The Bitcoin price popped during the overnight session as momentum in cryptocurrencies surged. After days of consolidation, the coin’s price jumped to $52,000, the highest it has been since May this year. As a result, its total market cap came near the $2 trillion mark.

Bitcoin fall and comeback

Bitcoin has established a strong track record of falling and coming back to life. A good example is what happened in 2020 as the Covid-19 pandemic started.

Previously, the BTC price crashed from more than $13,000 to below $4,000. After this sell-off, the price staged a major comeback that pushed the price to almost $65,000 in May this year.

In July, Bitcoin prices dropped slightly below $30,000 as investors remained pessimistic about the coin. They were also worried about the potential for high-interest rates from the United States as the economy rebounded.

Recently, however, Bitcoin prices have surged as demand remains steady. The price crossed the $52,000 mark for the first time in almost four months.

This rebound is attributed to several factors. First, the US published mixed jobs numbers last week. On Friday, data by the Bureau of Labor Statistics (BLS) showed that the country added just 235k jobs in August. This was the lowest monthly addition in several months. It was also the first month in three months that the country added less than 900k jobs.

Therefore, the relatively weak jobs numbers meant that the American economy was starting to weaken as the Delta variant spreads. As such, there is a likelihood that the Federal Reserve will have a wait-and-see attitude before starting its tapering process. This is in line with what Jerome Powell, the Federal Reserve chair, said at the virtual Jackson Hole Symposium in August.

A relatively dovish Federal Reserve is usually bullish for risky assets like cryptocurrencies and growth stocks. Indeed, the Nasdaq 100 index has also jumped to an all-time high. This index is made up of most technology stocks in the US.

BTC demand is still there

The Bitcoin price has rallied as demand remains significantly higher. In the past few months, on-chain data has shown that most big buyers remained net buyers of the coin.

Indeed, some of the biggest holders like MassMutual, MicroStrategy, and Square did not sell their holdings. Therefore, most of those who sold were likely small traders who could not stomach the significant decline.

At the same time, data compiled by CoinMarketCap shows that the volume of Bitcoin traded in key exchanges has been on a strong bullish trend. For example, on Sunday, the volume of Bitcoin traded was worth more than $30 billion. This brought the volume to market capitalization ratio to about 32. In contrast, the ratio was at 21 on the same day in August.

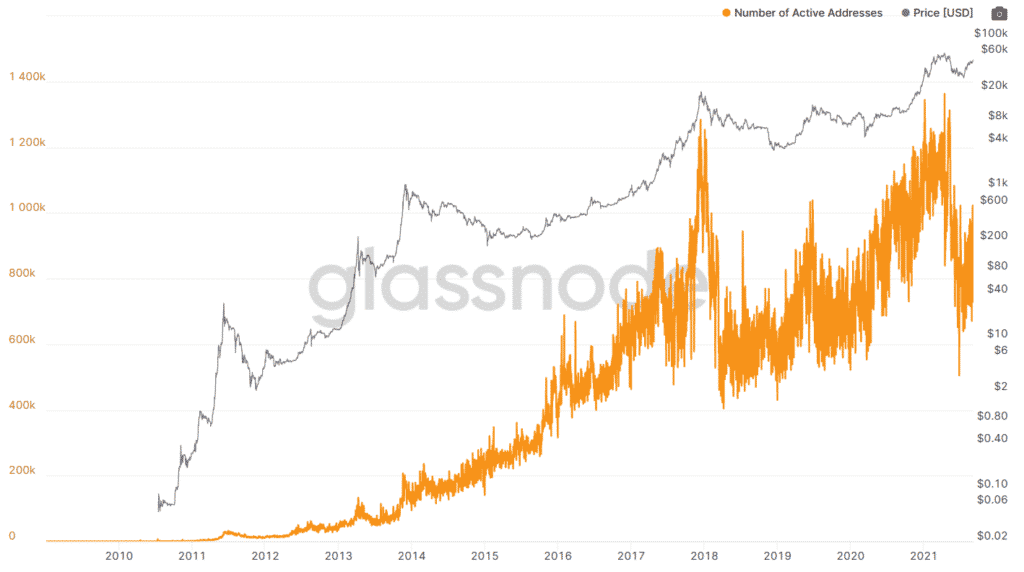

Bitcoin addresses vs. prices

A closer look at the on-chain data tracked by IntoTheBlock shows that the bid to ask volume imbalance has jumped to 1.85%. The number of Bitcoin addresses has also been rising. Still, other data have sent a bearish picture, with the total exchange outflow being higher than inflows.

Bitcoin price forecast

The daily chart shows that the BTC price has been in a strong bullish trend in the past few weeks. This trend started after the coin formed strong support at the $30,000 mark. Along the way, Bitcoin has surged above the key resistance level at $41,333 and $50,000. It has also moved above the key 50-day and 100-day Exponential Moving Averages (EMA). Therefore, the coin will likely keep rising as bulls target the key resistance at $60,000.