Sydney-based brokerage company Vantage FX operates as a true NDD offering clients RAW ECN spreads and STP executions through its account types. The broker reiterates offering tight spreads starting from 0.0 pips and lightning-fast executions on a wide range of markets such as forex, indices, shares, commodities, among others that traders speculate on through FX trading and CFDs.

Pros

- No deposit, withdrawal, and inactivity fees

- Deal with RAW ECN spreads, STP executions, and interbank access

- 50% welcome bonus

- Free FX signals

- Negative balance protection

- Segregation of funds

- Funds are held in top-tier banks

- Access to diverse markets

- Regulated by the ASIC

Cons

- High minimum deposit compared to other brokers

- Slippage and rollover — yes

- Not available in the USA and Canada

- Trading fees and commissions — yes

Vantage FX launched in 2009 to help traders pursue their financial goals by offering transparent access to the financial markets with powerful trading technology. Over the last decade, the broker grew to achieve this vision. Not only does it offer clients direct access to the liquidity markets using state-of-the-art trading technology, but it also claims to have won a portfolio of awards and operates under the eyes of legitimate regulatory bodies.

Its head office is headquartered in Sydney, Australia, and leads its subsidiaries in providing RAW ECN spreads starting from 0.0 pips, STP executions, and leverages of up to 500:1.

These conditions apply to the broker’s range of tradable assets that include:

- Forex

- Indices

- Energies

- Soft commodities

- Precious metals

- US, UK, EU & AU Share CFDs

Clients trade these assets through Vantage FX’s account types after funding the account. The minimum deposit is capped at $200, making the broker averagely easy to finance.

The broker also claims to offer quality security of clients’ funds by holding their money in top-tier banks and segregating the clients’ cash from the broker’s operating capital. It also provides negative balance protection and waives all inactivity fees.

To ensure efficient funding and withdrawal of money, Vantage FX provides a mainstream of payments options to its umbrella of clients. The broker mitigates all costs on deposits and withdrawals, giving the clients an appetite to make transactions in and out of the broker’s wallet.

Its payment options include:

- Wire transfers

- BPAY (Australian clients only)

- VISA and MasterCard

- JCB

- E-wallets

With the trading account funded, clients speculate on the FX pairs and the value movement of the other assets assisted by the broker’s well-furnished trading platforms. The broker offers sophisticated trading platforms such as the MT4, MT5, and its proprietary app — the Vantage FX App. The platforms integrate with smart trading tools and plugins to make trading a fun experience.

Some of the trading tools include:

- Forex VPS

- Economic calendar

- FX calculators

- Sentiment indicators

- Pro trader tools

Besides the well-established trading environment, Vantage FX also allows clients to tap into social trading through platforms such as ZuluTrade, MyFXBook Autotrade, and Dupli Trade, making it a good broker for investors looking to become signal providers or followers.

Regulation

The broker boasts of having registered with reputable agencies that survey its activities. The broker holds licenses from agencies such as the ASIC making Vantage FX an average-risk broker to trade with. Its registrations and licenses include:

- Registered and regulated by the Cayman Islands Monetary Authority (CIMA) with the license number 1383491

- Regulated by the VFS with the registration number 700271

- Regulated and registered with the Australian Securities and Investment Commission (ASIC), under license number AFSL 428901

