- Dogecoin bounces off record lows

- Western Sanctions on Russia fuel crypto demand

- Dogecoin threatens to break out

Dogecoin is one of the cryptocurrencies ready to launch after bottoming out of all-time lows of $0.10 a coin. The coin is showing signs of edging higher amid renewed buying spree in the broader cryptocurrency market. The bounce back is being fuelled by strong crypto demand in the aftermath of crippling sanctions on Russia.

Russian citizens being forced to look for new stores of value from the heavily battered Rubble has seen most people rush to buy cryptocurrencies. Bitcoin and Ethereum are some of the coins that are attracting strong bids all but fuelling strong bids across the board.

DOGEUSD technical analysis

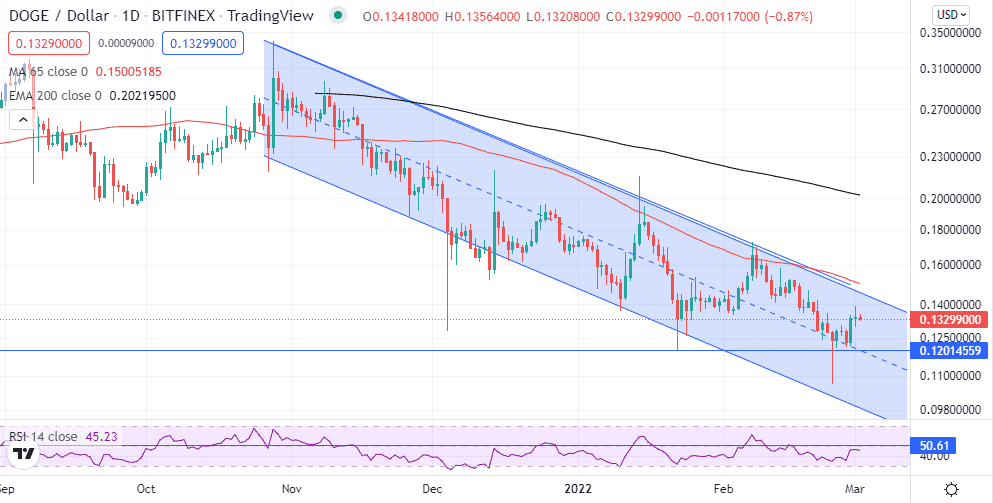

After plunging to lows of $0.10 DOGEUSD has bounced back, rallying by more than 10% to highs of $0.13. However, the chart below clearly shows that meme coin is still engulfed in a bearish descending pattern. A rally followed by a close above the descending channel should re-affirm the bounce back play from all-time lows.

In the short term, DOGEUSD is staring at short-term resistance near the $0.15 a coin level. A rally followed by a close above the level should pave the way for a rally to one-month highs near the $0.17 level, which also happens to be the next substantial resistance level.

With DOGEUSD trading below the 65 EMA and 200 EMA, it still looks bearish. However, finding support above the two moving averages would reaffirm strong bullish momentum, a move that could attract more buyers still on the side. In addition, the Relative Strength Index moving above the 50 handle would reaffirm the upward momentum setting the stage for higher highs.

Why is dogecoin rallying?

Dogecoin recent rallies have come at the backdrop of reports cryptocurrencies are at the heart of facilitating a surge in capital out of Russia. Western nations imposing sanctions on the country over its invasion of Ukraine have also seen banks being barred from using the SWIFT network.

The net effect has been Russian citizens being forced to use alternative means as a way of circumventing the sanctions. Immediate data shows a spike in volumes of high-profile tokens a development that indicates Russian institutions may resort to using cryptocurrencies in the financial system.

Given the nature of the sanctions imposed on Russia, cryptocurrencies’ utility is becoming increasingly clear given their ability to enable the transfer of money anonymously and across borders. Further deterioration of Russia’s financial system should benefit the broader cryptocurrency market as a means of capital savings.

The Rubble depreciating by more than 30% against the dollar is increasingly forcing Russians to look for other alternatives to safeguard their wealth. Given the country is a hub of cryptocurrencies, it does not come as a surprise that most of them are opting to invest in high-profile crypto.

Dogecoin’s growing popularity as a meme coin has seen it attract some of investments, which might explain its recent price swings to the upside. Increasing demand for cryptocurrencies to move wealth around should continue to boost the price of Dogecoin among other altcoins.

Now what?

Dogecoin has been under immense pressure amid the risk-off mood in the capital markets. The Russia-Ukraine standoff is turning out to be the main catalyst driving the meme coin price action. The coin looks set to continue trading in tandem with other altcoins as Western sanctions on Russia continue to fuel strong demand for cryptocurrencies.