The Dow Jones Industrial Average had its worst day since February as fears of inflation continued. The index declined for the second consecutive day, shedding 478 points. These losses are set to accelerate as futures tied to the blue-chip index fell by more than 210 points.

Dow Jones and inflation

The Dow Jones is an index made up of 30 blue-chip American companies like Apple, Microsoft, Coca-Cola, Boeing, and Caterpillar. The index has surged by more than 40% in the past 12 months amid a global pandemic.

These gains are attributed to the fact that the Federal Reserve has provided unlimited liquidity in the market. It has lowered interest rates to zero and bought assets worth more than $3 trillion in the past 12 months. Indeed, the expansion of the balance sheet in the past year has been more than what it did in the decade after the 2008/9 financial crisis.

Stocks tend to do well when interest rates are low for three reasons. First, these rates drag the US dollar lower. In fact, the dollar index has dropped by more than 10% in the past 12 months. A weaker dollar tends to be good for Dow Jones stocks because most of them do a lot of business abroad.

Second, low interest rates lead to a rotation from low-yielding bonds to equities. Finally, with interest rates low, many companies and individuals tend to move their assets to stocks.

Therefore, the Dow Jones has dropped because of inflation fears. This is important since inflation leads to higher interest rates due to the dual mandate of the Federal Reserve. Recent numbers have signaled that inflation is rising. Utility bills of most Americans have jumped while commodities like lumber, crude oil, copper, gasoline, and crude oil have more than doubled in the past 12 months.

US CPI data ahead

As such, the DJIA index will today react to the latest US inflation data that will come out on Wednesday. Economists polled by Dow Jones expect the data to show that the headline CPI rose by 3.6% on an annualized basis. This will be higher than the Fed’s target of 2.0% and the highest figure in a decade. Still, this performance will be because of the fact that inflation slumped in April last year as the US went into lockdown.

A higher-than-expected inflation numbers will likely have negative effects on the Dow Jones because it will mean that the Fed may start tapering its asset purchases earlier than expected. However, it could also push the index higher since higher inflation has already been priced in. Furthermore, the 5-year breakeven rate has jumped to 2.68%, the highest it has been since 2008.

The best performers in the Dow Jones this year are companies like Goldman Sachs, Walgreens Boots Alliance, Caterpillar, and American Express that have jumped by more than 25%. On the other hand, the top laggards are Merck, Apple, Walmart, and Salesforce that have dropped by more than 3%. In total, only eight companies in the index have dropped this year.

Dow Jones forecast

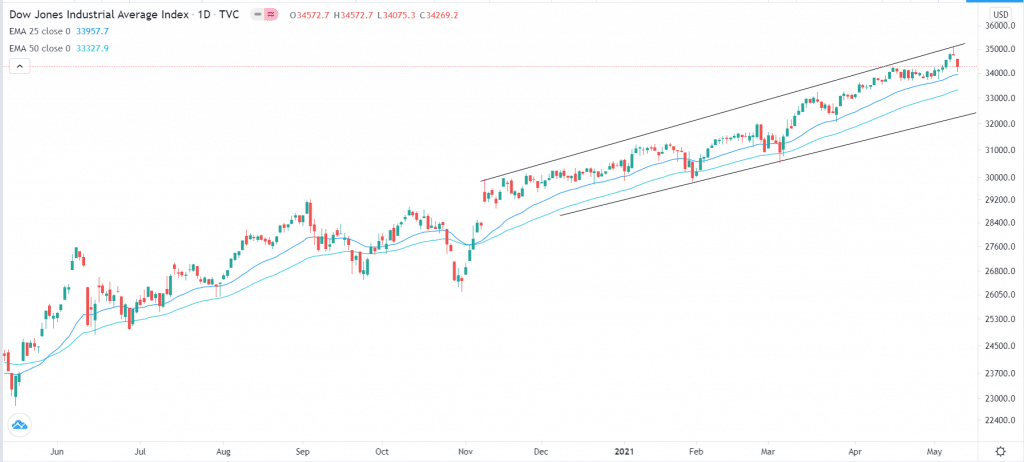

The daily chart shows that the Dow Jones index has been on a strong upward rally in the past few months. It reached its all-time high of $35,080 this month. On the daily chart, the index is still being supported by the 25-day and 50-day exponential moving averages (EMA). It is also slightly below the upper side of the ascending channel. Therefore, the index is likely to resume the upward trend in the near term as bulls target the all-time high.