The Consumer Price index is an important economic metric analyzed by persons looking to trade fundamentals in the forex market. It stands out as an important metric as it provides insights into how the economy is doing in relation to inflation levels. Policy officials pay close watch to the metric when evaluating monetary policy.

Understanding CPI

CPI acts as an accurate representation of inflation levels as it tracks the prices of goods and services over a predefined period. Monetary policy officials track this metric as it informs their decisions on interest rate hikes and cuts.

The final CPI figure is arrived at on weighting the prices of a basket of goods and services. Some of the goods taken into consideration are those at the heart of people’s daily lives, including groceries, transport costs, and healthcare.

Whenever the average prices of these goods increase over a specified period, it is interpreted as an uptick in inflation leading to a higher CPI reading. Similarly, the same implies deflation in the economy when prices decrease significantly, thus a lower CPI reading.

The US Federal reserve strives to maintain an inflation level near the 2% mark. Whenever it increases or declines substantially below the level, it acts as a call to action to stem inflationary or deflationary pressures.

The Importance of CPI in forex

Forex traders pay close attention to the CPI print as it is at the heart of the monetary policies that central banks such as the Federal Reserve undertake. Whenever the inflation levels in an economy are rising, characterized by rising CPI readings, the FED or other central banks are often forced to act to curtail prices getting out of hand.

Some of the policies that might come into play to curtail a spike in inflation involve reducing the amount of money in supply, which often causes prices to edge lower. Hiking interest rates in a bid to raise the cost of borrowing often comes into play.

By hiking interest rates resulting in a spike in borrowing costs, officials hope to reduce the amount of money supply that often results in decreased spending power. Higher interest rates tend to force people to save money to benefit from higher yields.

During periods of deflation characterized by a significant decline in prices of goods and services, officials act by trying to bolster consumers’ spending power. To do so, they may cut interest rates in a bid to lower the borrowing costs.

Reduced borrowing costs make it easy and affordable for businesses and people to get loans that they can use to buy goods and services. Increased spending only goes to spur economic activity.

How CPI affects forex

The ability of the CPI metric to influence interest rate hikes in an economy means it is a key driver of currency pair exchange rates. In times of higher inflation characterized by high CPI readings, calls for higher interest rates are common to reduce the total amount of money in circulation.

Whenever interest rates increase, demand for a country’s currency also tends to increase. This is because people try to take advantage of the high-interest rates by investing in high-yielding products such as government bonds. Additionally, high interest rates are associated with growing economies that only go to strengthen currency sentiments in the forex market.

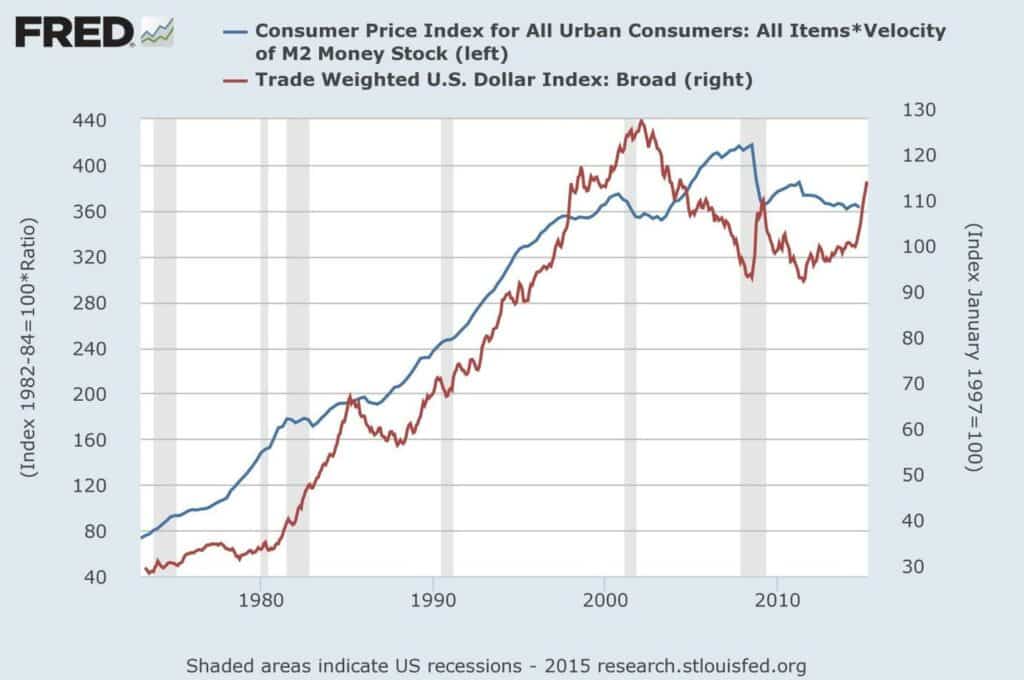

For instance, the dollar often strengthens against the majors whenever the FED hikes interest rates to curtail runaway inflation, given its increased demand in the market. This is partly because market participants will borrow in low-yield countries such as Japan only to invest in US government bonds to take advantage of the high interest rates in play. The US dollar has a direct correlation with CPI.

