The Dow Jones index jumped by more than 350 points on Friday after the relatively weak US retail sales numbers. The index ended the week at $34,382, which was still 2% below its all-time high of $35,085.

Rotation to value

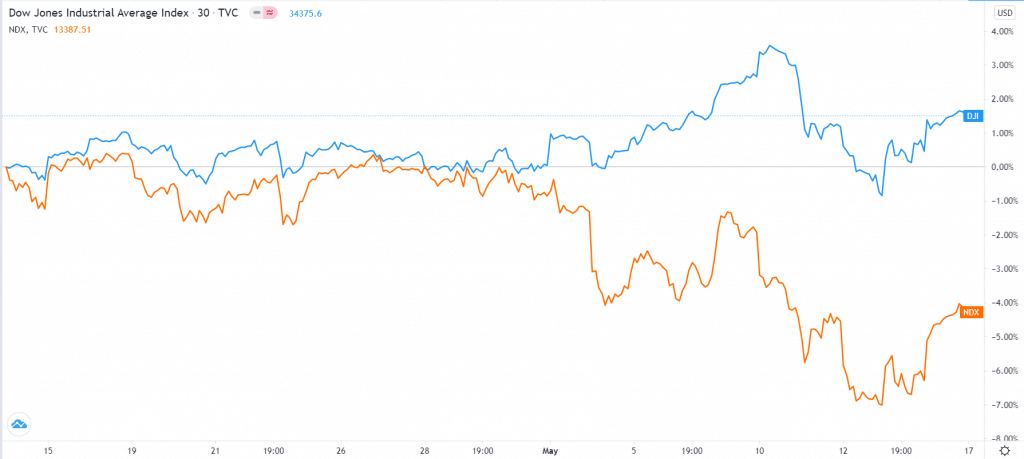

The Dow Jones index has recently benefited from the ongoing rotation from growth to value stocks. Indeed, in the past month, the index has jumped by more than 1%, while the Nasdaq 100 index has dropped by more than 4%.

Dow Jones vs. Nasdaq 100

The performance of the Dow Jones is mostly because of the recent upbeat economic data from the United States. In the past few weeks, flash numbers have revealed that the US labor market is doing relatively well. The recent JOLTs report showed that there were more than 7 million vacancies in the country. Further, many companies in the retail and hospitality industry have recently announced higher wages in their bid to attract workers.

Last week, data showed that consumer prices are surging. The headline consumer price index rose by 4.2%, while core CPI rose by 2.3%. In the same month, the producer price index (PPI) data rose by 6.2%, the highest increase since 2011. This trend could continue as the prices of commodities like lumber, copper, and iron ore have all soared to their all-time high.

Therefore, the Dow Jones has jumped as investors rotate their holdings from high-growth companies to value companies. Indeed, some of the best-known growth companies like Tesla, Shopify, Spotify, and Teladoc are all down by more than 30% from their peak this year. Historically, value stocks tend to do well in a period of higher interest rates.

This week, from a macro perspective, the index will react to the upcoming minutes of the Federal Reserve. The minutes will provide a picture of the member’s thinking as they made the recent rate decision. In it, they decided to leave interest rates unchanged and extend its open-ended quantitative easing (QE) policy, pointing to the uneven nature of the recovery.

Retail earnings ahead

The Dow Jones will also react to the upcoming earnings from American retailers. Their results come after most of them rallied on Friday after data showed that some sections of the retail sector did relatively well in April. In fact, shares of department stores like Macy’s, Nordstrom, and Target were among the best performers in the S&P 500.

This week, some retailers that form part of the Dow Jones index will publish their results. On Tuesday, Home Depot is expected to report relatively strong results since most people used their stimulus checks to improve their homes. Walmart and Target will also publish their results on Tuesday.

On Wednesday, Lowe’s, a Home Depot competitor, will also publish relatively strong results. Other top companies that will release their quarterly earnings are Cisco, L Brands, Applied Materials, and Deere. Still, the biggest issue among many investors will be on their forward guidance.

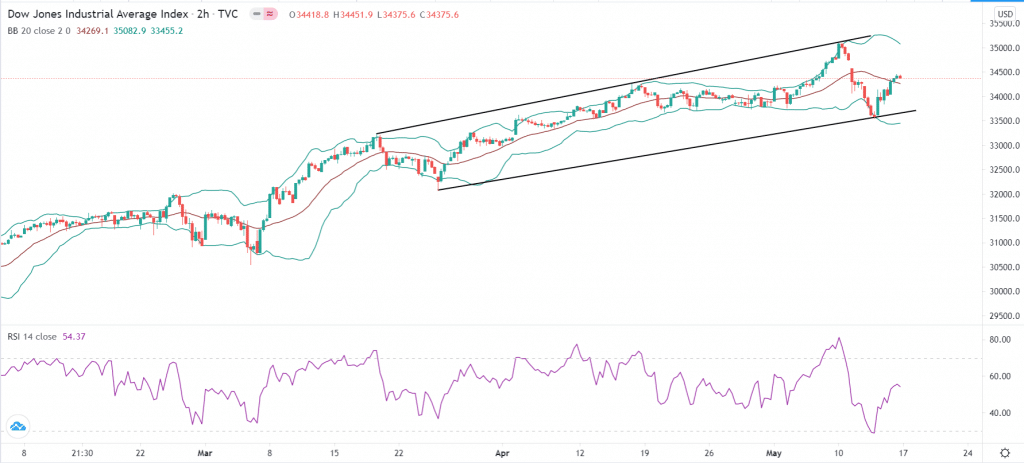

Dow Jones technical forecast

The two-hour chart shows that the Dow Jones dropped to a low of $33,568 last week. This was a notable level since it was along the lower side of the ascending channel that is shown in black. The index has moved above the middle line of the Bollinger Bands while the Relative Strength Index (RSI) has moved from the oversold level to 50. Therefore, there is a possibility that the index will keep rising as bulls target the upper side of the channel and the all-time high at $35,110. However, a drop below the lower line of the channel will invalidate the bullish thesis.