Fusion Markets is an FX and CFDs broker offering an array of trading instruments around the globe. The company’s major objective is to provide fast, easy, and low-cost market access to change traders’ expectations regarding their providers. The company operates as a No Dealing Desk (NDD) owing to its tight spreads, no minimum deposit, and super-fast executions of up to 0.02 milliseconds.

Pros

- Tight spreads starting from 0.0 pips

- No fees on deposit and withdrawal

- Ultra-fast execution speeds of up to 0.02 milliseconds

- No minimum deposit

- Simple account opening process

- Myfxbook copy trading is available

- Free US share CFD trading

- Regulated by ASIC

Cons

- Limited asset selection

- Not available for US clients

- No negative balance protection

It is an Australian-based brokerage company founded in 2017 by a group of veterans in the Australian FX industry. The company offers an array of trading instruments traded as CFDs with low spreads starting from 0.0 pips.

It is a highly reputable broker regulated by top-tier regulatory body the Australian Securities and Exchange Commission (ASIC) alongside Vanuatu Financial Services Commission (VFSC). As a true NDD, the company offers cutting-edge technology with ultra-fast executions of up to 0.02 milliseconds, ideal for a perfect customer experience.

The asset basket holds products such as:

- Forex

- Energy

- Precious metals

- Equity indices

- Commodities

- Share CFDs

Fusion Markets offers two account types through which clients can trade on these instruments. However, fees and commissions are relatively low as the company aims to offer easy and cheap access to the global markets – the wide array of asset classes makes it possible for clients to diversify their portfolios sufficiently.

The trading accounts include

- Zero account

- Classic account

- MAM/PAMM accounts

The broker believes that offering too many account types complicates trading in that one has to choose between several account types. To make trading simple and fast, the company only offers two main account types from which clients can choose.

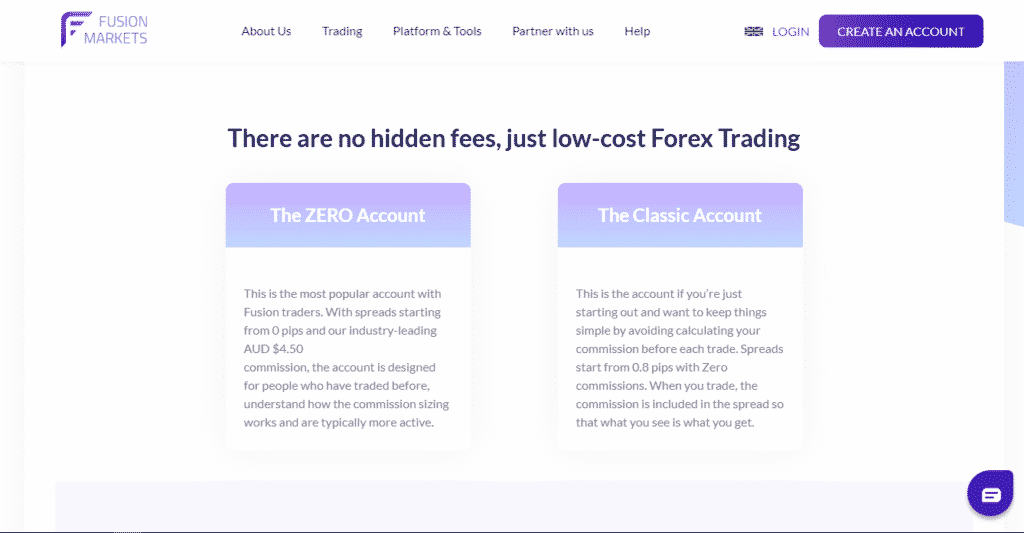

Fusion Markets’ spreads and commissions are relatively low as a low-cost trader. However, fees are chargeable depending on the type of account chosen. With the Zero account, spreads start from as low as 0 pips and a commission of $4.50/USD, while the Classic account charges no commission with spreads starting from 0.8 pips.

