- Bitcoin turns bearish below $40,000.

- The dollar impact is strengthening.

- Bitcoin long-term prospects are bullish.

Rising inflation and the prospects of the US Federal Reserve raising interest rates are factors behind the recent sell-off in the cryptocurrency market. The market has turned bearish, with Bitcoin spearheading a drop lower in the market.

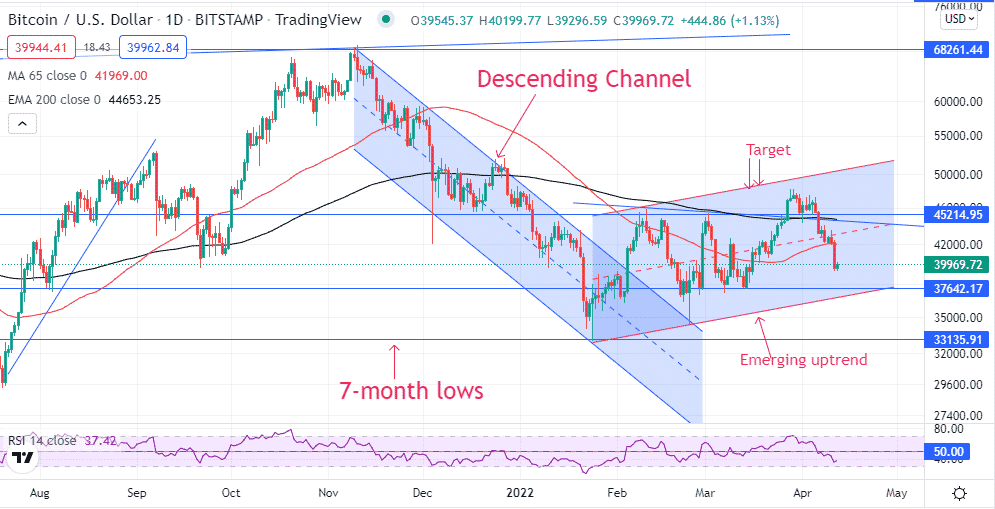

BTCUSD technical analysis

The flagship cryptocurrency has turned bearish after dropping below the $40,000 psychological level. Technical indicators already affirm a buildup in selling pressure. BTCUSD has already closed below the 200-day moving average, signaling short sellers are in control.

The Relative Strength Index has also dropped below the 50 level, signaling the start of a downtrend in the short term. A drop to the $39,608 level means BTCUSD is susceptible to further losses. A drop to the $37,600 area could be on the cards as it is the next substantial support level.

A break below the $37,600 could pave the way for short sellers to fuel another leg lower, back to 2022 lows near the $33,100 level. On the flip side, bulls will have to steer a bounce back above the $40,000 level to avert the risk of the flagship cryptocurrency plunging lower.

Why is Bitcoin dropping?

Dollar strength factor

Bitcoin is on the receiving end amid growing concerns that the Federal Reserve will embark on an aggressive monetary tightening spree to try and avert runaway inflation. The flagship cryptocurrency has been under pressure in 2022, owing to the US dollar strengthening across the board to two-year highs.

The cryptocurrency was up by 73% in 2021 at the back of the US dollar, dropping to three-year lows. With the dollar turning bullish as the FED moves to hike interest rates and trim its bond-buying program, non-yielding assets are under pressure.

Investors are increasingly turning their attention to investments likely to benefit from the central bank hiking interest rates. Bond yields on treasury yields continue to tick up, affirming a change in sentiments in the market away from non-yield investments.

While Bitcoin remains under pressure amid renewed dollar strength, its long-term prospects remain intact. Pullbacks in recent months have acted as buy opportunities from where more bulls have joined the fray and helped fuel a new leg higher.

Bitcoin accumulation

In recent months, an average of 96,000 bitcoins has been moved off major cryptocurrency exchanges. The movement suggests the whales are not selling their holdings, as is the notion implied by the Bitcoin price drop. The movement means the holders are merely moving their BTC holdings for safekeeping in anticipation of price appreciation in the future.

Bitcoin, unlike most cryptocurrencies, has a finite supply on the total number of coins that will ever be in circulation. To date, nearly 19 million coins have been mined out of a total supply of 21 million tokens. As the Bitcoin supply declines and holders continue to hoard their BTC holdings, Bitcoin price is expected to rise, given the strong demand in the market.

Increased Bitcoin adoption as a means of payment is one factor expected to strengthen Bitcoin demand and send its price higher. Friendly regulations are another important factor that could help support further price swings after the recent deep pullback.

Final thoughts

Bitcoin is under pressure after failing to find support above the $40,000 level. While the crypto is down by about 30% from its peak, it is still an exciting play as a long-term investment. The volatile nature of cryptocurrencies means the flagship crypto has what it takes to bounce back, backed by solid underlying fundamentals. Waning supply, increased crypto adoption, and friendly regulation should help support an uptick in price after the recent pullback.