It is a well-regulated broker that offers its customers access to over 12,000 markets across forex, indices, shares, commodities, and, in limited countries, crypto. Customers can comfort by the broker’s 38-year operating history and strong financial backing from its publicly traded parent company.

The City Index trading platform offers a range of customization options, including 16 chart types with 65+ indicators designed for traders to perform technical analysis. The platform’s research portal highlights trade ideas using fundamental and technical analysis, while traders can follow the markets on its native apps built specifically for smartphones and tablets.

Pros

- Low fees for the FX market.

- Various research tools.

- Fast account opening.

- It is regulated in three tier-1 jurisdictions, making it a safe broker.

Cons

- High stock CFD fees.

- Non-user-friendly desktop platform.

- Product portfolio limited to FX and CFDs.

- It doesn’t offer MT5, and the MT4 offering includes a smaller product range.

City Index is a global online financial trading platform and multi-asset broker founded in 1983. Over 39 years later, it has grown to offer retail investors FX trading, CFDs trading, and spread trading.

This global broker has a head office in the UK. When trading in the financial markets, it can be very time-consuming to find a broker that meets your needs. We will dive deep into this review and assess how well the platform functions as an international multiple financial asset trading platforms for traders in 2022.

Regulation

The broker maintains Dubai, Singapore, and Australia offices and has local approvals from the UAE Central Bank, MAS, and ASIC.

- It is a trademark of GAIN Capital UK Ltd, regulated by the FCA in the UK, and has an additional eight registrations in jurisdictions worldwide.

- It is authorized and regulated by the Financial Conduct Authority (FCA) and holds client funds following their client money rules.

Account Types

The broker has a simple classification of accounts named after the different modes of trading. This broker offers types of accounts:

- Standart account

- MT4 account

Standart account

This type of account is best suited for clients outside of the UK and those who hedge as part of their trading strategy.

- It’s accessible on the native platform for both desktop and mobile applications.

- The clients can trade over 4,000 instruments from the following asset classes.

- The minimum trade size is one lot for FX pairs.

- Spreads start with 0.5 points.

- No commissions except when trading share CFDs; a commission starting from £10 or 0.1% is paid when trading share CFDs.

- Margin requirements from 3.33% on FX, 5% on indices, and 20% on shares.

- The available trading tools are HTML 5 charts, a research portal, an economic calendar, and a Reuters newsfeed.

MT4 account

- The clients can trade on the MT4 platform, compatible with iOS and Android.

- Over 80 FX pairs – majors, minors, and exotic pairs.

- Clients can use EA to automate the trading strategy, either download or create a trading strategy and robots via an MQL4 programming language.

- Comes equipped with the standard MT4 charting package: indicators, time frames, chart types, and drawing tools.

- Use the customizable economic calendar provided by City Index to your advantage when completing the fundamental analysis.