The broker offers no minimum deposit, which serves as an added advantage making the company stand out among its competitors. The company offers a range of payment options from which traders can choose.

They include:

- Visa

- MasterCard

- eWallet i.e. Skrill and Neteller

- Bank transfer

- Dragon Pay

- Interface transfer

- Jeton

Regulation

It is regulated by top-tier regulator ASIC alongside VFSC, making it a relatively safe broker to trade with. The licenses are as follows:

- Australian Securities and Exchange Commission(ASIC) under license №226199

- Vanuatu Financial Services Commissions) under license №40256

Account Types

The broker provides an array of accounts through which clients can trade on the available asset classes.

Classic account

- Minimum deposit — $0

- Spreads from —, 0.8 pips

- Commissions — $0

- Simple and user-friendly interface

Zero account

- Minimum deposit —$0

- Spreads from — 0 pips

- Commission — 4.50 AUD

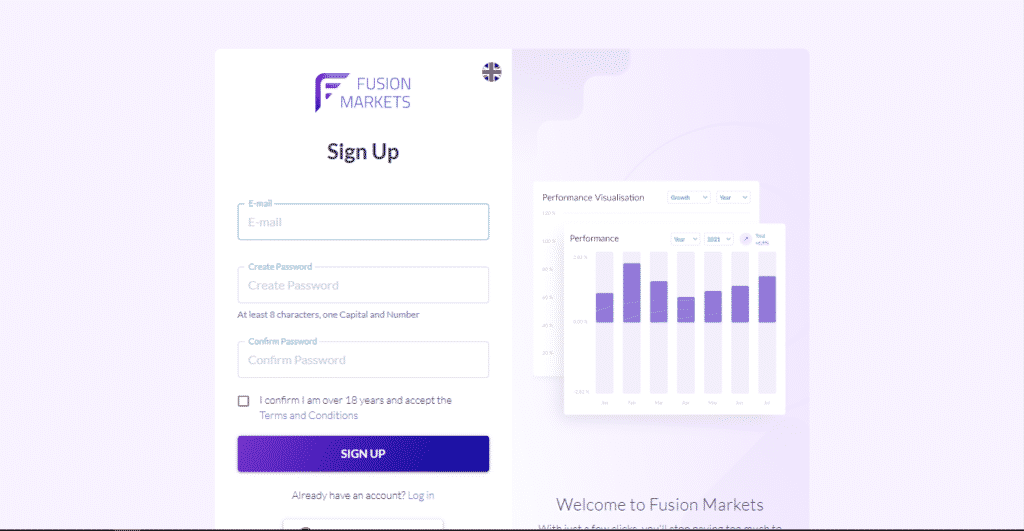

How to open a Fusion Markets account?

The broker offers a fully digitized and simple account opening process. To open a live account, the following steps are mandatory.

Step 1. Add your email address and create a password.

Step 2. Log in to the client portal interface and click the profile icon.

Step 3. Fill in your personal details such as date of birth.

Step 4. Select the account type, leverage size, and set a security question.

Step 5. Verify your identity and residency by uploading a copy of your passport/ID/driver’s license.

Step 6. Fund your account and start trading.

Fees and Commissions

Fees and commissions at Fusion Markets are relatively low given that the broker is a low-cost financial service provider. The broker offers spreads starting from as low as 0.0 on different currencies such as the AUD, USD, CAD, JPY, and CHF.

Commission on asset classes such as FX and Precious metals are charged at $4.50 AUD per lot. The amount is greatly cheaper when compared to what other brokers charge. The broker charges a minimum of $2.25 commission per lot across the MT4 and MT5 trading platforms.

In general, the broker charges minimal to no fees as in the case of inactivity fees and Debit/Credit card fees — the company charges no deposit fees as well.

Payment options

The broker offers various payment options ranging from debit/credit card, Neteller, Skrill, Bank wire, Fasapay, Cryptos, PayPal, etc.