Pros

- Regulated by the ASIC

Cons

- Only regulated by one two-tier agency

- It’s unavailable in some nations, including the USA and Canada

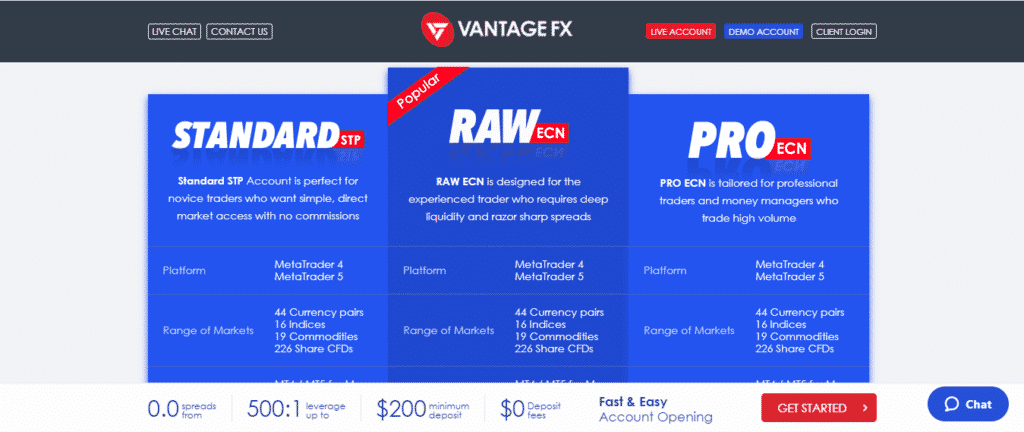

Account Types

Customers have a wide range of accounts to explore ahead of starting their trading journey with Vantage FX. The brokerage platform provides several account types tailored to serve different criteria of clients. The array of accounts consists of a RAW ECN account, Standard STP account, PRO ECN, and a Swap-free account.

Standard STP account (recommended for novice traders)

- Platform — MT4 and MT5

- Range of markets — 44 FX pairs, 16 indices, 19 commodities, 226 share CFDs

- Platform choices — MT4/MT5 for Mac, WebTrader, Mobile Apps

- Minimum deposit — $200

- Minimum trade size — 0.01 lot

- Leverage — up to 500:1

- Spreads from — 1.0 pip

- Commission — $0

- Conversion of promotional credit into cash — no

- Account base currencies — AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY, HKD

RAW ECN account (recommended for experienced traders)

- Platform — MT4 and MT5

- Range of markets — 44 FX pairs, 16 indices, 19 commodities, 226 share CFDs

- Platform choices — MT4/MT5 for Mac, WebTrader, mobile apps

- Minimum deposit — $500

- Minimum trade size — 0.01 lot

- Leverage — up to 500:1

- Spreads from — 0.0 pips

- Commission — from $3 per lot per side

- Conversion of promotional credit into cash — no

- Account base currencies — AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY, HKD

PRO ECN (recommended for professional clients trading high volumes)

- Platform — MT4 and MT5

- Range of markets — 44 FX pairs, 16 indices, 19 commodities, 226 share CFDs

- Platform choices — MT4/MT5 for Mac, WebTrader, mobile apps

- Minimum deposit — $20,000

- Minimum trade size — 0.01 lot

- Leverage — up to 500:1

- Spreads from — 0.0 pips

- Commission — from $2 per lot per side

- Conversion of promotional credit into cash — no

- Account base currencies — AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY, HKD

How to open a Vantage FX account?

The account opening process takes less than five minutes and involves the following steps.

Step 1. Log into the broker’s official website and press the “open account button.”

Step 2. Fill in your details on the form that pops up.

Step 3. Choose the trading account type.

Step 4. Verify your email and required documents.

Step 5. Fund your account.

Step 6. Start trading.

Fees and Commissions

The broker operates as a trustworthy NDD broker offering RAW ECN spreads and STP executions, which means the broker offers low spreads and doesn’t charge fees on the spread. However, the minimum spread starts from 1.0 pip for the standard STP account traders meaning Vantage FX charges fees on the markup for that caliber clients.

The minimum spread for the ECN account traders starts from 0.0 pips showing that the broker doesn’t charge fees due to the markup spread but adds trading commissions per side.

For example, the RAW ECN account traders incur commissions starting from $3 per lot per side, while the PRO ECN account clients incur a dollar less of that amount. But the broker waives most fees for clients such as broker fees, deposit fees, inactivity fees, among others, giving it the traction as a reliable brokerage platform.

