Chinese banks will hold 7% of foreign currencies in reserves, according to Bloomberg. The rate is a 2% increase and is the first in ten years aiming to counter the rise in yuan.

China’s move targets liquidity management, as well as countering the dollar and other currencies’s supply to tame the Yuan.

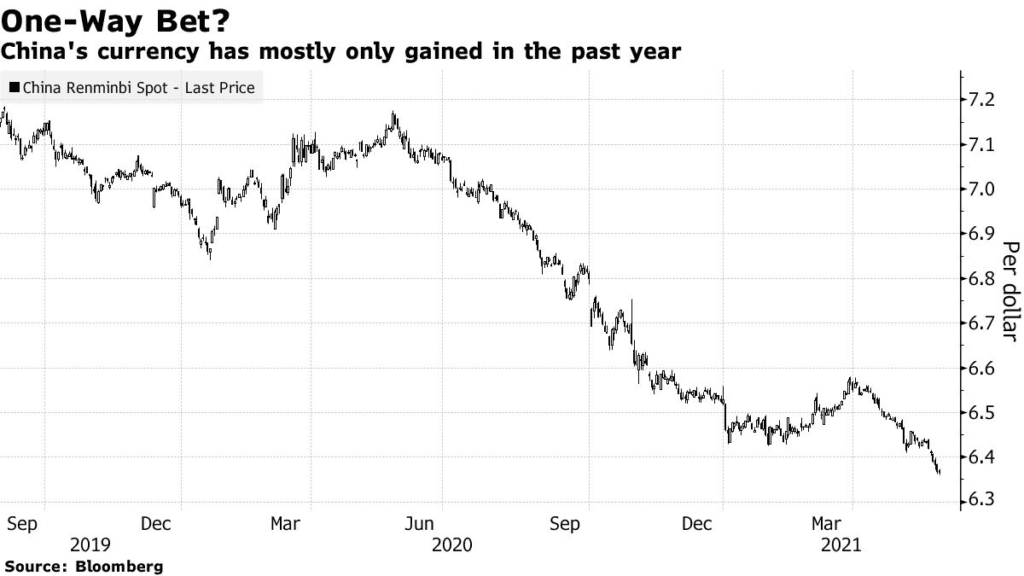

Analysts project the impact of China’s move to be little and signifies a lack of satisfaction with the strengths of the Yuan which is now at a three-year high.

Commerzbank economist Zhao Hao sees the move as attempting to unsuccessfully slow the market.

More analysts including Citigroup are unconvinced of China’s move and expect it to continue to rally on high inflation and interest rates.

Supported by a resurging China’s economy, yuan has remained attractive to investors worldwide.

The Yuan surged 13% against the dollar since May last year, the strongest in five years.

Chinese Yuan is currently declining. USDCNY is up 0.20%