The broker accepts payments in seven major currencies, i.e., the USD, EUR, GBP, JPY, SGD, and THB — the company, however, charges no fees on deposits. Withdrawal via international bank transfer is quite expensive as it charges about 20 AUD — withdrawal for credit/debit cards, electronic wallets, and bank transfers are all free. The minimum withdrawal amount stands at $35.

Pros

- Free deposits and withdrawals

- No minimum deposit

- An array of base currencies offered

Cons

- Does not accept minor account currencies

Deposit

At Fusion Markets, deposits can be made through bank transfer, credit/debit cards, Neteller, Perfect Money, or PayPal.

Withdrawal

A particular method used in the deposit is expected to be used when withdrawing.

Available Markets

Fusion Markets offer a range of currency pairs alongside CFDs. The markets offered range from FX, energy, precious metals, indices, commodities and share CFDs. Trading is supported by a 24/5 multilingual customer service with ultra-fast executions of up to 0.02 milliseconds.

Forex

Fusion Markets offer over 90+ currency pairs tradable on its platforms. These currencies are traded with tight spreads starting from 0 pips depending on the account type with ultra-fast execution speeds of up to 0.02 ms — FX trading can be accessed on a 24/5 basis a week.

Energy

The broker offers an array of tradable energies such as trade crude oil, Brent oil, and natural gas. The broker charges no commission on energy trade, and the margins are relatively low.

Precious metals

The broker offers precious metal options such as gold, silver, zinc, copper, and platinum.

Equity indices

The broker offers an array of CFDs on major Indices with tight spreads and flexible leverage.

Commodities

The broker allows trading of major commodities such as coffee, wheat, and sugar with competitive pricing, exchange-free trading, and $0 commissions.

Share CFDs

The broker offers at least 50 equities from the US through Share CFDs via the MT5 trading platform. They include Apple, Amazon, Alphabet, Facebook, and Microsoft. Fusion Market charges no commissions on US share CFDs.

Trading Platforms

Fusion Markets’ preference lies with the MetaTrader4 software. The trading platforms offered have different trading conditions and they include MetaTrader4, WebTrader for MT4 and MT4 mobile apps, and MetaTrader 5.

MetaTrader4

- Expert advisors

- One-click trading

- Tradable assets include FX, indices, commodities, and cryptocurrencies

- Customized charts (50+ indicators and scripts)

- Ultra-fast executions of up to 0.02 milliseconds

WebTrader for MT4

- Web browser trading

- Compatible with various operating systems

- One-click trading

- 30 indicators for technical analysis

- Real-time quotes in Market Watch

- Nine time frames

MetaTrader 5

- Tradable assets include FX, stocks, futures, and CFDs

- Ultra-fast execution speeds

- 21 time frames

- Advanced pending orders

- 80+ technical analysis tools

- Market depth

- Expert advisors with MQL

- Virtual private server

Features

Fusion Markets features include the following:

- There is a range of trading techniques such as hedging, scalping, and expert advisors.

- Minimum trade sizes on currency pairs, metals, and other commodities. The broker charges a minimum of 0.01 per lot.

- Operates as a true NDD broker keeping fees and commissions at their minimum prices.

- Maximum leverage of up to 30:1 on FX and metals and 2:1 for crypto trading.

- Offers 50+ indicators and a wide range of tools as standard.

- The platform also offers Virtual Private Server (VPS).

- Economic calendar, trading calculators.

Education

The broker offers a demo account which serves as the only educational tool in the platform. The platform does not contain major educational tools such as educational videos, platform tutorial videos, and educational texts.

Customer Support

The broker offers a multilingual, easily accessible customer support service running through various channels such as Live Chat, Telephone, and Email. The customer support provides a quick response and serves 24/5 a week.

Review Summary

It is a reputable and trusted broker, given that ASIC regulates it. The company’s trading and non-trading feed are very low compared to its competitors, making it the broker of choice by many around the globe.

Despite the excellent image and low-cost services, the company offers very few educational resources and does not offer investor protection.