U.S Federal Reserve is expected to keep fiscal support despite a favorable recovery outlook, according to Bloomberg. The dovish tone seeks to convey that despite the ongoing recovery, the coronavirus is still a threat.

Previously, Fed Chair Jerome Powell said the U.S economy was at an “inflection point” with quick job creation and growth but facing renewed Covid-19 risks.

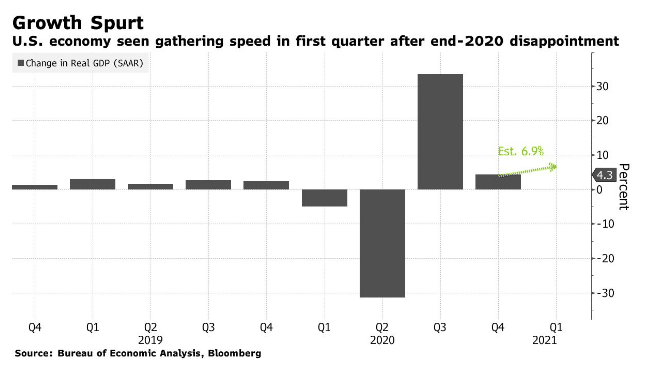

Analysts expect solid recovery in the first quarter to be reflected in an anticipated 6.9% gross domestic output increase.

Fed is also expected to keep interest rates near zero and maintain buying bonds at $120 billion on a monthly basis.

There is an expectation that Fed could adjust interest rate on excess reserves from the current 0.10%.

Analysts also expect Fed to maintain its plan to start slowing asset purchases after “substantial” progress is achieved in inflation and employment goals.

U.S stocks are currently mixed as the dollar declines. SPY is up 0.057%, QQQ is down 0.30%, EURUSD is up 0.08%.