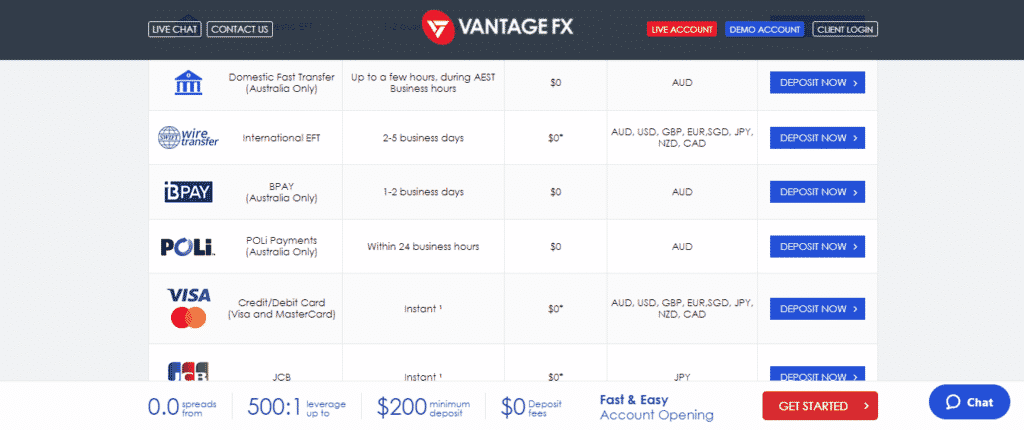

Payment options

The broker diversifies its payments options to cater to all its worldwide clients. Clients have multiple methods to select upon funding a Vantage FX trading account with an array of accepted currencies. The broker accepts AUD, USD, EUR, GBP, NZD, SGD, JPY, and CAD. Traders use deposits and withdrawal channels such as wire transfers, ETFs, BPAY, POLI, VISA, and e-wallets.

Pros

- Multiple payment options

- Deposit and withdrawal is free

Cons

- Some channels only apply to domestic clients

Deposit

The broker accepts deposits from these methods:

- Bank Cards like Visa, Mastercard

- Domestic ETFs

- Wire transfers (for international clients)

- E-wallet transfers like Skrill and Neteller

Other methods include:

- JCB

- China Unionpay

- POLI & BPAY (Australian clients only)

- AstroPay

- FasaPay

- Thailand Instant Bank wire transfer

Withdrawals

Deposit methods apply on withdrawals.

Available Markets

Vantage FX claims to offer clients access to several markets that provide 300+ tradable assets. It notes that clients trade 44 FX pairs, 16 indices, 19 commodities, and 226 share CFDs. As mentioned, these assets trade with interbank grade rates and ultra-fast executions.

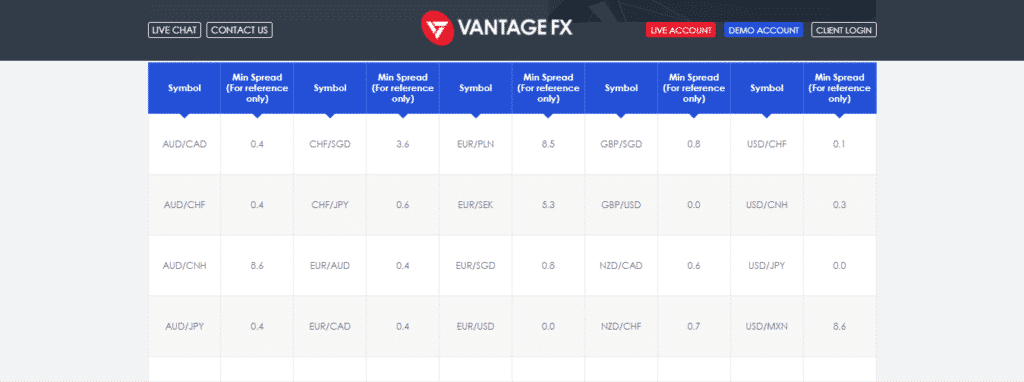

Forex

The FX market holds 44 currency pairs encompassing significant pairs, minors, exotics, and trades from Monday through Friday with razor-sharp spreads and lighting executions. The pairs yield from nine base currencies and trade with neutral leverage of up to 500:1. However, the minimum spread and trading commissions depend on the currency pair.

