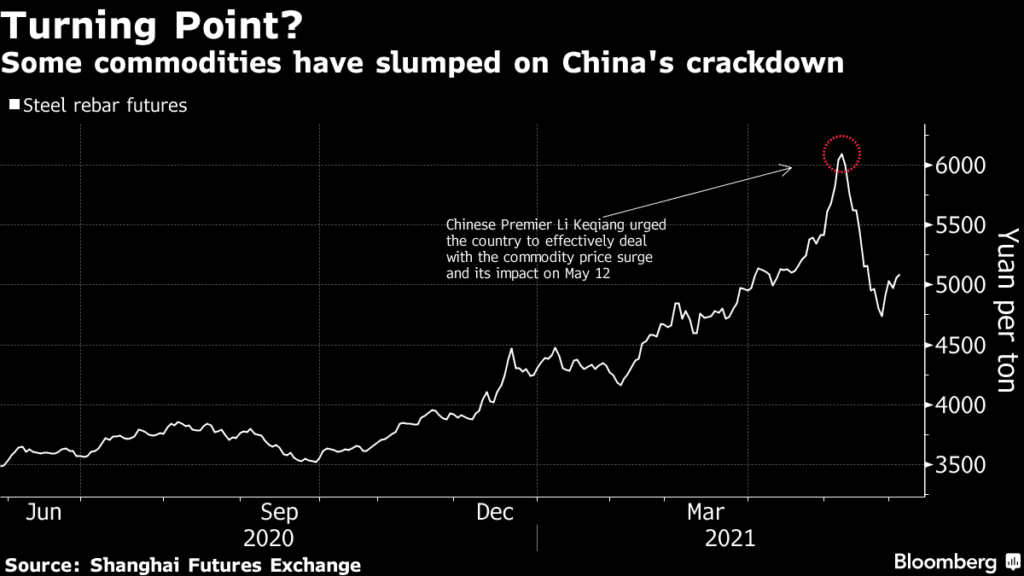

Goldman Sachs does not expect China to win the war on curtailing rising commodity prices, according to Bloomberg. Strategist Jeffrey Currie says Beijing has lost the fight to control prices and has advised its clients to buy the temporary China-led dip.

China’s ballooning commodity prices have seen officials raise transaction rules, force producers to sell holdings, changed tax rules, and targeted “malicious” traders fueling the surge.

Rising commodity prices have been an area of policy interest in China, with the inflation of the late 1980s also fueling similar moves.

Although China’s actions have shown a few signs of success, Goldman sees it as temporary, and the rally is set to continue due to global supply constraints amid high demand.

China’s meddling of financial markets has raised eyebrows, with analysts faulting its role amid the need to maintain freer markets.

Beijing cites the need to maintain social and economic stability in its crackdown actions which also extends into cryptocurrency markets.

Most major commodities are currently gaining. CL1! is up 0.35%, HG1! Is up 0.35%, STEEL is down 0.11%.