‘Gas’ on Ethereum is more than a transaction fee value. Like the literal gasoline needed for a car, gas on the world’s most used blockchain is what essentially ‘fuels’ the entire ecosystem.

While Ethereum (ETH) is arguably the most significant cryptocurrency project after Bitcoin, it hasn’t been without drastic issues, one of them being the overpriced gas fees in recent history.

Nowadays, performing any action utilizing ETH – whether creating an NFT using an Ethereum token standard or buying a coin secured by its blockchain – will more than likely involve users considering the best times for lower costs.

Ultimately, the fees have skyrocketed over the years due to the massive demand for the Ethereum blockchain. The number of decentralized applications created with Ethereum keeps increasing, and all this activity has consequently made the coin’s price more valuable than ever before.

This article will dive into how gas works on Ethereum, why it’s been so costly, and the future plans from the Ethereum Foundation to ensure a more pleasant user experience.

What is gas on Ethereum?

Gas is simply a fee paid in executing a transaction on Ethereum to compensate miners for their computational resources in validating and processing. It’s a unit of measure for the amount of computational work needed to fulfill specific tasks.

Ultimately, every transaction has a specific gas cost based on the computational resources required to execute it. As expected, such prices are paid in the blockchain’s native currency, Ether or ETH.

We denote these costs as a small denomination of ETH known as ‘gwei,’ (giga-wei), which is equal to 0.000000001 ETH (or 10-9 ETH).

Fun fact: ‘Gwei’ is named after Wei Dai, the Chinese computer engineer is known for his influential contributions to cryptography.

Another concept to understand is the gas limit, referring to the maximum price any person should pay per transaction. This mechanism was designed to ensure fair and transparent pricing based on an operation’s complexity.

The minimum amount of gas to perform the simplest transaction on Ethereum is 200 gwei or 21 000 gas units, equivalent to 0.00000020 ETH (about $4.25 at the time of writing).

Of course, if the task is more demanding, the gas cost will be appropriately higher based on the necessary computing requirements.

How do Ethereum transaction fees work?

When you perform a transaction using ETH or any Ethereum-based token, a gas limit is applied before it’s submitted to the blockchain. Users can specify the gas limit manually on some platforms, and in other cases, one doesn’t have this privilege.

How operations function on Ethereum is characteristic of proof-of-work blockchains generally. One of the fundamental problems is these ledgers are inherently slow.

The ‘mempool’ (a pool on the blockchain consisting of all pending transactions) can only handle a limited number of requests at a time due to the inherently low block size. So, miners naturally prioritize transactions with higher gas fees above others.

This causes those with lower gas fees to be on a ‘waiting list.’ Therefore, you’d have to pay higher prices to have your transactions validated quicker since miners have an obvious financial incentive.

Conversely, if the fees are lower, this results in slower confirmation times or in your transactions sometimes being stuck since there’s a less monetary appeal for miners to confirm them.

Why have gas fees been so high over the last few years?

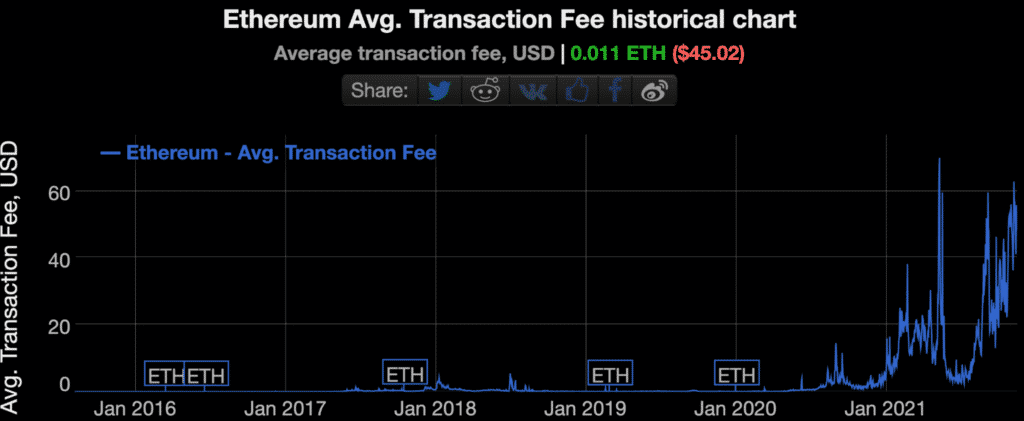

The chart below(from BitInfoCharts) depicts a line graph of the average gas fee on Ethereum since its inception. Presently, the average transaction cost is roughly $45, which is tremendously expensive for any currency.

This is despite the recent ‘London hard fork’ implemented partly to stabilize the gas price issue. Ethereum has historically functioned on an ‘auction pricing system’ of sorts where miners prioritize the transactions with the greatest gas fees first.

However, this creates a ripple effect where senders set even higher bids to have their requests processed the quickest.

When the network becomes busy (as it usually is), there’s a ‘baseline’ fee to pay for every operation determined by supply and demand forces. Fortunately, users aren’t forced to pay a high gas fee.

Of course, if you opt for a cheaper or normal option, your transaction will take the longest to clear. Over the last three years, one of the main drivers for Ethereum’s network becoming congested is DeFi (decentralized finance).

Recently, the minting of NFTs has seen an even more significant demand for the blockchain’s resources. Research has suggested specific days and times where gas fees are at their lowest based on past historical trends.

It’s been said weekends are more optimal for fee reduction than during the week, although there are specific sessions to observe at these times.

If you need to use Ethereum on any other day, it’s recommended to transact between 01h00-03h00 and 21h00-23h00 CUT (Coordinated Universal Time).

Final word: how things will change for the future

The Ethereum Foundation has proposed two solutions, one for the short-term and another for the long-term. In August 2021, as part of the EIPs (Ethereum Improvement Proposals), Ethereum implemented an upgrade dubbed the ‘London hard fork.’

This change effectively replaced the auction-style gas fee mechanism, which has been prevalent on the network, with a less-dynamic structure setting transaction costs based on overall demand.

Yet, users can still pay a higher premium if they want their transactions validated sooner. However, the hope is for gas fees to be more predictable. The long-term solution is more significant; Ethereum 2.0.

With Eth2, the blockchain will transition towards proof-of-stake, making mining obsolete. Mining-based ledgers have long faced scalability issues, resulting in high transaction costs. With staking, Ethereum can process thousands of transactions per second since less computational work is required.

The proposal to introduce sharding, a mechanism where a network is split into ‘partitions,’ will ‘spread the load’ and allow even higher throughput than ever before.

Overall, these adjustments will make transaction fees much more affordable to the levels of blockchains like Solana, one of Ethereum’s biggest competitors.