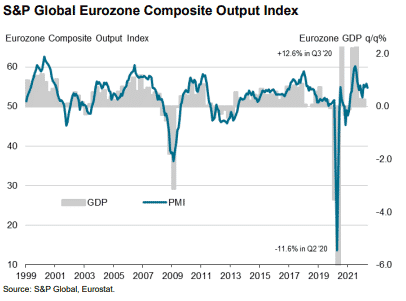

(S&P Global) Growth within the eurozone weakened in May, as the Composite Output Index edged to a four-month low of 54.8, compared to 55.8 in April.

The service sector was the main driver of growth, helping to offset growth weaknesses although momentum faded, with the PMI at 56.1 compared to 57.7 in April.

The falling growth reflected ongoing geopolitical tensions following the Ukrainian war, persistent supply-chain bottlenecks, and subdued demand for goods. Inflationary pressures also contributed.

Output inflation rose at the second-fastest rate on record. Input costs were the slowest in three months, increasing at one of the fastest rates on record.

Backlogs were also pointed to be on the rise, with the levels up for the fifteenth straight month. The backlogs were contributed by difficulties in hiring, material shortages, and growing new order intakes.

Ireland was the fastest growing economy, despite the momentum slowing to a four-month low in May. Italy was the weakest performer, although it posted a modest expansion in its private sector.

DAX is up +0.034%, EURUSD is down -0.16%.