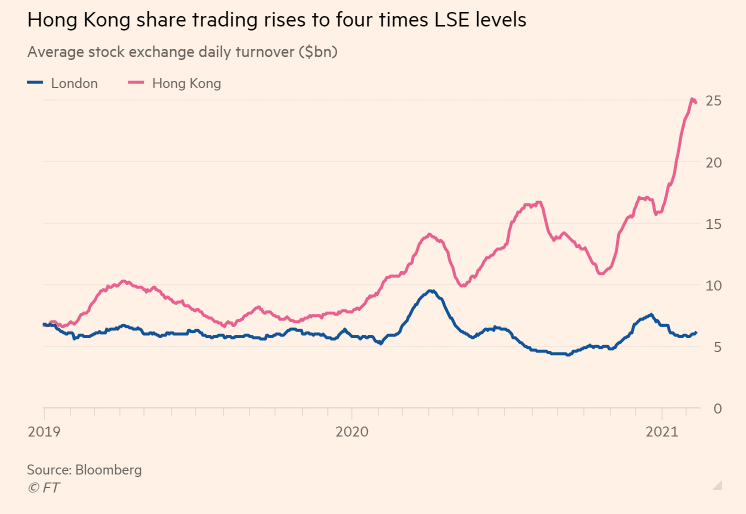

Stock trading volumes have surged to four times in Hong Kong compared to those in London’s main exchange, according to Financial Times. The rise has been caused by a high appetite for large technology stocks from foreign investors.

- Trading volumes in Hong Kong also reached almost 60 percent of the New York Stock Exchange as investors, mostly from China, pumped $50 billion into shares listed in the finance hub this year.

- Average daily turnover on Hong Kong’s stock exchange in the 30 days to February 16 rose to about $25 billion, more than a quadruple the average turnover on the LSE in the same period.

- This month, Hong Kong hosted the bumper $5.4 billion listings of Chinese viral video app Kuaishou, the world’s biggest tech initial public offering since Uber in 2019.

- Hong Kong’s continued tech listings have led to it being seen as the Nasdaq of Asia.

- Investors, mainly from mainland China, are attracted to stocks listed in Hong Kong since they are valued at a significant discount.

- High-profile secondary listings by Chinese tech groups have also injected more liquidity into Hong Kong’s market.

- The surge in Hong Kong trading volumes comes amid political upheaval following Beijing’s introduction of a national security law last year.

Mainland Chinese investors have purchased a net of $49.1 billion of Hong Kong-listed equities in the year to date, up from about $8 billion a year ago.