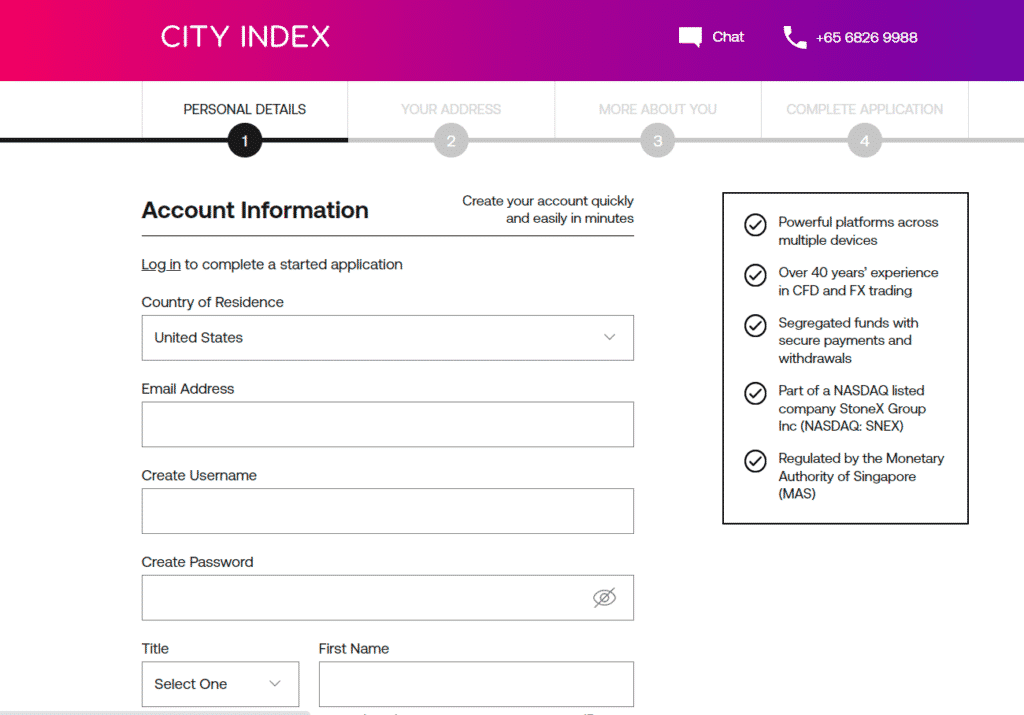

How to open a City Index account?

Step 1.

Look for the “Open account” button on the top right corner of any website page.

Step 2.

Insert your details: country of residence, name, date of birth, phone number, e-mail address, username, and password.

Step 3.

Confirm your address, complete a questionnaire about your financial experience and wealth, and complete the application with a KYC process.

It must verify its clients by requesting proof of identities, such as a passport, driving license, or national ID card, and a proof of residence, such as a bank statement or utility bill. The whole account opening process will take several minutes, and, in general, your account is generally approved within one business day.

Fees and Commissions

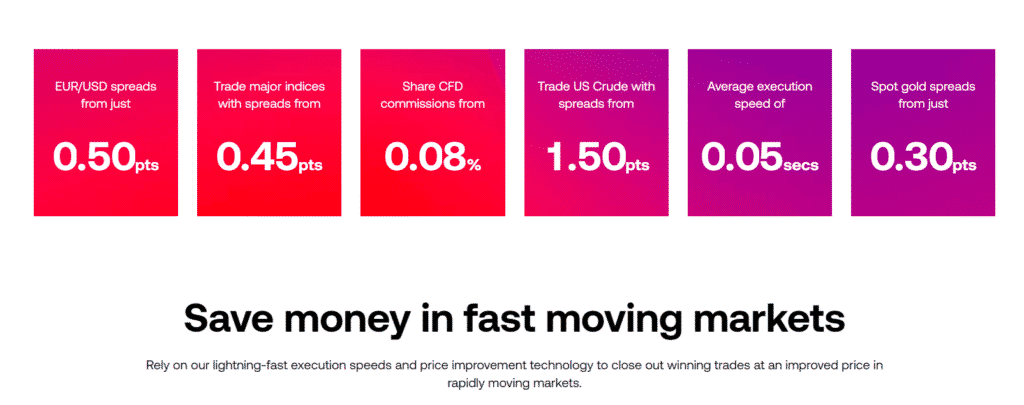

The broker has fixed or variable spreads depending on the market in question.

With flexible leverage when trading forex on City Index, spreads can be as tight as 0.5 points. The following example spreads, and margins will provide you with an idea of what to expect from the broker.

| Forex trading | Index CFDs | CFDs futures |

| EUR/USD: 0.5 min., 0.8 typical, 0.5% margin AUD/USD: 0.5 min., 0.9 typical, 0.5% margin EUR/AUD: 4.2 typical, 0.5% margin NOK/SEK: 4.2 typical, 1% margin EUR/USD forwards: 8 min., 0.5% margin AUD/USD forwards: 8 min, 0.5% margin | Australia 200: fixed at 1 point min., 0.50% margin EU Stocks 50: fixed at 2 points min., 0.50% margin US SP 500: fixed at 0.4 points min., 0.50% margin China A50: 10 points min. around market spread, 1% margin | Australia 200: 7:10 around market spread/23:50 fixed, 2 point min., 0.2% margin EU stocks 50: fixed at 3 points min., 0.50 margin US SP 500: fixed at 0.6 points min., 0.2% margin |

Broker fees

The broker does not charge deposit fees but does charge a monthly inactivity fee of £12 (or equivalent) if you do not use your account for more than 12 months. Traders also pay a financing charge on BTC exposure if they hold a position overnight.

Traders need to verify what additional charges may be charged by their financial institution. In addition, they may be subjected to currency conversion fees if traders transfer fees in a currency different from their account base currency.