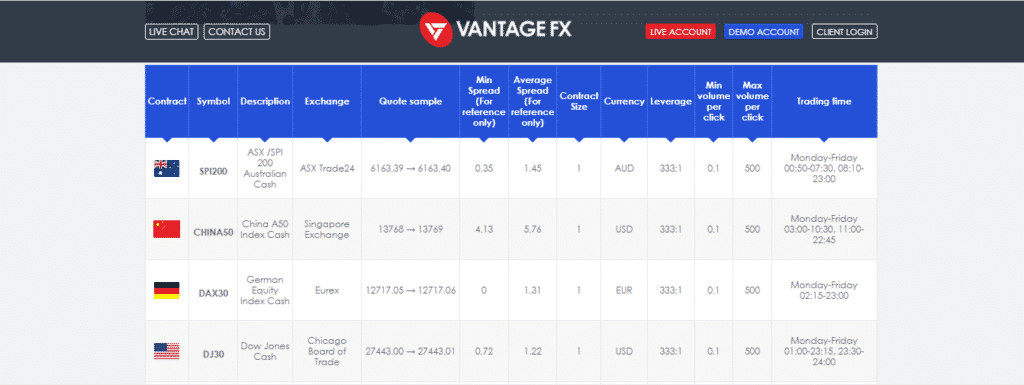

Indices

The broker provides traders access to the most liquid stock exchange indices from across the globe, including the S&P 500, DAX, FTSE, DJ30, etc. The markets attribute to about 15 major stock markets that clients exploit their instruments through CFDs with leverages of up to 333:1 and tight spreads.

Commodities

The commodities market landscape holds all sorts of physical and soft tradable products such as energies, metals, beverages like cocoa and coffee, and fiber goods such as cotton.

Energies

The energy bracket consists of crude oil, natural gas, gasoline, low sulfur gas oil, and cash oil. Natural gas trades with a leverage of 20:1 and 0.1 lot. Meanwhile, clients also speculate on crude oil with a leverage of up to 100:1 and 0.01 lots. Thus, other products like gasoline and low sulfur gas oil trade as natural gas. Cash oil includes instruments like UK & US oil.

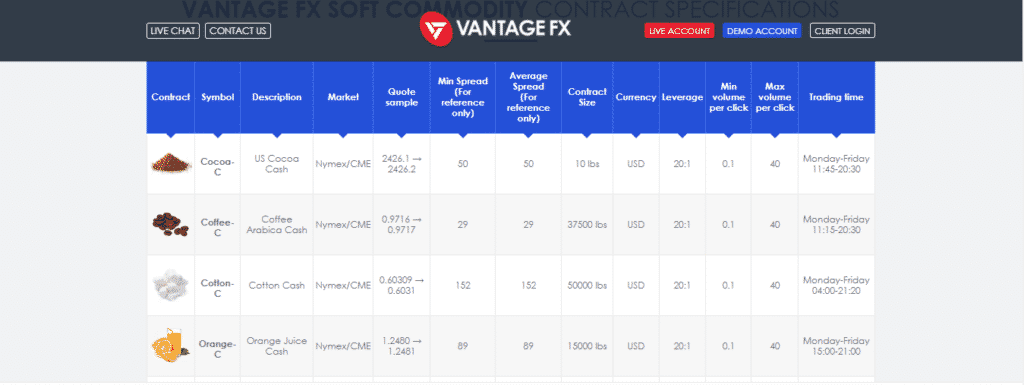

Soft commodities

These consist of all grown commodities that back the futures markets. At Vantage FX, cocoa, coffee, cotton, orange juice, and sugar are offered. These products trade 24/5 with leverages of up to 20:1 and 0.01 lots.

