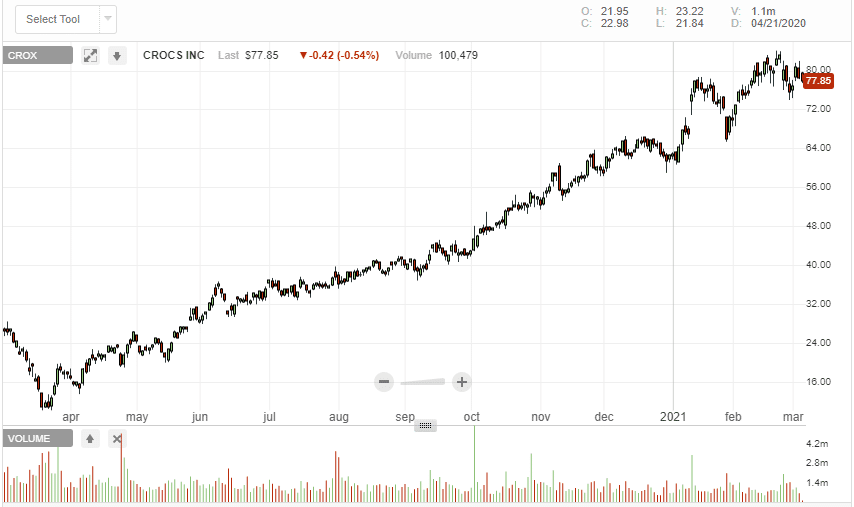

Crocs Inc. (NASDAQ: CROX) had an impressive 2020 amid renewed investors’ interest that saw the stock rally by more than 50%. After initially plunging below the $10 a share mark, the stock bounced back on colossal volume, rallying by more than 300% from the one-year lows, as investors reacted to the pandemic presenting a perfect business opportunity.

Crocs improving fundamentals

As the pandemic caused havoc and changed people’s way of life, Croc’s increasingly became part of the casual pandemic lifestyle. Its clog became a closet staple for most consumers as working and studying from home became a trend.

Sales powering to record highs all but affirmed how the company’s brand was resonating well with consumers. Similarly, it does not come as a surprise that Croc’s has become a Wall Street darling. The stock is flirting with record highs above the $70 a share level.

While it has pulled lower, the correction appears to be a minor correction going by the solid underlying fundamentals that affirm growth metrics and long-term prospects. A closer look at the chart shows that pullbacks have presented buy opportunities from where bulls have come and helped steer the stock higher.

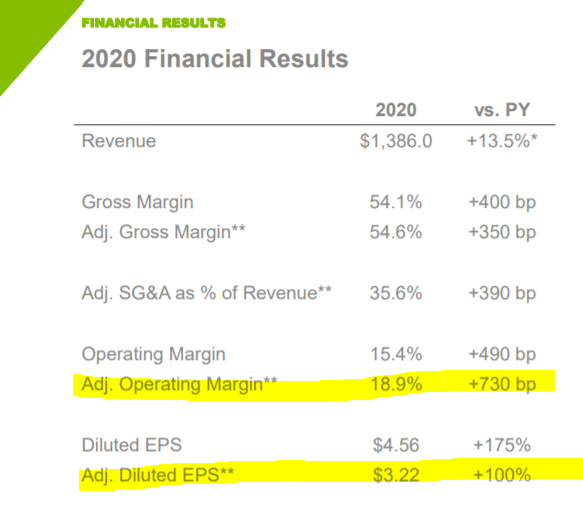

Record financials

Croc remains well-positioned for an impressive year on the operational and execution front. The company finished 2020 with a strong brand momentum depicted by record fourth-quarter revenues and earnings.

The pandemic has allowed Croc to reach new customers, most of whom are expected to be a key driver of growth going forward. A solid customer base could explain the 56.5% revenue increase in the fourth quarter that came in at $411.5 million. Net income increased nearly ten-fold to $183.3 million or $2.69 a share compared to $19.9 million generated last year.

China opportunity

Strong momentum across various product categories backed by solid digital channels should help Crocs achieve 20-25% sales growth. Crocs also remains well-positioned to take advantage of potential opportunities in the sandal categories and personalization through its high margin Jibbitz.

China presents tremendous opportunities for the company, given that it accounts for less than 7% of the company’s total revenues at the moment. The fact that the country accounts for the second-largest footwear market in the world affirms the untapped market that could be a key driver of the top-line going forward.

