Ever since the start of the pandemic, central banks across the world have undertaken massive easing measures to support the economy. This could possibly be because of the lessons learned from the 2008 recession.

Back during the credit and housing crisis of 2008, the problems were mainly of liquidity and had originated from the housing market of the US. While the Federal Reserve did take some steps to support the market, these turned out to be too little and too late. As a result, the US and, subsequently, the global economy was plunged into one of the worst economic crises ever since the depression of the 1930s.

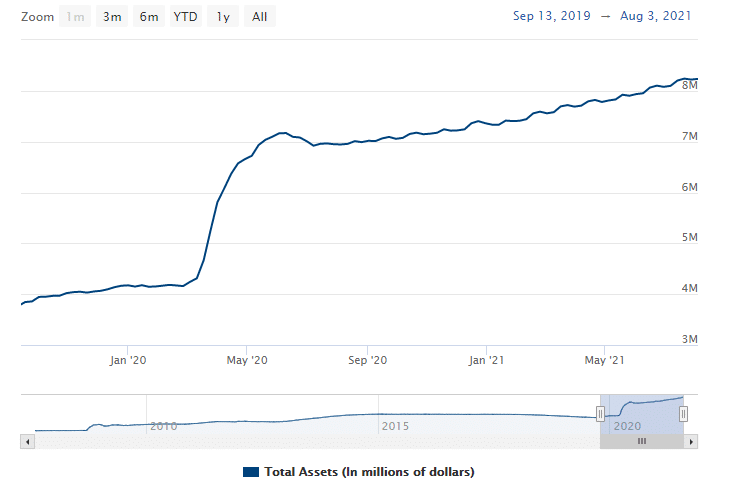

Having witnessed this crisis just a few years back, the Federal Reserve was quick to act this time around. The Fed increased its bond purchases at a record rate, with its balance sheet also seeing a commensurate rise.

As can be seen in the chart above, the Federal Reserve purchased billions of dollars of assets every week in the initial months of the pandemic. It has continued its purchases so far, with the Fed balance sheet now standing at a staggering $8.1 trillion!

Easing measures are unsustainable

It is pretty obvious that measures of this magnitude are not sustainable. Moreover, their purpose might already have been served. The reasoning behind such massive liquidity pumping was to support the US economy. The US government had put some very stringent restrictions on businesses and individuals in order to control the Covid-19 pandemic.

However, over the past few months, we have seen a sharp recovery of sorts. Vaccination numbers have been picking up, with half of the US population fully inoculated. This has helped the Federal government and state governments to lift restrictions across the country. The reopening is also reflected in the economic numbers, which have been encouraging so far.

Moreover, the US inflation rate has been on the rise as well. For the Federal Reserve, this is a major point of concern. All the economic growth can be undone if inflation goes out of control. Inflation is an obvious side effect of these easing measures. So, keeping all these points in mind, the Federal Reserve has been giving indications that it might start to taper its purchases much sooner than expected.

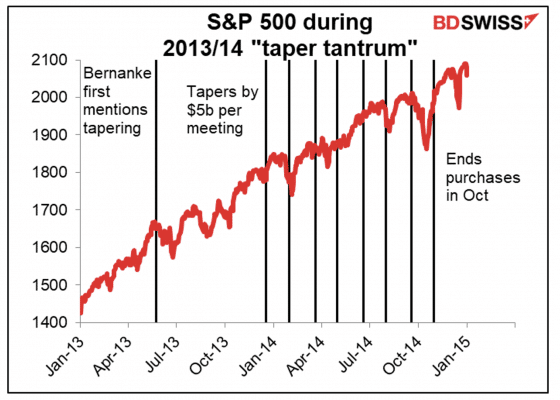

A similar situation had happened in 2013. The Federal Reserve had initiated bond purchases in response to the 2008 pandemic, and it had continued doing so for several years. This had made markets complacent who expected surplus liquidity for extended periods. However, in 2013, Ben Bernanke declared his intentions to taper the purchases. This caught the markets by surprise, and benchmark stock indices saw a sharp fall.

What lies ahead?

Despite several indications by the Federal Reserve in its FOMC meetings, the markets still don’t seem to have priced in any sort of tapering. Stock prices still remain around the same levels as they were before the Fed indicated a change of its intentions. This sets up the market for particularly sharp moves across the board.

In June 2021, Powell acknowledged at his press conference that progress had been made toward the Fed’s macroeconomic goals. The FOMC began assessing the pace and composition of its asset purchases alongside the economic conditions on a meeting-by-meeting basis in July 2021.

Minutes of the June 2021 FOMC meeting recorded some disagreement among Fed policymakers about when to begin tapering. “Various participants mentioned that they expected the conditions for beginning to reduce the pace of asset purchases to be met somewhat earlier than they had anticipated,” the minutes said.

FOMC members also discussed different speeds of tapering for Treasuries and mortgage-backed securities at the meeting. “Several participants saw benefits to reducing the pace of purchases more quickly or earlier than Treasury purchases in light of valuation pressures in housing markets,” the minutes said.

Although, unlike Ben Bernanke, Jerome Powell who is the current Federal Reserve chairman is known to be much better at communication. He has so far made statements so that they ease the markets into any changes rather than any sudden announcements. But despite multiple statements indicating a potential taper, the markets seem to have ignored it so far.

It is a matter of time and patience. There are two paths out there. One is that the Federal Reserve continues to make these statements and make the taper extremely gradual. In this case, even though there may be an initial sharp market reaction, it shouldn’t continue for long.

The second case is that the Federal Reserve feels that the purchases are doing more harm than good, especially on the inflation front. In that case, there could be a significant reversal with the Federal Reserve sharply reducing its purchases. Markets are bound to react sharply in this particular case, and the prices will continue to remain impacted for an extended period of time.

The last FOMC (Federal Open Market Committee) meeting was held on 27th and 28th July. The committee kept all the key parameters unchanged in this meeting as expected. However, what is more, important is the discussion among the members that happened to arrive at this decision and their future expectations. The minutes of the meeting will be out in a couple of weeks’ time, and all eyes will be on what interest rate and liquidity path the Fed intends to take in the near future.

Apart from the minutes of the last meeting, the upcoming FOMC events are also the key triggers. The next meeting will be held on 21st and 22nd September, which is another key event to look out for.