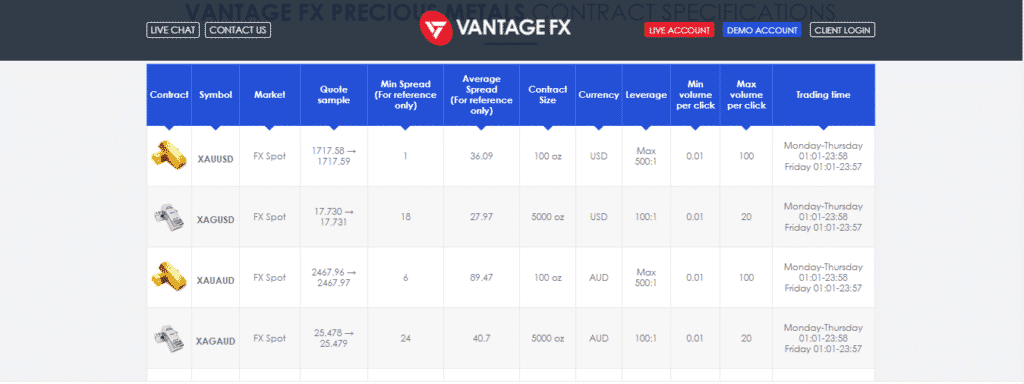

Precious metals

Just as the name suggests, these assets consist of the world’s mined valuable metals such as gold, platinum, silver, among others. At Vantage FX, the instruments offered include gold, silver, and copper and trade from Monday through Friday. Gold trades with a leverage of up to 500:1 and 0.01 lot. Meanwhile, silver and copper trade at a leverage of up to 100:1 and 50:1 and 0.01 lot respectively.

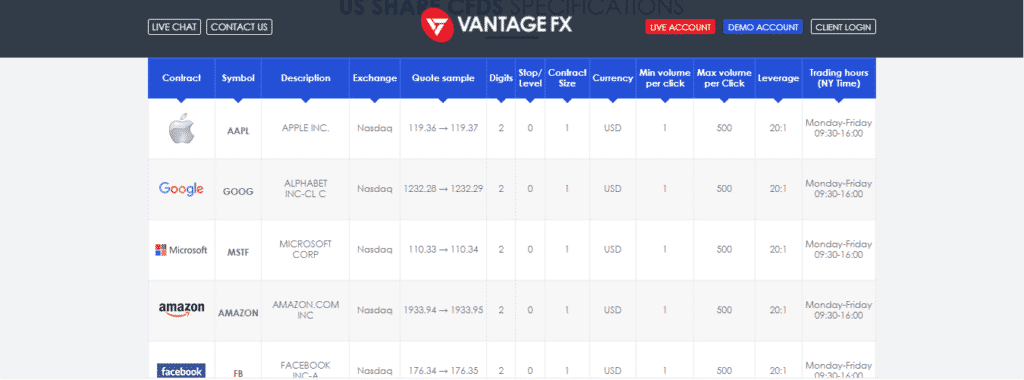

Share CFDs

The share CFDs market at Vantage FX holds shares of giant companies from all world regions such as the US, UK, AU, and EU. The broker claims to offer 226 share CFDs trading on global exchanges like Nasdaq, NYSE, among others, and clients have the opportunity to go long and short with leverages of up to 20:1. The market opens from Monday to Friday.