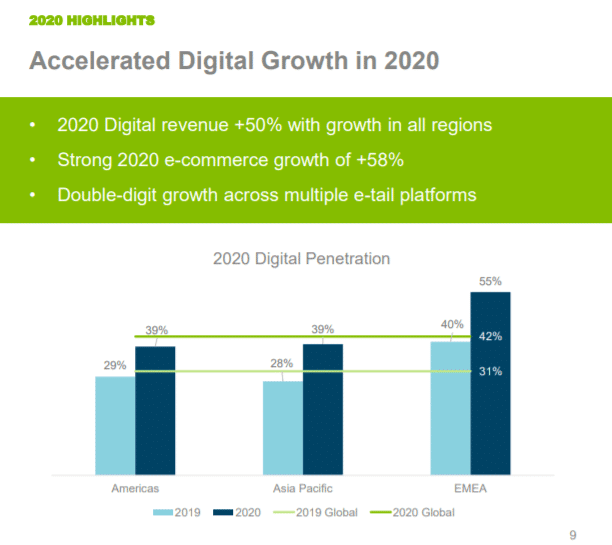

Digital sales growth

The apparel and footwear industry has been reeling from reduced traffic to brick-and-mortar stores. The pandemic exacerbated the situation as fears of contracting the deadly virus saw people shun shopping malls.

While reduced traffic malls have significantly hurt retailers of Crocs’ likes, increased focus on e-commerce is proving to be a solid bet. Concerted efforts to bolster digital operations should continue to strengthen Crocs revenue base as consumers shopping patterns shift to online,

Expanded digital and Omni-channel capabilities are some of the factors that affirm why 2021 could be another record-breaking year, as was the case in 2021. Digital sales are becoming an important aspect of Croc’s revenue base. In the fourth quarter, digital sales were up 50.2% and accounted for 41.5% of the company’s total revenues versus 31.1% a year ago.

Focusing on online sales should allow the company to reach a broader market key to accelerating sales growth.

Crocs have also affirmed its commitment to returning value to the shareholders. In the fourth quarter alone, the company repurchased 1.7 million shares valued at $131.7 million. The company repurchased 3.2 million shares valued at $170.8 million for the full year. Having spent a mere $337.8 million of a $1 billion share repurchase authorization, it’s clear that more buybacks could come into play in 2021 as the company looks to return maximum value to shareholders.

2021 outlook

Sales growth is not expected to cool down even with the pandemic being brought under control. Crocs growth areas remain intact, driven by the Clogs Sandal and visible Comfort technology. Product demand should remain high in 2021, with America’s and the EMEA regions poised to generate sturdy results throughout the year.

Chief Executive Officer, Andrew Rees, has already reiterated plans to accelerate growth in 2021 with new product innovations. The introduction of new sandals to strengthen the brand portfolio could come into play. With sandals presenting a $30 billion market opportunity, this could be an important growth frontier going forward.

Similarly, Crocs is eyeing a strategic partnership with celebrities as part of an aggressive marketing campaign. Global launches with Justin Bieber and Post Malone’s likes should help strengthen brand awareness conversely accelerate sales growth.

Given the investments that Crocs is making towards accelerating sales growth, it does not come as a surprise that it has issued an impressive 2021 guidance that affirms expected continued growth. Revenue should increase by between 20% and 25% compared to revenue of $1.4 billion reported in 2020.

Bottom line

Crocs has outperformed the overall industry over the past three months. While the stock did receive a boost on third-quarter results topping estimates, the same looks to come into play in the fourth quarter, and full-year results also coming in better than expected.

The company has done exceedingly well amid the shocks that have clobbered the retail industry in the aftermath of the pandemic. Strong brand momentum backed by strong cash flow has allowed the company to pursue growth opportunities in new markets. A diversified product line has also allowed the company to reach a broader market conversely, drive sales growth.

Solid performance in key markets of Americas and the EMEA at the back of healthy demand for clogs sandals Jibbitz and Visible Comfort technology all but provide early signals of what 2021 could turn out to be. With digital sales increasing by double digits, Crocs could be in for yet another record-breaking year has given the expected strong business momentum.

While the stock has rallied significantly, touching record highs in recent weeks, pullbacks have acted as solid support levels from where additional legs higher have come into play. Backed by solid underlying fundamentals and improving industry factors, Crocs looks set to continue edging higher.