- Bitcoin is under pressure amid heightened trading and mining crackdown in China.

- EUR/USD bounce back has stalled amid a resurgent dollar.

- Oil prices rally past the $75 is attracting strong resistance amid production concerns.

- US indices have regained their bullish momentum after last week’s sell-off.

Bitcoin bounce back stalled on Tuesday as the flagship cryptocurrency remained under pressure as traders remained wary of the Chinese crackdown. BTC/USD touched five month lows sliding below the $30,000 level and looking increasingly bearish.

After the recent slide, the pair is staring at crucial support near the $28,000 level.

BTC/USD needs to bounce back and find support above the $30,000 level to avert a slide to the $28,000 level. However, bears remain in control and look set to push the pair lower amid soaring bearish pressure.

The catalyst behind the recent sell-off is the People’s Bank of China summoning China’s largest banks and payment firms, urging them to crack down on any form of cryptocurrency trading. As it stands, no form of OTC transactions are legitimate in China, and banks are not allowed to transfer money for cryptocurrency purchases.

The crackdown has also targeted mining operations, all but piling pressure on the cryptocurrency. The Chinese crackdown comes on the heels of Elon Musk fuelling a sell-off wave from record highs following Tesla’s decision to end BTC payments citing energy consumption in mining.

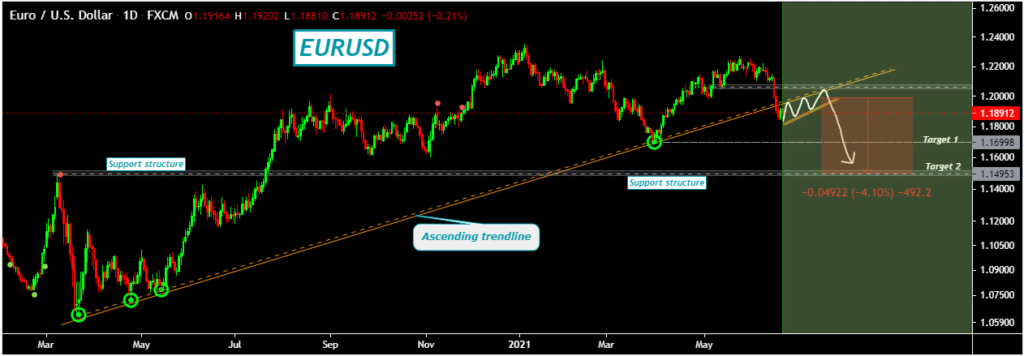

EUR/USD bounces back stalls

In the Forex market, the EUR/USD bounce back also stalled Tuesday morning as the U.S dollar came back rolling after being on the back foot at the start of the week. EUR/USD slid below the 1.18912 level as buying pressure on the greenback piled pressure.

EUR/USD bounced back to the 1.18912 level on Monday helped by upside yields on the German 10-year reference. On a larger scale, though, the pair price is following the ascending trendline. If the down trend continues, it will first find support at the $1.16998 and then at the $1.14953 level.

Looking ahead focus is on the FED chair Jerome Powell who is expected to testify about economic progress amid the pandemic. His remarks could have significant sway on the dollar strength, consequently influencing EUR/USD pairs.

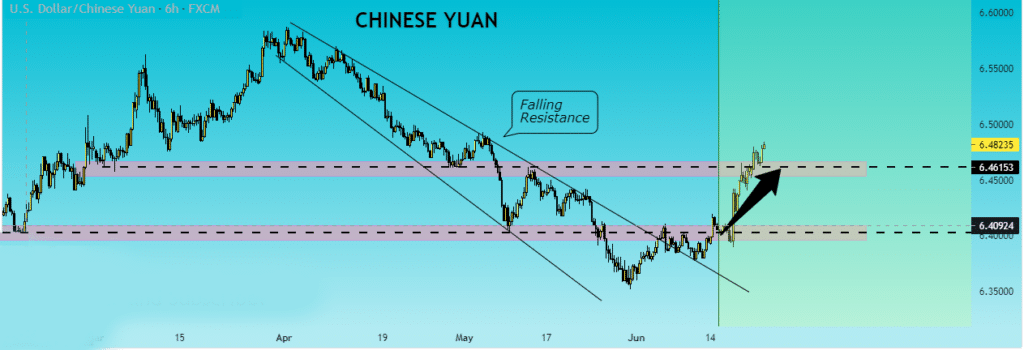

USD/CNH looks bullish

The Chinese yuan is another currency under immense pressure amid the resurgent US dollar. The USD/CNH pair is seen rising past the 6.500 level amid broader dollar strength. A rally followed by a close above the 6.4930 should result in the pair powering through the 6.500 level.

