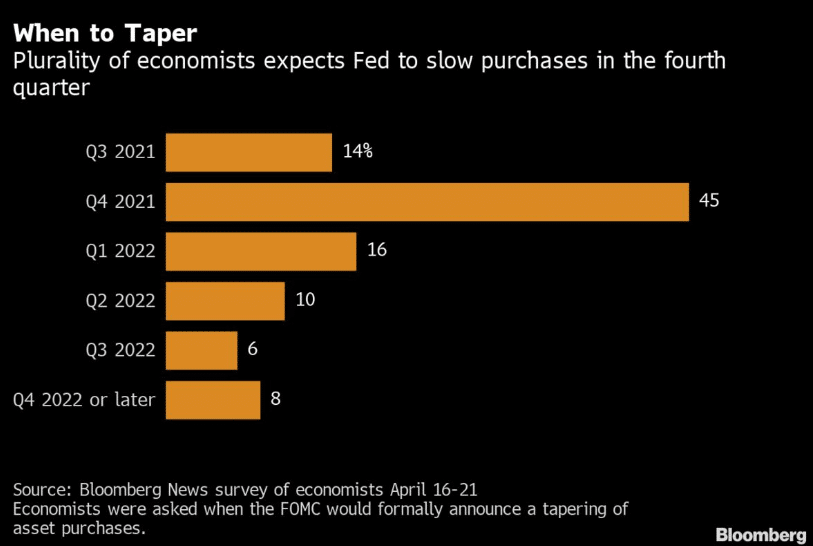

45% of economists see the Federal Reserve tapering with bond purchases in the fourth quarter, according to Bloomberg Quint. The number reflects a hawkish shift from March when more economists expect tapering in 2022.

14% economists see tapering happening in the third quarter.

The Federal Open Market Committee will conclude its two-day meeting on Wednesday as analysts expect it to affirm plans to adjust purchases.

Analysts expect the FED to maintain its benchmark rate from a zero to 0.25% range.

Fed could also seek a minor change to the interest on reserves, with analysts expecting a move up to 0.15% from 0.10%.

Fed has in the past hinted of policy change once employment and inflation goals are met.

With the U.S unemployment dropping and inflation expected to surpass 2% in 2021, analysts see a “substantial progress” to support tapering.

Powel has called for patience saying it would take “some time” to attain substantial progress in economic goals.

Economists expect the Fed to taper with bond purchases once unemployment hits around 4.5% and inflation at 2.1%.