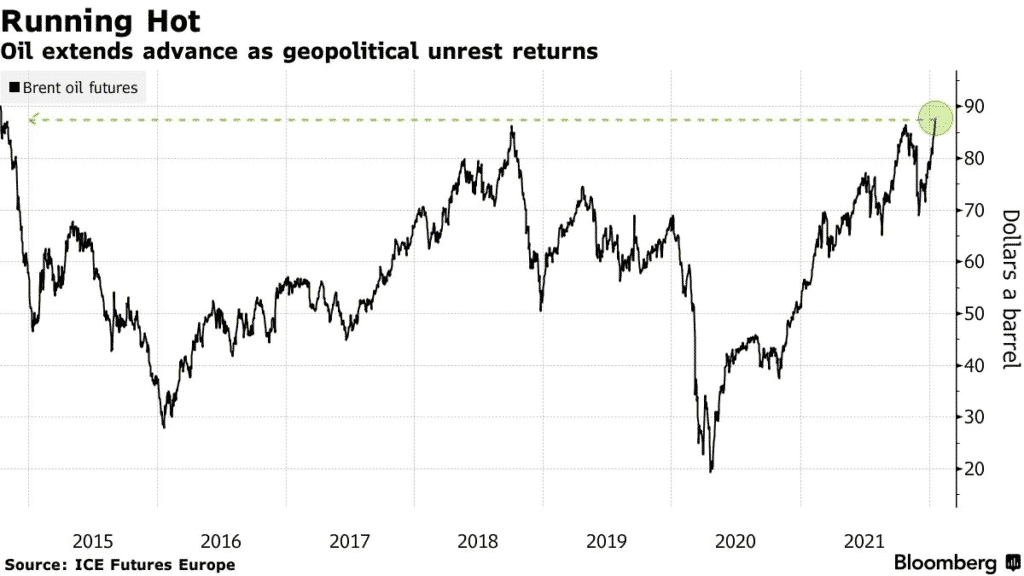

(Bloomberg) Brent crude rose to a high of $88.13 a barrel, its highest level since October 2014, as markets priced for supply tightness due to escalating tensions in the United Arab Emirates.

The rise in oil prices happens even as the UAE vows to retaliate against the deadly attacks by the Houthi militants in capital Abu Dhabi in which three people were killed on Monday.

Following the growing tensions, Goldman Sachs is predicting that Brent could top $100 in the third quarter, with investors monitoring the situation.

Grayson Lim, a senior crude analyst at FGE, says investors are viewing the market as tight, with the Omicron now seen as causing a small impact.

Head of commodities at ING Groep NV Warren Patterson says the market sentiment remains constructive, with the UAE attack only boosting the prices further.

The latest development adds impetus to the oil prices, which started the year on a strong footing due to outages in major producers such as Libya. Rising demand for oil across Europe is also adding to pressure for higher prices.

UAE ranks as the third-largest oil producer among OPEC countries. The oil cartel is expected to give their monthly report on Tuesday, which could offer further clues of the market situation.

CL1! is up +0.95%.