On the downside, strong support is seen at the 6.4580 level, below which the pair could drop to the 6.400 level. With the dollar looking increasingly bullish, USD/CNH looks set to continue edging higher as bulls remain in control.

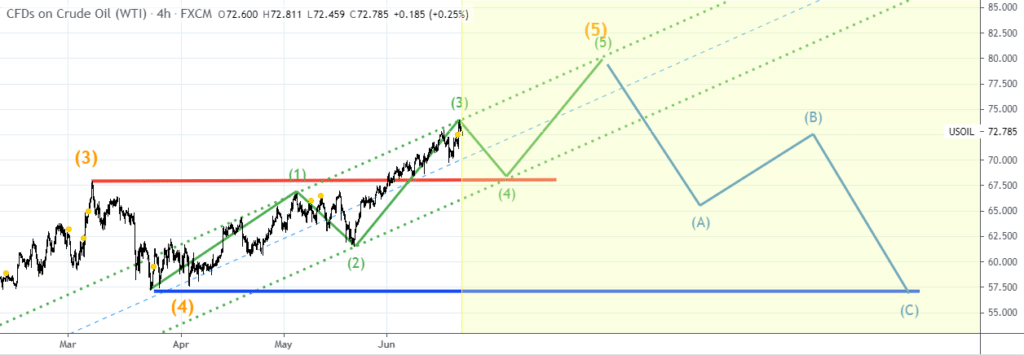

Oil prices above $75

Oil prices retreated from two-year highs on Tuesday as the market reacted to the prospects of OPEC starting discussions on raising production. Brent Oil futures were up 0.32% to $575.14 early Tuesday morning, hitting levels last seen in April of 2019. WTI oil was up 0.1% to $73.19.

However, Brent Oil fell 53 cents to $74.37 a barrel as WTI crude fell 0.9% to $75.30 a barrel. The drop came as OPEC opened discussions on ending last year’s record output curbs. The group is poised to meet on July 1.

Amid the pullback, oil remains increasingly bullish thanks to healthy demand perceptions. Easing COVID-19 fears have resulted in demand edging higher, helping push oil prices higher in the last four weeks. As a result, BofA Global Research has already raised its price forecast for the year. The firm expects oil prices to rise past the $100 mark on tighter supply and recovering demand.

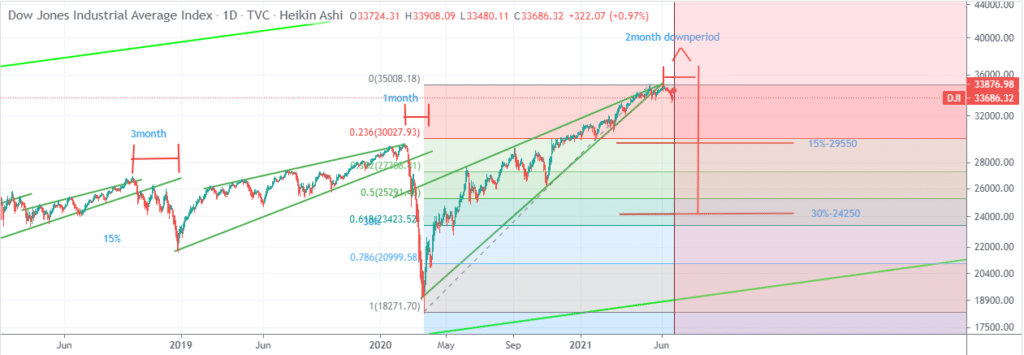

US indices recover

In the stock market, bullish momentum is once again gathering steam going by the Dow Jones Industrial Average posting its best day since March. The Dow was up 586.89 points or 1.76% on Monday as the S&P 500 jumped 1.4% and tech-heavy NASDAQ rose 0.79%.

The indices recouped some of the losses registered last week following the Federal Reserve updated inflation and interest rate hike talk projections. Focus in the equity market is on the FED chair that is poised to testify before the House of Representatives on Tuesday.