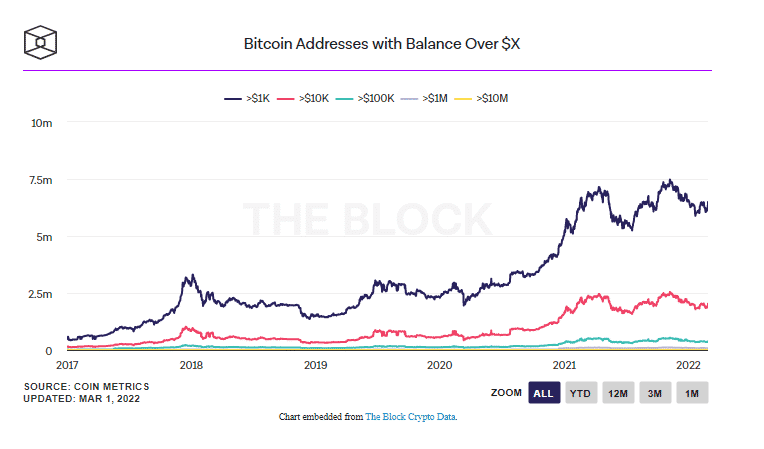

(The Block) Bitcoin wallet addresses hoarding more than 1,000 BTCs rose almost 5% on the last day of February to reach a total of 2,226. The number is the highest since June 2021.

The addresses hoarding more than 100 BTCs also spiked by a modest 1.3% to 15,953, while lower holdings also saw an increase.

The rise in Bitcoin whales happens when the Western countries are stepping up sanctions against Russia following its invasion of Ukraine.

Crypto enthusiasts are now speculating that the sanctions imposed on Moscow are impacting inflows into crypto, pointing out that there might be an influx of wealthy Russians into digital assets.

Cake DeFi CEO Julian Hosp has described the rise in Bitcoin hoarding as a “non-event.” He says it may be a sign that wealthy individuals have suddenly developed an interest in crypto, or the spike could be an act of rebalancing in exchanges and custodial services.

The rise in Bitcoin hoarding happens even as the broader crypto shows recoveries, with Bitcoin briefly topping the level at $44,000, while Ethereum reclaimed $2,900.

BTCUSD is up +0.66%, ETHUSD is down -1.04%.