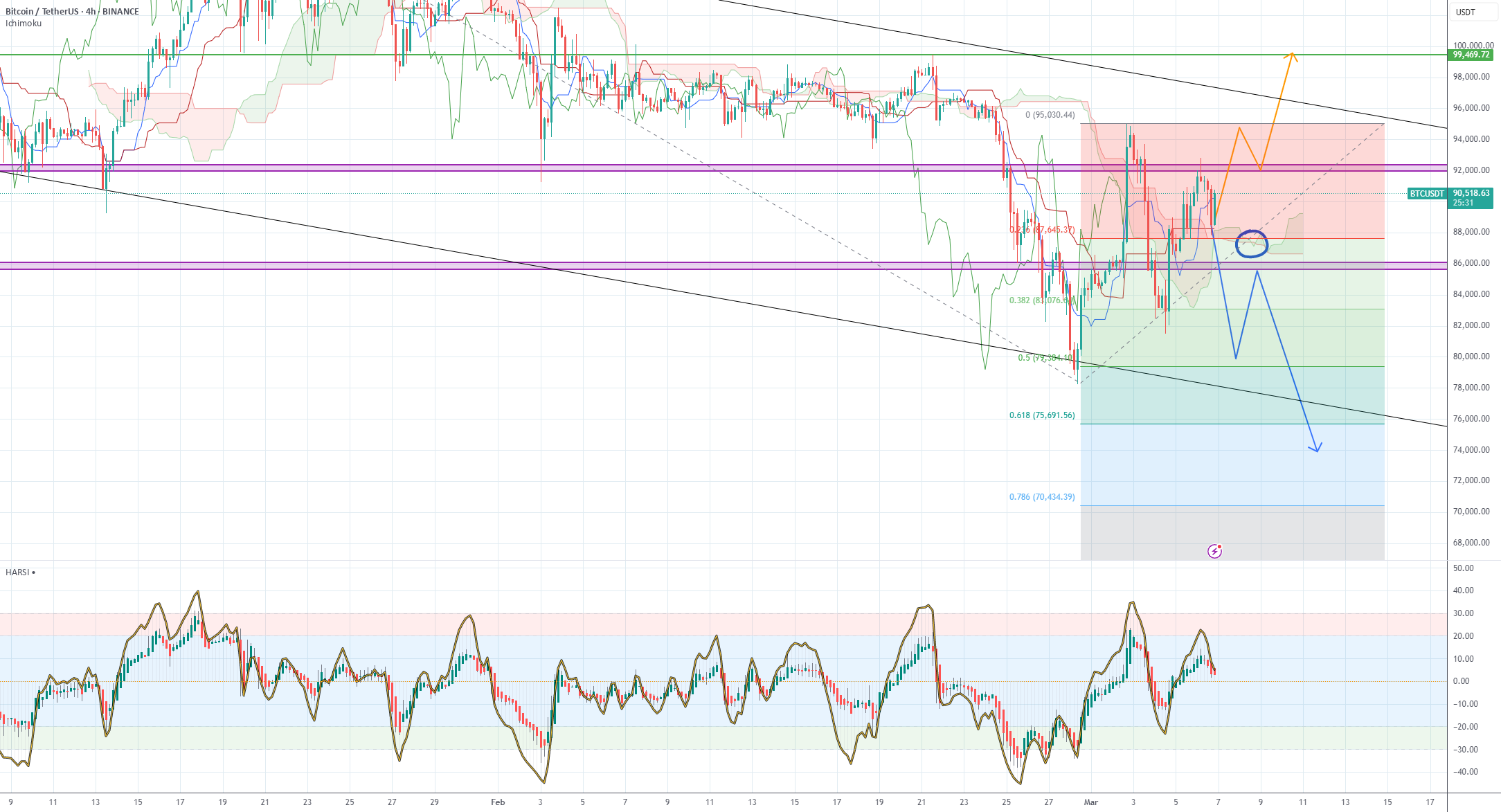

🎯 Key Support and Resistance Levels

Resistance Zone: $100,000 is identified as a key resistance level.

Support Zone: The $83,500-$86,000 range is a strong support area where the price recently showed a reaction.

Additional Critical Levels: If the support fails, $76,000 and $72,000 could serve as potential re-entry points.

📊 Ichimoku Indicator & Technical Signals

The price is currently inside the Ichimoku cloud, indicating a highly volatile and uncertain zone.

If the price stabilizes above the cloud, further upward movement is possible.

However, failure to hold above the cloud increases the likelihood of a deeper correction toward support levels.

📈 RSI (HARSI) Analysis

The indicator has recently been in the overbought zone and is undergoing a correction.

This correction may lead to a slight pullback, providing a re-entry opportunity.

⚡ Market Structure & Overall Trend

Bitcoin has failed to break its previous high but has been forming higher lows.

Recent candlestick formations indicate increasing selling pressure, suggesting a possible price decline.

Observing higher timeframes is crucial to confirm a continued bearish trend.

🔄 Bitcoin Dominance (BTC.D) Analysis

BTC dominance is fluctuating between 60% and 61%.

It remains above the Ichimoku cloud but has shifted from a strong bullish trend to a neutral state.

A decline in dominance could favor altcoins, while a breakout above 63% might push the market back toward Bitcoin.

📉 Bearish Scenario & Potential Targets

If selling pressure continues and the $86,000 support is broken, a decline toward $76,000 or even $72,000 is likely.

The presence of a liquidity node within the Ichimoku cloud suggests the market may move toward filling that zone.

The $62,000 level has also been identified as a key liquidity area on lower timeframes (4H), which could become a future target.

📈 Bullish Scenario & Trading Opportunities

If the price stabilizes above $92,000, the next targets will be $97,000 and then $100,000.

A strong reaction in the $83,500-$86,000 range could present a potential buy opportunity.

💡 Proposed Strategy

1️⃣ If strong bearish candles form with high volume, consider short positions targeting $76,000 and $72,000.

2️⃣ If a bullish reaction is observed near $83,500-$86,000, look for a buying opportunity.

3️⃣ Stay updated on fundamental news, as new liquidity inflows could shift the trend.

📌 Final Conclusion

Bitcoin is currently at a critical juncture. If it fails to break key resistance levels, a deeper correction may follow. However, if liquidity enters the market and price stabilizes above key zones, a renewed uptrend is possible. The final decision depends on how the price reacts at these crucial levels. Always practice proper risk management and set stop-losses accordingly. 🚀