The US dollar continues to register substantial gains against the major’s on receiving support from rallying yields and safe-haven trades.

- Euro and pound are under immense pressure edging lower heading into the weekend amid a strengthened dollar across the board.

- Gold and Bitcoin remain bullish across the board despite the dollar strength.

The US dollar is headed for another weekly gain after coming under immense pressure at three-month highs. Yields rallying to 14-month highs are the catalyst offering support to the dollar, which also appears to have regained its safe-haven status. Gold is under pressure to hold on to gains above the $1,730 level heading into the weekend as euro and pound weakness persists.

Dollar strength

After sliding by more than 0.1% Friday morning, the dollar index appears to have hit strong support at 91.60 seen by the rallies registered during the European session. The index taking out the 92.0 handle affirms the bullishness amid rising yields.

The 10-year US yield retreating from a more than one year peak of 1.754% to lows of 1.693% was the catalyst behind US dollar weakness during the Asian session. However, the yields bounced back, fuelling further gains in the dollar against the majors.

Euro-pound weakness

Euro is one of the majors that is struggling amid a resilient dollar. The EUR/USD pair hit strong resistance at the 1.984 level, retreating lower as the European session opened on Friday.

Gains above the 1.1900 level have been limited this week. Euro weakness stems from growing COVID-19 concerns in Europe amid struggling vaccination campaigns. The European Medicine Agency has had to calm the storm after a scare over clots associated with the AstraZeneca shot.

Flaring tension between the US and Russia and China in the mix also appears to be fuelling dollar strength as a safe–haven, conversely sending the euro lower. The British pound is another major feeling the greenback strength brunt on the Bank of England failing to offer any meaningful direction.

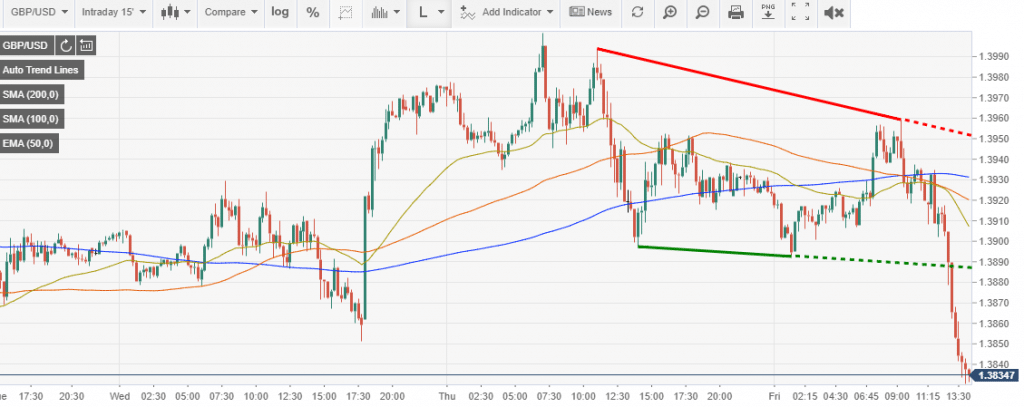

After hitting strong resistance near the 1.40 handle, the GBP/USD has edged lower and set to finish the week below the 1.39 handle. With the pair sliding to the 1.3870 handle, the bearish pressure is piling up. The BOE has already made it clear it won’t tighten any monetary policy until there is evidence of progress in economic recovery with inflation rising to the 2% target.

The Japanese yen strengthened slightly against the dollar Friday morning as the Bank of Japan slightly widened its long-term interest rates band. The widening paves the way for rates to range in around 0.5% vs. 0.4% at the moment.

However, the yen continues to lose ground against the dollar heading into the weekend. After touching session lows of 108.60, USD/JPY appears headed back to the 109 handle at the back of greenback strength.

Gold range-bound

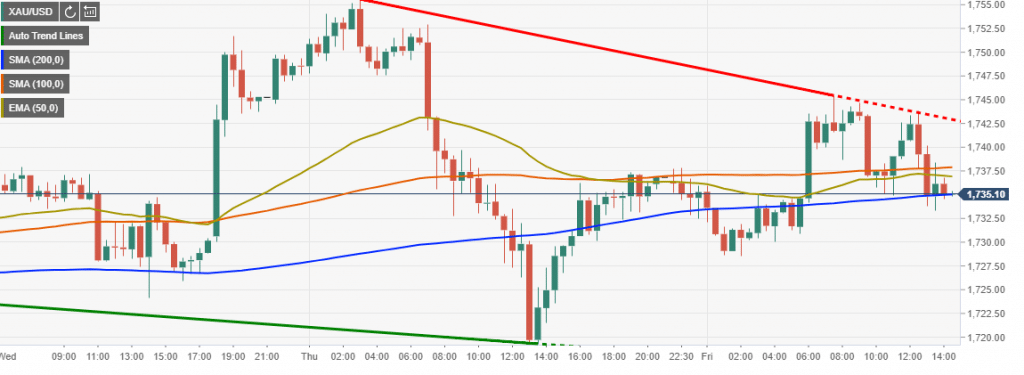

In the commodity markets, gold appears to have regained its upward momentum as it continues to shrug off dollar strength. The yellow metal has already passed resistance at 55 and 100 hours SMAs on finding support above the 1725 level.

After rallying to near three weeks high of $1,755, the yellow metal edged lower as the European session progressed on Friday. However, it appears to have found support near the 1730 level amid dollar strength across the board.

While a rally to the $1,755 handle was supported by treasury yields edging lower early Friday morning, gold also appears to be regaining its safe-haven status. Tensions between the US and Russia and China could be the catalyst to offer support for further price gains as investors exit risky assets.

On the other hand, Bitcoin is facing strong resistance near the $60,000 level resorting to trade in a range with the $56,700 emerging as the immediate support.