City Index does not charge withdrawal fees, but if you want a same-day payment using a CHAPS bank transfer, it will cost you £25.

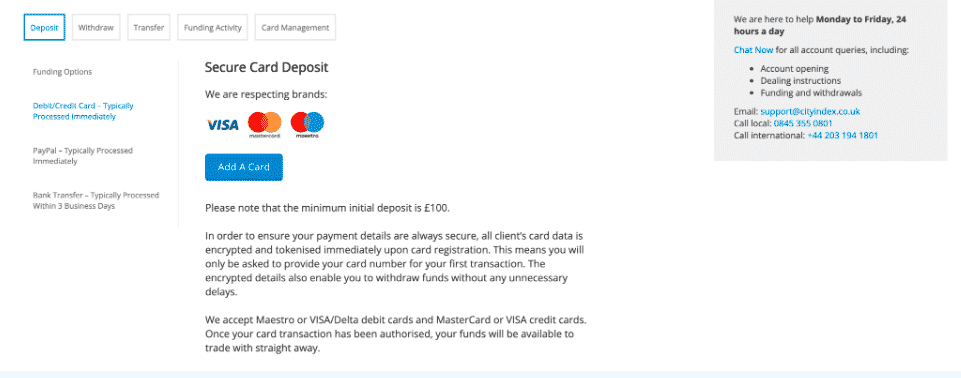

Payment options

Deposit

The payment methods made available by City Index are numerous:

- Bank wire transfers.

- Credit cards that are Visa or MasterCard.

- Debit cards that are Visa, MasterCard, Maestro, or Electron.

- PayPal is also available.

Withdrawals

The minimum withdrawal amount is $150, or your available account balance. The maximum you can withdraw in a single transaction is $20,000.

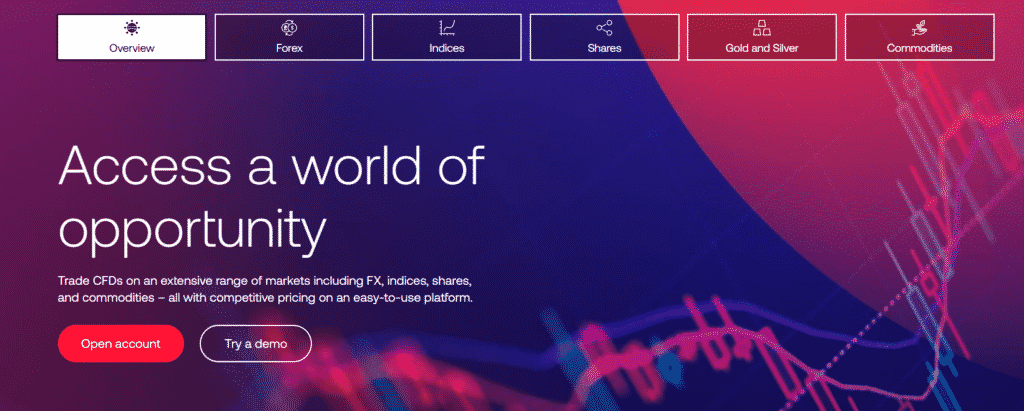

Available Markets

City Index’s award-winning platform offers more than 12,000 global FX, CFD, commodities, and spread betting markets. The latter could be a beneficial alternative to standard CFDs if you are based in the UK because it comes with certain tax efficiencies for country residents. Below, we detail all trading instruments available at City Index.

Forex trading

- It enables trading with 84 currency pairs, including major USD/JPY, GBP/USD, and EUR/USD.

- Competitive spreads start at 0.5.

- Minor and exotic pairs are also among the options for FX traders.

- FX traders face minimum spreads of 0.5 for major pairs like EUR/USD and AUD/USD, while those for GBP/USD and EUR/GBP are slightly higher at 0.9.

Indices trading

- Trade major global indices at City Index including Wall Street, the Germany 40 and the US SP 500.

- Wide range of markets.

- Over 20+ major global indices.

- Spreads from 0.3 pips.

Shares trading

- Commissions from 0.008%.

- Access over 6000 shares, including IPO.

- Open CFD positions.

Gold & silver trading

- Speculate on the future price of the world’s most popular precious metals.

- You can trade gold and silver as a CFD, with low fixed spreads from 0.45pts.

- Trade gold, copper, platinum and other metals markets.