Consequently, the strong demand of the US dollar given the high yields on offer causes the dollar to strengthen against other currencies such as the British pound, euro, or the Canadian dollar.

In addition, whenever the FED is forced to cut interest rates in a bid to counter deflation, the dollar tends to weaken. The weakness arises because borrowing costs reduce significantly, making it easy for people and businesses to borrow. Demand for the dollar reduces as there is no incentive to invest in government bonds given the low yield on offer.

With more money in circulation, demand tends to decline, leading to weakness in the native currency in the currency market. Consequently, whenever the FED cuts interest rates, the dollar tends to weaken against the majors.

CPI trading strategy

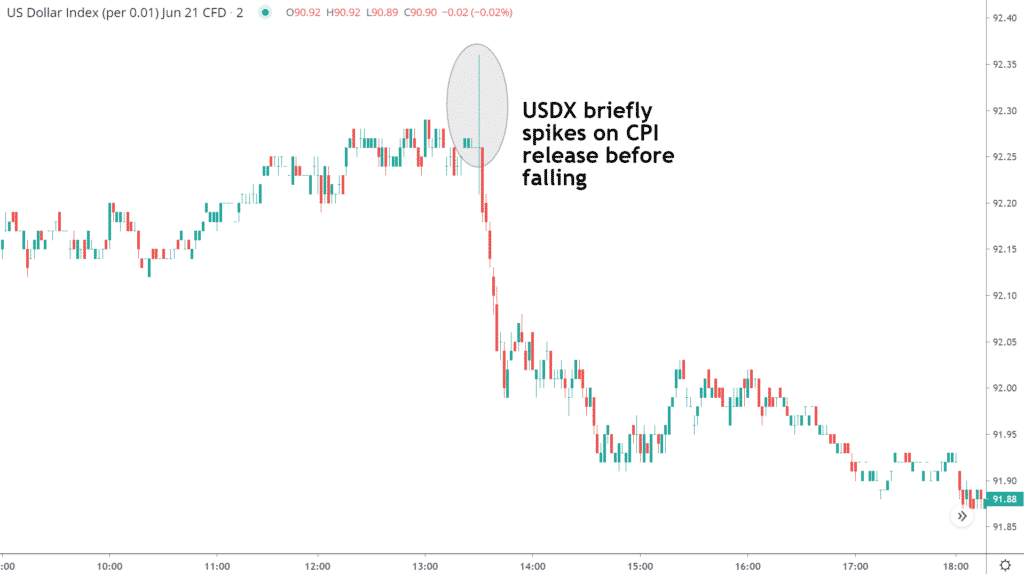

It is important to note that CPI interpretation is not always straightforward, such that a currency strengthens on a higher print and weakens on a lower reading. In the chart below, the dollar strengthened as the CPI reading came better than expected. However, afterward, the US dollar weakened as it became clear the Federal Reserve was not going to raise interest to counter rising inflation.

The US dollar slumped as US treasury yields also came under pressure.

Analyst’s expectations on CPI readings are released every other month based on the market’s prevailing supply and demand dynamics. To trade the print, it is important first to understand the analyst’s expectations. CPI tends to trigger increased volatility as traders compare the actual print with the previous reading and, most importantly, analysts’ expectations.

In case of a better than expected reading, the same could signal the need for an interest rate hike to curtail further spike in prices of goods and services. Similarly, in the case of a lower than expected reading, the same could imply the need for more accommodative policies to counter a further slide in prices.

Given the intense CPI reading volatility, it is important to be cautious heading into and after the report. The smart play would be to wait for the dust to settle and for key market players to interpret the information before opening any position.

It is advisable to wait for at least 15 minutes after the CPI reading is made available. Once the 15 minutes have elapsed, key market players would have interpreted the status of inflation levels. In return, a dominant trend would emerge on various currency pairs making it easy to pinpoint and enter a trade in the prevailing market trend.

Bottom line

The Consumer Price Index is an important indicator of inflationary pressures in an economy. The metric is commonly tracked in the forex market as it influences monetary policy mostly on interest rates hikes and cuts. In return, interest rate hikes and cuts cause currencies to weaken or strengthen against their rivals.