the trader is allowed to change the strike price, provided that the current price is equidistant from both put and call strike prices.

Buying OTM call and OTM put options is usually tied to market fundamentals such as monetary policy changes, jobs data, budget, manufacturing data, etc.

This long strangle strategy is ideal for volatile markets because it gives traders an opportunity to make profits when the actual stock prices move significantly.

How it works

Suppose General Motors’ stock price is $8,800, and you bought the stock’s OTM call option at the strike price of $9,070 and paid a premium of $10. You then bought an OTM put option at $8,530 and paid a premium of $8 for it. The net premium paid would be $18.

- The upper breakeven point would therefore be (OTM Call strike price + total premium paid) = $8,818.

- The lower breakeven point = (OTM Put strike price – total premium paid): $8,530-$18 = $8,512.

This there means that you would make a profit as long as the price movement remains within the $8818-$8512 range.

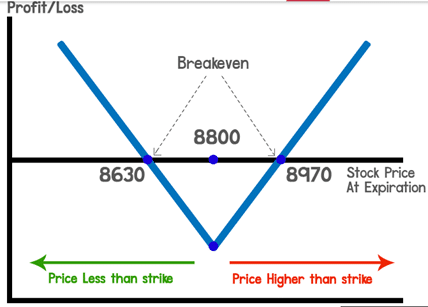

Long straddle

Some traders find this strategy attractive because of its limited risks and the potential to give unlimited profits. It is quite simple, considering that you only need to buy a long call or long put option. The long straddle is a great way to invest when you are bullish about significant price movements, although you can’t tell whether it will be an upswing or a downward spiral.

Like the long strangle strategy, traders also have to buy options contracts with the same expiry. However, the long straddle uses at the money (ATM) call and ATM put options, whose strike prices must be equal to the current price and must have equal lots. In this type of market, contracts nearing expiry are usually cheaper.

A look at a hypothetical example

Suppose Netflix’s stock is trading at $88.00, and its ATM calls are going at $86.30. If you purchase a lot of 100 ATM call options for $8,630 and at the same time you buy the corresponding ATM puts trading at $88.00, it would mean that 100 ATM put options will cost $8,800. Your net debit will therefore be $170 for the two premiums on your ATM call and put options. The long straddle strategy will therefore mean that the maximum loss you can incur is $170 in case prices remain unchanged at the time of contract expiration.

Profit/Loss potential

With the long straddle strategy, you stand to make an unlimited profit for as long as there is a significant change in prices during the contract period, regardless of the direction.