- Hedge against falling indices and periods of market turbulence.

Commodities trading

- Take advantage of global market volatility by trading the world’s leading commodities with CFDs, including crude oil, gold, natural gas, etc.

- Spreads from 0.06 pips.

- Margin from 20%.

Trading Platforms

You can choose from three web trading platforms:

- Web Trader – HTML5-based trading platform.

- Advantage Web – an older web trading platform.

- MetaTrader 4 – third-party trading platform, specialized in forex trading.

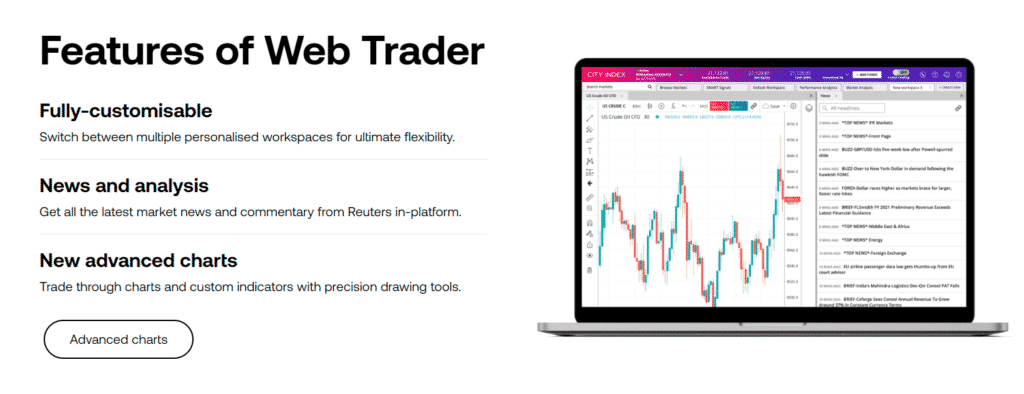

HTML5 web trader platform

Access multiple workspaces, trade tickets, advanced risk management, stop limits, and margin calculator.

AT Pro mobile platforms

Suited for iOS and Android mobile devices and tablets, 24-hour access, live streaming prices and charts, live Reuters news and economic calendar

MetaTrader 4 online trading platform

Popular trading platform for Forex, trading 84 global FX pairs with EAs, custom indicators, time frames, and charting.

Features

- Market news and analysis

This section contains a wealth of knowledge and information. Each day reports on markets, forex, and financial news are given. On top of that, comprehensive technical analysis, alongside graphs and expert analysis, are posted.

- Recognia

Recognia and worth exploring the power of the technical analysis portal. The portal scans and monitors the markets for patterns that could make for potentially profitable opportunities.

- Signal alerts

City Index offers a real-time alert service via e-mail and text. This could help you keep abreast of new developments to anticipate price fluctuations.

- Historical data

City Index facilitates access to historical data, via a simple Excel plugin. This allows you to view all relevant instrument information in an easy-to-digest and compatible format.

Education

The broker offers retail investors and professional traders hundreds of lessons available at their fingertips. When you open an account with City Index, you also gain access to an impressive educational trading academy. The educational material encompasses a broad range of topics, from lessons on how CFDs work and a trading strategy course valued at over $5,000.

You can learn to trade with Training Academy and have access to the following types of educational material:

- Understand how CFDs work course

- Technical analysis and fundamental analysis guides

- Trading strategy guides

- Research tool guide

- Expert news and analysis

- Free webinars

- Earnings report

- Economic calendar

The weekly forex outlooks and forecasts published every Monday at 10.00 a.m. are another insightful tool that will prepare forex traders for the week ahead.

Customer Support

City Index customer service is good. You can reach them in many ways and get fast and relevant answers via phone and chat. On the negative side, e-mail support is prolonged.

You can contact City Index via:

- Phone

- Live Chat

Its customer service is not fully 24/7 but is available 24/5 from 5 p.m. Sunday to 5 p.m. Friday EST.

Review Summary

The broker has played a key part in driving innovation across the online trading world. You get three trading platforms to choose between, excellent educational resources and great training tools for new traders. It is perhaps unsurprising then that users hold positive opinions of the company’s offering.

On the positive side, it has low forex fees, a smooth account opening process, and high-quality research tools. It has some drawbacks, though. The product portfolio is limited, stock CFD fees are quite high, and the desktop platform lags behind its competitors.