The first inverse bitcoin exchange-traded fund will debut on Thursday on the Toronto Stock Exchange, according to Bloomberg Quint. The Horizons ETF is releasing a fund, under ticker BITI, which will allow investors to take short positions on bitcoin futures.

Todd Rosenbluth, director of ETF research for CFRA Research, expects the new ETF to provide an opportunity for investors expecting a bitcoin correction.

The ETF will provide up to 100% of the inverse daily performance of an index that “replicates the returns generated over time through exposure to long notional investments in bitcoin futures.”

Horizons BetaPro Inverse Bitcoin ETF will charge a 1.45% management fee, while a sister product, BetaPro Bitcoin ETF, will cost 1.00% and track bitcoin futures.

SEC has since 2013 rejected every bitcoin ETF application, citing concerns about manipulation and criminal activity.

The first bitcoin ETF in North America launched less than two months ago in Toronto and has already reached $1 billion in assets.

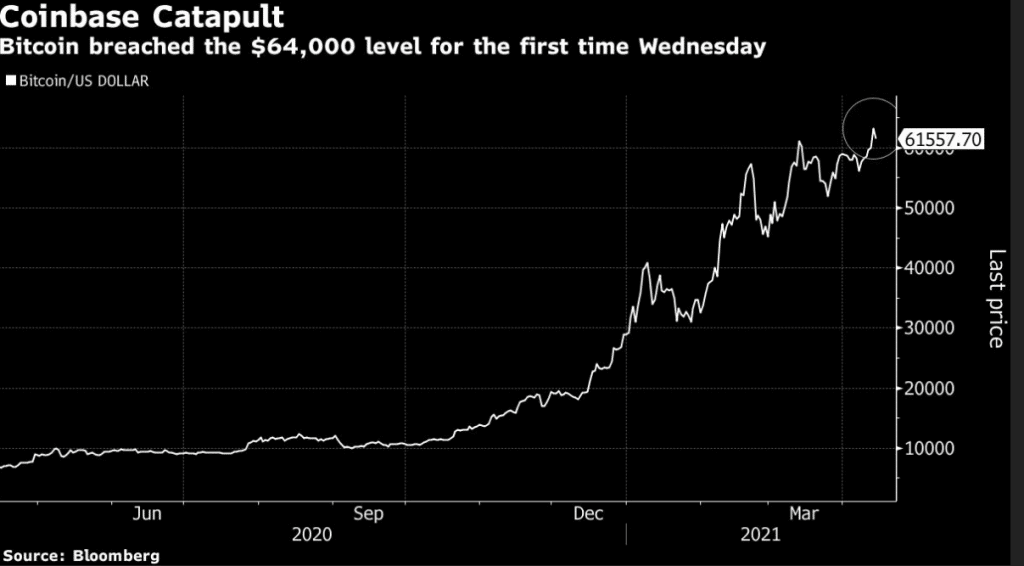

The launch comes when bitcoin breached the $64,000 level for the first time on Wednesday.

Bitcoin is currently declining. BTCUSD is down 0.52%