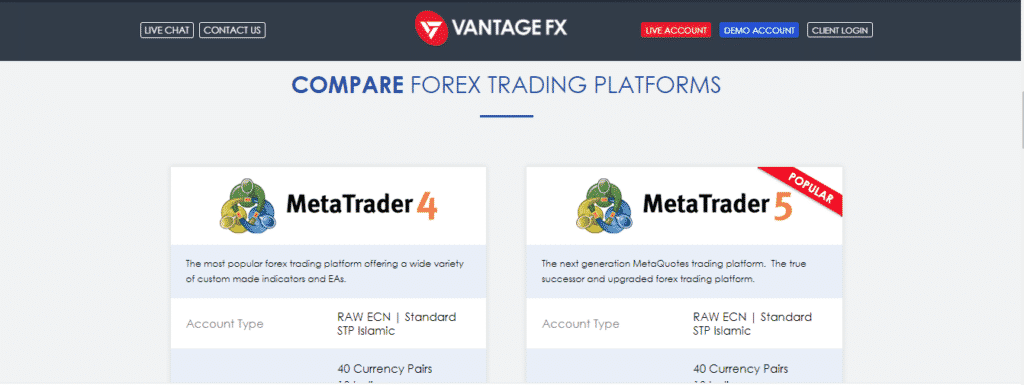

Trading Platforms

Vantage FX provides unique trading platforms interfaced with smart trading tools for market traders and copy trading clients. As confirmed in this review, the broker offers the MetaTrader platforms and its trading platform to on-market clients and social trading platforms as ZuluTrade MyFXbook to copy traders.

The trading platforms come in different versions to operate on other interfaces such as the Web, Windows, Mac, and the phone. That said, let’s explore the array of available trading platforms.

MetaTrader 4

- Account type — RAW ECN / standard STP Islamic

- Range of Markets — 40 currency pairs, 13 indices, 20 commodities, 100 share CFDs

- Platform access — Desktop, web, mobile

- Leverage — up to 500:1

- Minimum trade size — 0.01 lot

- Account base currencies — AUD, USD, GBP, EUR, SGD, CAD

- Hedging — yes

- Scalping — yes

- Number of time frames — nine

- Forex robots — MQL4 based

MetaTrader 5

- Account type — RAW ECN / standard STP Islamic

- Range of Markets — 40 currency pairs, 13 indices, 20 commodities, 100 share CFDs

- Platform access — desktop, web, mobile

- Leverage — up to 500:1

- Minimum trade size — 0.01 lot

- Account base currencies — AUD, USD, GBP, EUR, SGD, CAD

- Hedging — yes

- Scalping — yes

- Number of time frames — 21

- Forex robots — MQL5 based

Features

Vantage FX features generally include:

Trading tools

- Forex VPS

- Expert advisors

- Trading calculators

- Economic calendar

Analytical tools

- Market watch information tools (smarter tools)

- Technical analysis tools

- Sentiment indicators

- Protrader tools

Education

Vantage FX cares for the well-being of its clients in the trading space by taking into account the need to provide innovative educational materials. These materials come in handy, boosting the clients’ skills for better profits. Clients access the resources on the broker’s website and include materials such as:

- Articles and guides about forex

- Manuals on how to use the trading platforms

- Videos on how to use trading tools

- Daily market updates

- Educational webinars

Customer Support

The broker says to offer 24hr award-winning support that clients contact through a spectrum of channels. Vantage FX traders link with the broker’s support for any help via the helpline email, chat, and calls, as the Vantage FX provides an international phone number for that.

Besides, its website provides rich information in the help and support section about various fields such as account application, funds management, trading platforms, and account management.

Review Summary

Vantage FX is considered a relatively safe broker as it holds a two-tier trading license from the ASIC and other reputable registrations. The broker operates as a true NDD offering razor-sharp spreads and fast executions of 300+ instruments. Its vast client base around the globe trades these assets in the FX and CFDs industry with low commissions.

At the same time, the product portfolio is somewhat limited as the broker only offers FX and some CFDs. The customer service could be improved, especially concerning the relevance of emailed responses. The broker provides investors protection to its clients only from the UK.