A flash crash is a largely inexplicable, irregular market event where the price of a financial instrument suddenly and dramatically reduces in value before quickly recovering. As the term suggests, a flash crash happens rapidly, typically lasting for seconds or up to several tens of minutes.

Flash crashes can also occur for up-trending markets where the opposite occurs, particularly with currencies since they move in pairs instead of sole instruments. These anomalies have huge financial ramifications where hundreds of millions are made and lost.

Some form of a flash crash has transpired in virtually all financial securities like forex, stocks, futures, bonds, cryptocurrencies, etc. While this oddity has materialized a few times in the past, there is usually never a conclusive answer over why it occurs.

Moreover, a practical solution is not yet present because of the complexities involved. Isolated and contributing factors will vary depending on the market.

Much of the literature by experts suggests such these events are usually about 80% computer-driven and 20% human-driven. In some cases, human malpractice has been the leading cause through the techniques of spoofing, which do require the use of computers.

What exactly causes a flash crash?

Despite many experts disputing the role of computers – concluding such crashes are mostly self-driven – we still cannot deny their prominence, specifically, high-frequency, super-fast trading algorithms or systems used by large financial firms.

If we also understand such institutions trade substantial positions worth millions, it’s fair to assume astronomical size and computers contribute significantly to flash crashes when both factors combine at the right time.

Research suggests such algorithms are programmed with functions designed to react when certain abnormalities take place. For instance, a programmer might have coded a trading system to automatically sell a security during a defined result of a high-impact news release.

Other theories

One proposed theory that’s been discovered is ‘spoofing,’ which does logically explain, to some extent, the 2010 stock market and Ethereum’s 2017 flash crashes. Spoofing or dynamic layering is an illegal, manipulative practice in algorithmic trading when a party places a large limit sell order at a certain level in the market to attract sellers to that area.

This gives the impression of a possible sell-off. When the market gets close to that price, the ‘spoofer’ quickly cancels their order. This creates an imbalance of large selling forces, causing the price to decline dramatically.

After canceling the order, the ‘spoofer’ can buy the instrument at a much lower value and sell it back to its previous highs. The Dodd-Frank Act of 2010 best describes this unlawful method as “the illegal practice of bidding or offering with the intent to cancel before execution.”

In the two examples in a future section, we can see something resembling spoofing.

Adverse fundamentals driving the markets

Lastly, although fundamentals might be a secondary factor to a flash crash, they can still hold some significance. For example, the EURCHF crash of January 2015 occurred immediately after the Swiss National Bank announced removing the 1.2 peg it held for several years prior.

Such a news event was perceived as untimely and hugely significant. Another instance is the GBPUSD flash crash of October 2016, where the pound sterling fell 6% in two minutes.

Of course, human malpractice combined with computer trading may have been at play. However, this event did coincide with talks of a ‘hard Brexit.’ The period from June 2016 was a highly volatile time for the British pound because Britain decided to step away from the European Union.

Examples of well-known flash crashes

Now we’ll look at a few well-known flash crashes. Using some of the knowledge shared in the previous sections, we may begin to see certain patterns.

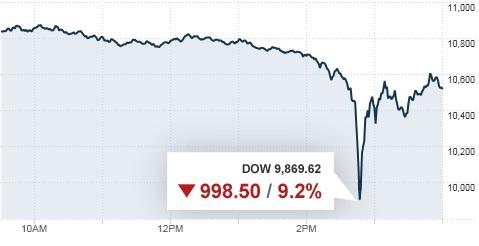

- 2010 stock market flash crash: One of the most noteworthy flash crashes in history happened in the stock market on the 6th of May 2010.

Prominent stock indices like the S&P 500 and the Dow Jones Industrial Average briefly lost unprecedented value in a matter of minutes before recovering. It has been described as a trillion-dollar crash.

Numerous investigations were conducted by US regulators where they considered theories of the ‘fat finger error,’ high-frequency traders, and technical glitches. In April 2015, the US Department of Justice laid criminal charges against a British trader named Navinder Sarao, who they alleged used spoofing methods before the crash.

- Ethereum 2017 flash crash: Perhaps one of the most severe flash crashes in cryptocurrencies took place on the 22nd of June 2017 with Ethereum. The crash happened on the GDAX exchange owned by Coinbase, where the price initially dropped from $318 to $224.

According to an investigation by GDAX, Ethereum’s value fell even further to 10 cents after the stop losses of 800 margin orders were liquidated. The initial drop was said to have been caused by a multi-million dollar short position at the $318 level.

Although reports suggest no malpractice, some could argue this was a form of spoofing, or at least it does mirror something like it. We can learn that a substantial order worth millions is capable of moving the price of an instrument substantially.

Can a flash crash be prevented?

Unfortunately, no one can prepare for a flash crash, as evidenced by their rarity in trading. Furthermore, regulation is lax and has no real control over dictating the limits to which the price of assets can move over a defined period.

Therefore, there is no actual method in place to prevent this anomaly. Nonetheless, one thing investors might consider is looking at the fundamentals of the instruments they are trading.

Any adverse news released during less busy trading periods in a market can shake up prices to some extent. Of course, no one has any control over the prevalence of computers and bad actors, though in some cases, unexpected fundamental results can play a role as they did with the EURCHF crash.

It’s also important to know the protective financial practices a broker or exchange may have in the rare case of such events.

Final word

The markets can sometimes be a crazy environment driven by influential, high-net-worth investors with manipulative techniques and advanced trading algorithms.

While a flash crash happens once in a blue moon, it’s an interesting occurrence to learn about nonetheless. Will another flash crash happen again in the next few years? Only time well.